In short

- IoT software spending reached $53 billion in 2022 and continues to grow strongly.

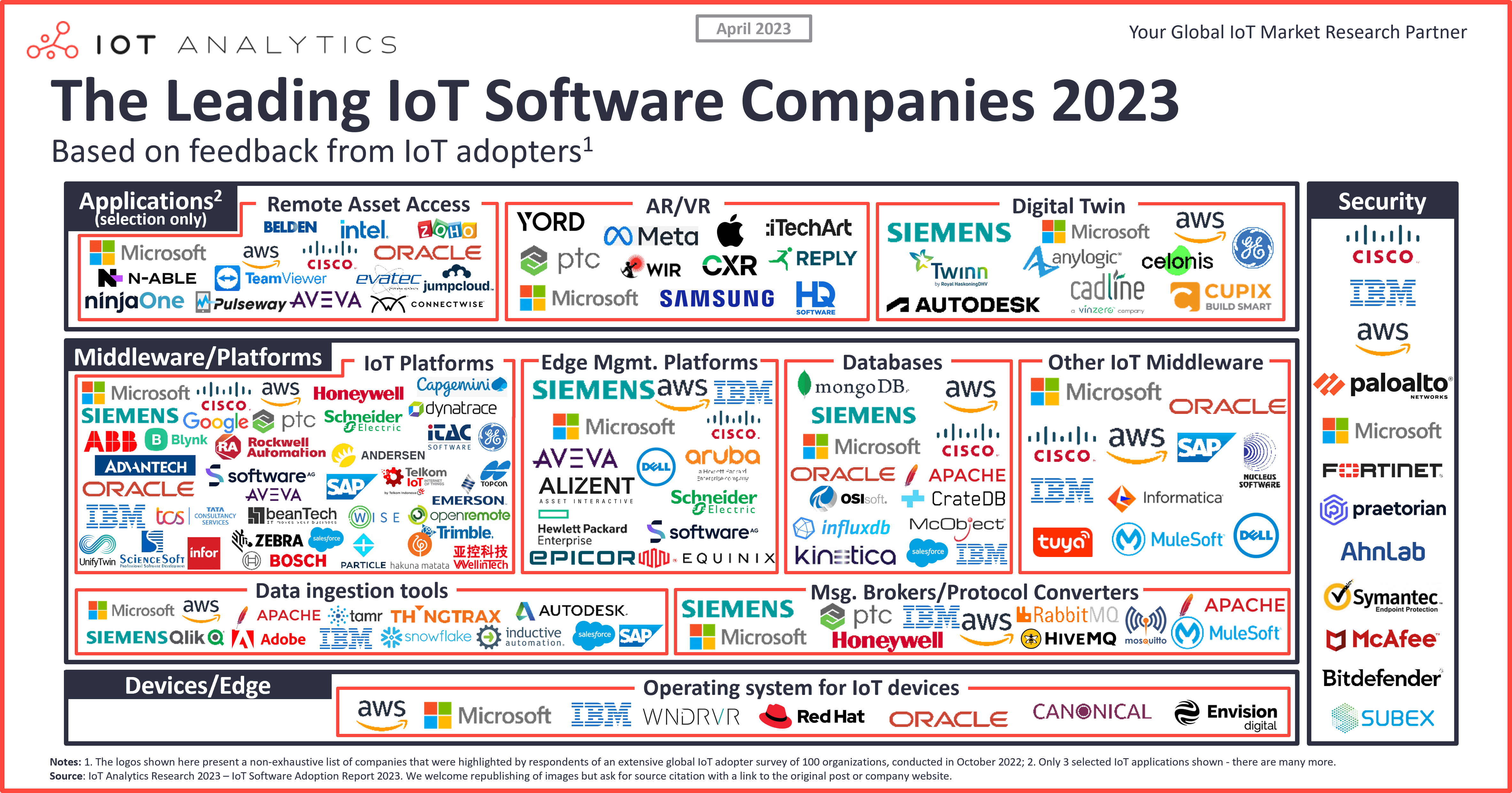

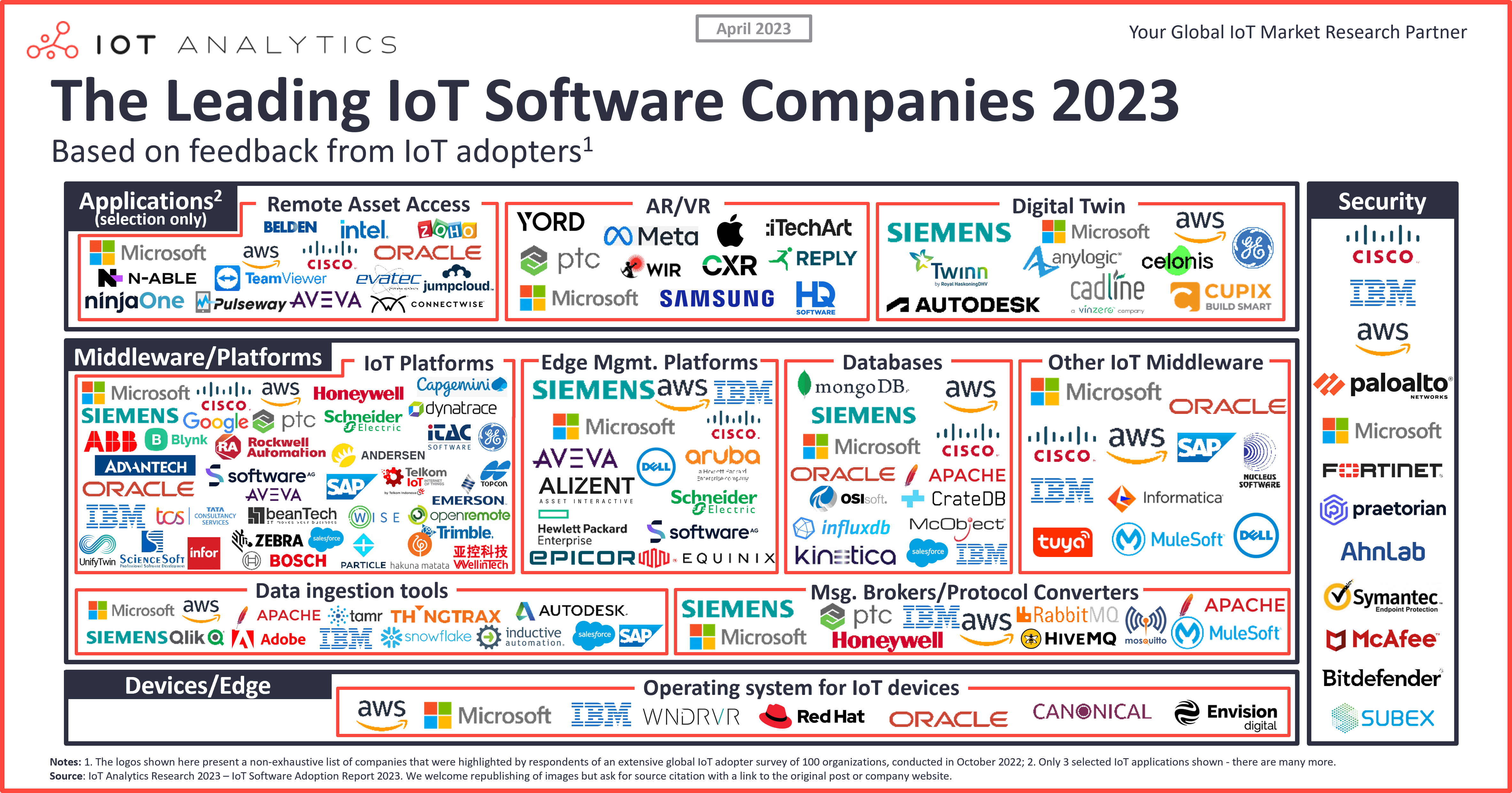

- The latest IoT Software Adoption Report 2023 highlights the top 100+ IoT software vendors used today based on an extensive survey of IoT users.

- The most common IoT software companies include Microsoft, AWS, Siemens, IBM, Cisco, Oracle, PTC, and MongoDB.

Why it matters

- Software is an essential element of any IoT solution, and the landscape of key vendors has changed over the past years.

- End-users’ opinions help everyone in understanding current IoT software market trends, allow IoT adopters to learn from others, and help IoT software vendors improve their offerings.

This article is based on one of the themes from our 164-page IoT Software Adoption Report.

Already a subscriber? Browse your reports here →

Click on the button to load the content from .

The big picture: The IoT software market in 2023

IoT software spending reached $53 billion in 2022 (according to the IoT Analytics Global IoT Enterprise Spending analysis). The market grew a staggering 31% in 2022 because of renewed enterprise focus on IoT after the COVID-19 recovery; strong growth in the number of actively connected IoT devices to 14.4 billion worldwide; and a software technology replacement cycle causing companies to invest in containerized solutions, software-as-a-service, low-code user interfaces, and AI-enhanced software. With the number of active IoT devices projected to reach nearly 30 billion by 2027, IoT software market growth is guaranteed.

