In short

- According to the 216-page B2B Technology Marketplaces Market Report 2024–2030, organizations are in the early stages of a paradigm shift in how they procure software – moving from traditional direct-sale to software marketplaces, a subset of B2B technology marketplaces.

- B2B software marketplaces are rising:

- They are the fastest-growing procurement channel: B2B software marketplaces are expected to make up 10% of all global enterprise software purchases by 2030;

- Dedicated platform providers are successful: Marketplace platform provider Zuora, for instance, grew their revenue nearly 3.5x in the last 6 years;

- Sellers make billions: CrowdStrike has seen over $1 billion in sales just from their AWS Marketplace listings;

- Marketplaces have become big: AWS Marketplace has grown to nearly 25,000 unique offerings.

- The shift to marketplaces has changed industry dynamics; e.g., it has challenged existing seller-reseller relations and allowed new co-sell partnerships among vendors.

Why it matters?

- For enterprise software vendors: B2B software marketplaces offer new revenue opportunities. Being present on the right marketplaces may be crucial for future success.

- For enterprise software procurers: B2B software marketplaces allow enterprises to simplify software procurement, reducing the amount of vendor interactions and speeding up the entire process.

This article is based on insights from:

B2B Technology Marketplaces Market Report 2024–2030

Download a sample to learn about the in-depth analyses that are part of the report.

Already a subscriber? Browse your reports here →

Intro to B2B software marketplaces

We are witnessing a paradigm shift in how organizations procure software, according to the 216-page B2B Technology Marketplaces Market Report 2024–2030, which looks at not only B2B marketplaces for software but also hardware and services. Driving this shift is an ongoing transition from traditional direct-sale procurement to a simpler means of channeling procurement through B2B software marketplaces.

In 2023, 1.8% of global enterprise software was purchased via B2B technology marketplaces. As discussed in this article, the research shows a strong future for B2B technology marketplace procurement as companies and sellers alike embrace the subscription economy and, with it, new revenue streams, dedicated cloud budgets, and co-selling opportunities.

What is a B2B software marketplace?

To define B2B software marketplaces, it is helpful to define B2B technology marketplaces first. For the purposes of the B2B Technology Marketplaces Market Report 2024–2030 and this article, IoT Analytics defines B2B technology marketplaces as a business model that facilitates commercial transactions of technology products through an online platform, from one business to another.

This definition excludes B2C marketplaces, as they focus on consumer transactions, not enterprises. This also excludes non-technology B2B marketplaces, such as third-party business services or supply procurement, and single seller B2B marketplaces, which are considered e-commerce websites.

Thus, B2B software marketplaces are focused on the provision of software solutions that enterprises can procure to meet their needs.

The dawning of B2B software marketplaces

In 2006, Salesforce was one of the first companies to introduce the concept of a cloud marketplace through its AppExchange platform. The platform allowed third-party sellers to build and sell apps that integrated with Salesforce’s CRM platform. Since then, other major technology players have entered the marketplace game through the years.

Nearly 18 years after this concept developed, software marketplaces are beginning to gain traction as a procurement channel option for enterprise IT departments globally.

The following four statistics highlight the rise of B2B software marketplaces:

1. Marketplaces are the fastest-growing procurement channel for software

In 2023, B2B software marketplace revenue grew 90% year-over-year (YoY), according to the report. No other procurement channel achieved this growth. The report predicts that software procurement via marketplaces will account for nearly 10% of global enterprise software spending by 2030—more than five times the current spending (1.8% in 2023).

Cloud hyperscalers (e.g., AWS and Microsoft Azure) and other large IT vendors (e.g., SAP and Salesforce) are leading factors in this projected growth. They already have a head start in the software marketplaces market due to most enterprises already having cloud budgets that can be used to acquire software on their marketplaces.

Additionally, IoT Analytics research estimates that in the most probable scenario, 60% of enterprise workloads will run in the cloud within the next two decades. This shift will likely strengthen hyperscalers’ marketplace positions as enterprises seek streamlined software and cloud solutions, leading to strong market growth.

2. Dedicated B2B marketplace platform providers are successful

B2B marketplace platform providers are companies that develop dedicated software that helps other companies operate their marketplaces, including seller integration, transactions, and ratings.

According to the report, the largest of these providers is Zuora, a US-based enterprise software company founded in 2007. In FY2023, it had a revenue of $396 million, a nearly 3.5x climb since 2017. Further, it supported 773 customers that hold annual contract values (ACVs) of at least $100,000.

Zuora has recently shifted its focus from massive growth to profitability. Yahoo! Finance analysis forecasts that Zuora will have its first profitable year in (calendar) 2024.

Its core offering is Zuora Central Platform, aiming to help IT and engineering teams “connect, scale, and deploy” revenue operations solutions alongside their broader monetization systems architecture. The platform provides microservice engines such as pricing, subscription orders, ratings, global payments, and subscription accounting.

