In short

- The cloud market reached $206 billion in 2022, fueled by the COVID-19 pandemic, digitalization, and SaaS adoption.

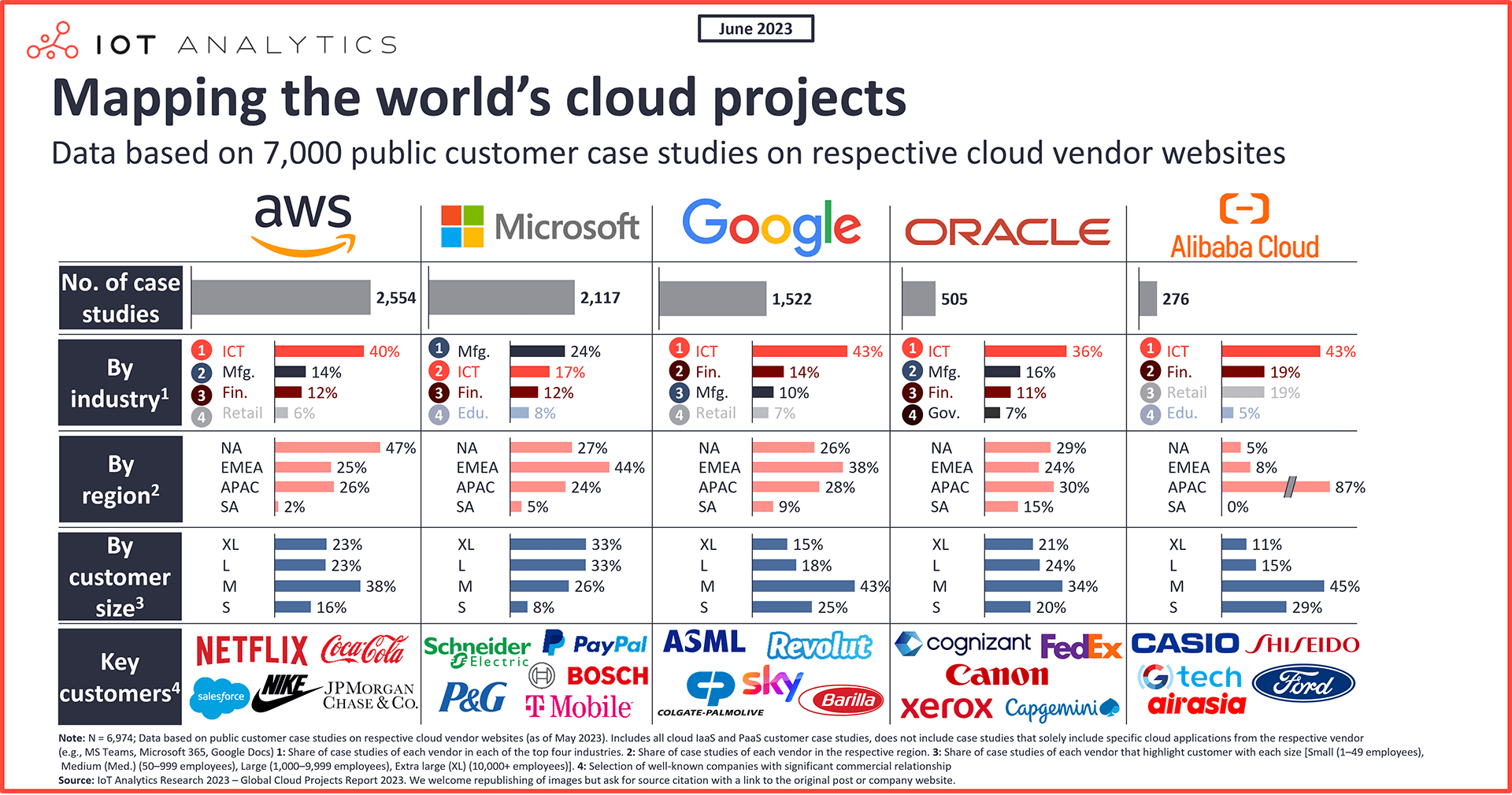