6 IoT software architecture choices

Companies pursue dozens of IoT use cases (examples include remote monitoring, predictive maintenance, and machine vision)—see our 2021 IoT use case analysis. Those use cases require software that can be realized in six ways. Companies can

- Add their IoT devices to existing software (e.g., ERP, MOM, PLM, or SCADA)

- Build IoT software in-house

- Hire a third party to build IoT software

- Use several open-source software components (e.g., Apache Kafka and Eclipse Mosquitto)

- Buy IoT software components (e.g., platforms and middleware)

- Buy entire IoT offerings

Option 1, adding to existing software, promises stability, reliability, and security. However, the past few years have shown that this approach has shortcomings, which have given rise to options 4, 5, and 6. For option 5 and 6, there are hundreds of commercial offerings that are specifically designed for IoT device data, do not come with the “baggage” of older enterprise architectures, and bring an element of scalability.

Our analysis focuses exclusively on companies that have chosen options 5 or 6.

The methodology of this analysis

IoT Analytics, in Q4 2022, surveyed 100 senior executives across manufacturing, real estate, retail, and other industries in North America, Europe, and Asia to better understand the IoT software market. All respondents procured and used IoT software. The vendors mentioned by the respondents are the basis for the IoT software companies’ landscape in this article. The accompanying 164-page IoT Software Adoption Report 2023 analyzes these companies’ spending patterns, adoption, decision-making criteria, payment habits, and much more. For more information, request a sample of the report here.