3. Some sellers have made billions on marketplaces

IoT Analytics research found that by listing on B2B technology marketplaces and leveraging marketplace programs like co-selling (more on this below), sellers on marketplaces have been able to grow their revenue by 10%–15%, with many of them closing deals worth over $1 million in ACV via these marketplaces.

As a leading success story, in 2023, US cybersecurity software company CrowdStrike became the first cybersecurity independent software vendor to surpass $1 billion in software sales using AWS Marketplace. It initially listed its software on the marketplace in 2017, and in 2023, its AWS Marketplace transactions were approximately 140% larger than those through other software go-to-market channels. By deploying its modules to the public cloud, CrowdStrike reported $296 million in annual recurring revenue in mid-2023, a 70% YoY increase.

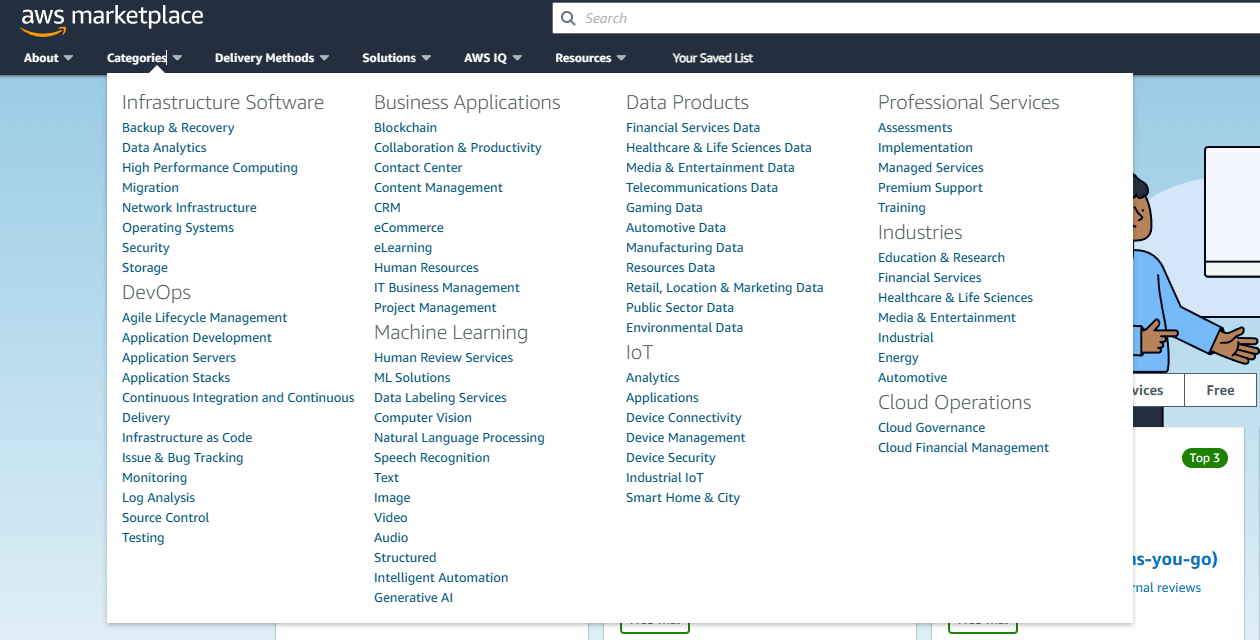

4. Larger marketplaces offering over 10,000 unique listings

As of December 2023, AWS Marketplace was the largest cloud marketplace operator, with nearly 25,000 unique products—a 152% jump in products since December 2020. Its largest product category is infrastructure software, with 10,688 offerings.

AWS Marketplace offers software, services, and solutions that can be deployed on AWS Cloud, making it a streamlined option for customers who run their own solutions on the cloud service. It was launched in 2012 alongside the AWS Partner Network (APN), a global community of 130,000 global partners aiming to leverage AWS technologies, expertise, and tools to build solutions for customers. A core component of APN is AWS’s co-selling program. This collaborative sales motion enables AWS partners to work closely with AWS sales teams to jointly identify, develop, and close opportunities with AWS customers.

4 early observations of the rising B2B software marketplaces market

Below are four observations that came up during IoT Analytics’ research and interviews regarding software and other B2B tech marketplaces:

1. B2B software marketplaces can be successful even without marketplace transactions

IoT Analytics’ research found that companies that had just launched their marketplaces felt added value outside of just transactions. The “window shopping” format of software marketplaces made products more visible to customers, and they developed a more informed overview of what is available. This has led to increased knowledgeable leads for the existing sales team.

2. Selling on B2B marketplaces requires extensive training

Switching from one-time purchases to selling subscriptions is challenging for sales teams. The report notes that several companies needed to train their sales team on new sales approaches when handling subscriptions, particularly taking a more customer-focused approach with the marketplace at the center.

Additionally, due to the subscription-based model, companies reported needing to realign their sales approach to emphasize the long-term value of software.

3. B2B marketplaces create friction with existing resellers

Many marketplace operators and sellers find themselves in a complicated situation with their resellers. The new marketplace business model puts traditional resellers at risk of losing business, especially if they do not adapt and embrace the new model.