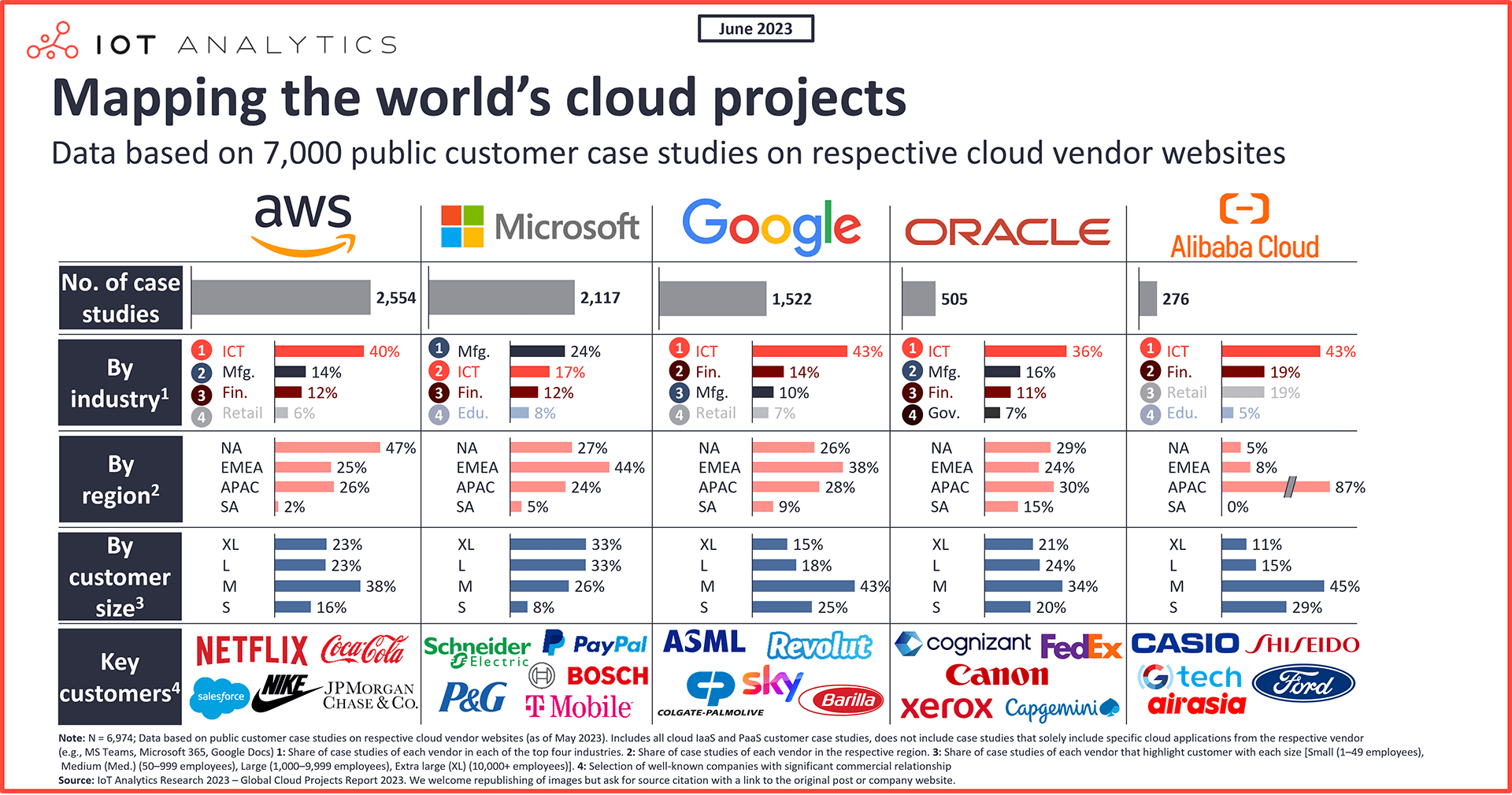

- A new analysis of 7,000 cloud implementations reveals distinctly different vendor footprints.