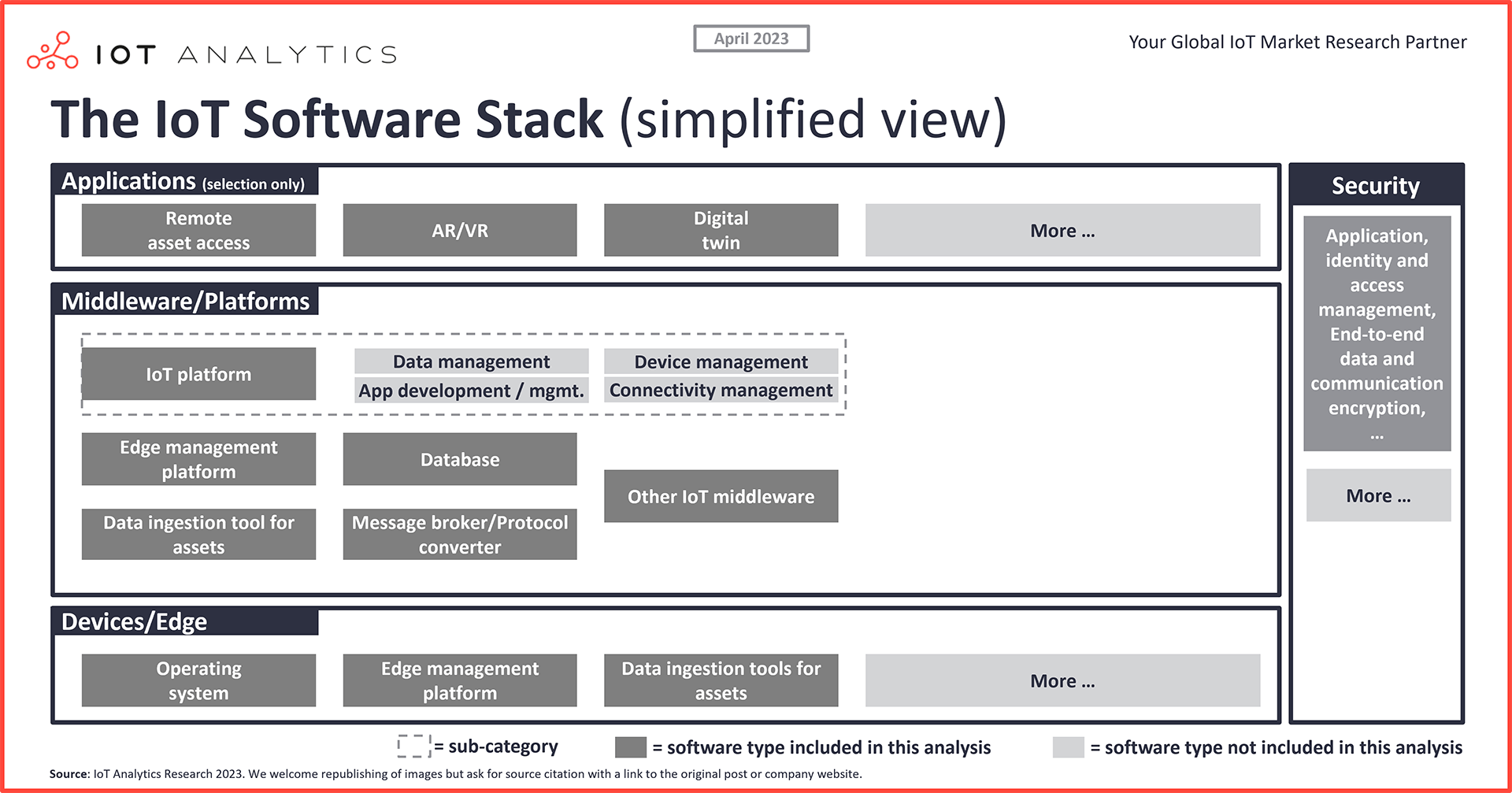

The IoT software stack

For this analysis, we divided the IoT software stack into four main components: applications, middleware/platforms, devices/edge, and security. Within these four components, we highlight 11 types of IoT software (although there could be more, especially in the IoT application layer):

- Remote asset access software allows an asset to be controlled or monitored remotely on one system while being displayed on a separate client device.

- Augmented reality or virtual reality software is used to visualize and create AR/VR.

- Digital twin software is used to create and manage a virtual replication of a real-world entity.

- IoT platforms are specialized software tools to build and manage IoT solutions.

- Edge management platforms are used to provision and manage remote devices at the edge.

- Databases for IoT datasets are used to capture the data produced by IoT devices.

- Other IoT middleware tools enable one or more kinds of communication or connectivity among several applications or application components in a distributed network.

- Data ingestion tools for shopfloor/operational assets gather and transfer structured, semi-structured, and unstructured data from the source to the target destinations.

- Message broker/protocol conversion tools translate a message from the sender’s formal messaging protocol to the receiver’s formal messaging protocol.

- IoT security software is cybersecurity software that focuses on increasing the security of IoT setups.

- Operating system for IoT devices/assets is operating system software that manages IoT devices and software resources for connected products or machines in the field and provides common services for computer programs.

The IoT software landscape 2023

Many small companies

IoT Analytics tracks more than 1,000 large and small vendors offering software for IoT scenarios. Although two companies are clearly leading the market, the overall landscape remains fragmented. As verifying which vendor fits into which IoT software type is almost impossible, we decided to present a chart entirely created by IoT end-users from our survey (rather than a secondary research analysis). These are the IoT software companies our survey participants used, and from our point of view, it is a good view of the market even though several vendors are missing. Some vendors may feel they should also feature in another IoT software category.

Recent IoT software divestitures

The recent announcements of IoT software discontinuation by three heavyweights (Google, SAP, and IBM) have rattled the IoT community. Nevertheless, the results of this survey show that a significant number of users are still leveraging these to-be-retired services. Our view is that there is a natural market consolidation in IoT software, and more specifically in IoT platforms, that we started to report on in 2021. We know of more IoT software companies that are exiting the market, as their IoT visions have not materialized.

IoT software companies are doubling down on IoT

However, we are tracking many other thriving IoT software companies that are doubling down on a longer-term IoT vision. The survey results confirm there is no appetite to stop investing in IoT software on the end-user side, although the high growth for the IoT platform segment seems to be over and end-users are putting more money, for example, into individual applications. Due to the recent IoT divestitures, end-users are also becoming more careful about choosing their software vendor partner.

8 leading IoT software companies in 2023

Here is a look at 8 of the top IoT software companies that survey participants highlighted.

1. Microsoft

According to our estimates, Microsoft is the IoT software market share leader, with a 9% share of the market in 2022 (Source: IoT Analytics Global IoT Enterprise Spending dashboard—vendor market share view). Almost 60% of the respondents in this survey use Microsoft software as part of their IoT setups. Microsoft has an offering in all 11 of the analyzed IoT software types. Some of Microsoft’s most prominent IoT software solutions include Azure IoT Hub, Defender for IoT, Azure IoT Edge, and Azure RTOS.