However, that need not be so. Both marketplace operators and sellers can engage the resellers and frame the marketplace business model as a new opportunity rather than a threat. Marketplace operators/sellers can work on offering special reseller incentives, providing reseller-specific marketplace extensions, or promoting added-value services from resellers on the marketplace.

4. Co-selling initiatives represent a strong growth opportunity in B2B marketplaces

Co-selling allows sellers to partner with larger marketplace operators and other marketplace sellers to share sales opportunities and leverage each other’s strengths to drive growth. This collaboration allows for shared resources, tapping into established customer networks, and aligning each party’s sales and technical expertise.

Consequently, co-selling programs often lead to enhanced product visibility, accelerated sales cycles, and enriched value propositions for customers—benefitting all stakeholders in the partnership.

The full B2B technology marketplaces market report offers a deeper dive into these and other takeaways (e.g., the pros and cons of different reseller engagement models).

The bright future of B2B software marketplaces and the broader marketplace business model

This article focused largely on B2B software marketplaces (with many of these being in the cloud). While our research did not dive into B2C marketplaces (such as those found in e-commerce), we did uncover other marketplace opportunities. For example, operating marketplaces also represent an interesting opportunity for the following:

- industrial automation companies that manage on-premises and edge-based software solutions

- manufacturers or startups that aim to position themselves at the center of a (niche) industry by building an industry-specific app store

- companies offering a mix of hard- and software

It should be noted that not every organization needs to develop its own marketplace. However, finding the right marketplaces to sell on and building up a proprietary online store (not a marketplace) are inevitable for nearly all technology vendors in the future. Building an online store is not as complex as building an entire marketplace.

The 216-page B2B Technology Marketplaces Market Report 2024–2030 dives further into these marketplaces and the role they play in technology and specifically in IoT solutions. Readers can learn more about the top actors across the B2B technology marketplace ecosystem, the market outlook, and more.

What it means for software vendors

8 key questions that company executives in enterprise software companies should ask themselves based on the insights in this article:

- Marketplace integration: How can we integrate our software products for listing in leading B2B marketplaces without significant restructuring or reengineering?

- Sales strategy evolution: Given the shift towards B2B marketplaces, what changes should we make in our sales strategies to align with this new distribution channel?

- Building up a marketplace: Is it strategically viable for us to develop our own marketplace? Do we have the appropriate strategy and sufficient financial resources in place to support this endeavor?

- Customer reach and engagement: How can B2B marketplaces expand our reach to new customers and markets that our traditional sales methods might not have been able to penetrate?

- Pricing and subscription models: How should we adjust our pricing models to suit the subscription-based nature of these marketplaces? What would be a competitive yet profitable pricing strategy?

- Partnership and co-selling opportunities: Which marketplace operators (like AWS or Salesforce) align best with our products and target market, and how can we leverage co-selling opportunities with them?

- Reseller relationships: How can we balance our existing reseller relationships with our move toward marketplace sales? Can we involve our current resellers in this new sales model?

- Data analytics and marketplace insights: How can we utilize data analytics from these marketplaces to gain insights into customer preferences, market trends, and product performance?

What it means for companies procuring software solutions

4 questions that those procuring software solutions should ask themselves based on the insights in this article:

- Procurement management: How can purchasing through B2B software marketplaces impact our overall software procurement processes? Are there cost savings or efficiencies to be gained?

- Integration and compatibility: How easily can we integrate software sourced from these marketplaces with our existing systems and technology infrastructure?

- Subscription management: Considering the prevalence of subscription models in these marketplaces, how will we manage and track multiple software subscriptions to ensure continuous service and optimal use?

- Long-term strategic impact: How will this shift to marketplace procurement impact our long-term software strategy and digital transformation goals?

More information and further reading

Are you interested in learning more about the software and platform market?

B2B Technology Marketplaces Market Report 2024–2030

This publication analyses the opportunity of selling software and related hardware / services via enterprise marketplaces, including, a 216-page market report, list of 100 marketplaces and 50 marketplace platform providers.

Related publications

You may also be interested in the following reports:

- IoT Software Go-to-Market & Commercialization Report 2023

- IoT Software Adoption Report 2023

- Global Cloud Projects Report and Database 2023

- Digital Twin Market Report 2023-2027

Related articles

You may also be interested in the following articles:

- Digital twin market: Analyzing growth and emerging trends

- The leading IoT software companies 2023

- Mapping 7,000 global cloud projects: AWS vs. Microsoft vs. Google vs. Oracle vs. Alibaba

- State of IoT 2023: Number of connected IoT devices growing 16% to 16.7 billion globally

Related dashboard and trackers

You may also be interested in the following dashboards and trackers:

- Global IoT Enterprise Spending Dashboard

- Global Cellular IoT Module and Chipset Market Tracker & Forecast

- Global Cellular IoT Connectivity Tracker & Forecast

- Global Cellular IoT eSIM Module & iSIM Chipset Tracker

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.