2. Amazon Web Services

AWS is the global market-leading cloud provider and has made several IoT software investments since the launch of its IoT Core service in 2015. Survey respondents use AWS IoT software products in six of the 11 IoT software types. Prominent examples besides AWS IoT Core include AWS IoT Greengrass and Amazon DynamoDB IoT. As a result, we can expect AWS IoT software to continue to grow. The survey results show that users expect to continue to increase IoT software spending with AWS, particularly companies in North America and smaller and medium-sized companies.

3. Siemens

Even though the company has moved away from heavily marketing its Mindsphere IoT platform, Siemens continues to invest in IoT. Two of the main strategic initiatives for Siemens include the Siemens Xcelerator portfolio of modern cloud-based SaaS-based software offerings (including industrial IoT applications) and the new Industrial Edge offering (including several IoT applications). Like Microsoft and AWS, Siemens received a high customer satisfaction rating in this survey, consistent with previous IoT Analytics surveys on IoT and IoT-centric topics.

4. IBM

Despite the deprecation of the IBM Watson IoT platform announced in November 2022, IBM remains one of the leading IoT software vendors (for now). Due to the company’s strong penetration rate in enterprises, many companies have used IBM’s tools for their IoT setups. It will be interesting to see how the picture changes in 2024, as customers must move their IoT deployments off IBM Watson IoT by 1 December 2023.

5. Cisco

Cisco has been a player in the IoT software landscape for years. Some prominent IoT offerings include the Cisco Edge Intelligence platform and the company’s IoT security products (e.g., Cisco ISE).

6. Oracle

Oracle is an enterprise software powerhouse and a cloud hyperscaler (although much smaller than the market leaders). Oracle’s IoT setups include the Oracle IoT Cloud Service and Oracle databases (e.g., Oracle Database).

7. PTC

PTC has been executing its IoT vision since the acquisition of Thingworx in 2013. To date, ThingWorx remains one of the leading IoT platforms, but it is not the only IoT tool PTC has to offer. Other prominent PTC tools for IoT scenarios include Kepware (message broker/protocol conversion tool) and Vuforia (AR/VR).

8. MongoDB

MongoDB has established itself as the commercial IoT database of choice for many IoT setups. Moreover, the company is on an impressive growth path in the wake of general workload movements to the cloud: the company’s top line more than tripled during the last three years to more than $ 1 billion per year (IoT is a portion of that). In addition, our survey participants gave MongoDB a high satisfaction rating for their IoT offering.

Looking ahead

These are just 8 of the 100+ IoT software companies we analyzed as part of the research. Although some parts of the IoT software landscape are consolidating (as highlighted above), the landscape remains dispersed. Smaller vendors still have room to fill the gaps and find their niches. The technological shifts happening right now (e.g., more powerful edge computing, new protocols, cloud-native software development, and containers) provide tremendous opportunities for any company to jump in and offer a more modern and native software experience. We have seen quite some shifts in the software landscape during the last five to eight years, and given where the market is now, it will not be surprising to see several new, smaller players capture a significant portion of this fast-growing market in the coming years.

More information and further reading

Are you interested in learning more about the latest IoT software market developments?

IoT Analytics is a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), AI, Cloud, Edge, and Industry 4.0.

IoT Software Adoption Report 2023

A 164-page report on the spending, decision-making, and procurement habits across 36 software types. Based on an extensive survey of 100 software end users in manufacturing, real estate, retail, and other industries.

Click on the button to load the content from .

Already a corporate research subscriber?

Related publications

You may be interested in the following publications:

- Cloud Computing for IoT Market Report 2021–2026

- Cloud Computing Market Report 2021–2026

- Industrial AI Software Platform Vendor Landscape Report 2021

- IoT Platforms Market Report 2021–2026

- Digital Twin Market Report 2023-2027

- Machine Vision Market Report 2022-2027

Related articles

You may also be interested in the following recent articles:

- The IoT cloud: Microsoft Azure vs. AWS vs. Google Cloud

- The case for a $2 trillion addressable public cloud market

- The rise of industrial AI and AIoT: 4 trends driving technology adoption

- 5 Things to Know About the IoT Platforms Market

- Decoding Digital Twins: Exploring the 6 main applications and their benefits

- Top 7 upcoming machine vision applications—enabled by recent advances in AI, cameras, and chips

Related market data

You may be interested in the following IoT market data products:

- Global Cellular IoT Module and Chipset Tracker and Forecast

- Global Cellular IoT Connectivity Tracker and Forecast

- Global IoT Enterprise Spending Dashboard

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.