- AWS dominates North America, Microsoft excels in EMEA, Google appeals to smaller IT companies, Oracle has a strong South American presence, and Alibaba leads in China and Asia.

- AI services are used in 14% of all projects; The average cloud project utilizes 4.5 different cloud services

Why it matters

- The analysis and associated database can guide cloud adoption strategy, customer overlap mapping, and cloud market forecasting and provides a number of other ways to better understand the industry.

The Cloud Market in 2023

Public cloud spending nearly doubled (+89%) from $109 billion in 2020 to $206 billion in 2022, according to our market model. This growth was fueled by the COVID-19 pandemic, increased digitalization efforts, and strong SaaS adoption. Although cloud growth rates have declined from the 40%+ levels in 2021 due to a slowing macroeconomic environment, nearly all major clouds continued to experience double-digit year-over-year (YoY) growth in calendar Q1 2023:

AWS grew 16% YoY , Microsoft’s Azure grew 27% YoY , Google Cloud increased by 28% YoY and Oracle’s cloud services grew 54% YoY. Only Alibaba’s Cloud segment declined. With cloud migrations still in progress, cloud modernization in its early stages, and AI on the horizon, the cloud industry has the potential to become a trillion-dollar business in the coming years.

As part of our ongoing coverage of the cloud (and IoT cloud) markets, we have published a database of 7,000 public cloud projects from five leading cloud vendors: Microsoft, AWS, Google, Oracle, and Alibaba and we have analyzed the information accordingly (See Global Cloud Projects Report and Database 2023). The database includes all public customer stories published by the respective cloud vendors up to May 2023.

How representative is the data?

The cloud project data appears representative enough to draw conclusions regarding the business footprint for each of the five vendors.

The table below shows Q1 2023 public cloud market shares (according to our own model) compared to the share of public customer references in our database:

| Company | Q1 2023 market share | Share of public projects |

|---|---|---|

| AWS | 39% | 37% |

| Microsoft | 27% | 30% |

| 9% | 22% | |

| Oracle | 2% | 7% |

| Alibaba | 5% | 4% |

| Others | 18% | Not analyzed |

The share of projects in the list is largely comparable to the actual market share of the vendors. Google appears to be an exception, with 22% of projects compared to 9% of market share. This gap may be explained by the fact that 68% of all Google Cloud public customer case studies involve small and medium companies (less than 1,000 employees) whose revenue footprint is likely relatively low. The data provides a comprehensive snapshot of how the customer footprint of these companies varies by industry, region, and customer size, and also reveals some key customers in each vertical.

Definition/Methodology:

The database of 7,000 global cloud projects is a compilation of all publicly known cloud customer references from the five leading cloud vendors on their respective cloud success story websites: AWS, Microsoft, Google, Oracle, and Alibaba. All projects in the list represent public information and were published on the respective vendors’ websites as of May 2023. To be included, a project must involve at least one public cloud Infrastructure-as-a-Service (IaaS) or cloud Platform-as-a-Service (PaaS) service. Pure Software-as-a-Service (SaaS) customer projects were excluded. We offered all five vendors the opportunity to comment on the results.

The insights from this article are based on market data from the Global Cloud Projects Report and Database 2023, A comprehensive database accompanied by a 148-page report analyzing 7,000 customer implementations of the largest cloud vendors, including a deep dive into IoT cloud projects.

Download a sample to learn more about the report structure, select definitions, select market data, additional data points, and trends.

Already a subscriber? Browse your reports here →

Click on the button to load the content from .

Comparing AWS, Microsoft, Google, Oracle, and Alibaba:

One notable observation from the analysis is the uniqueness of each company’s customer footprint.

1. AWS: Strong presence in North America and the ICT industry

AWS continues to dominate the cloud landscape, with customers often highlighting the comprehensiveness of its offering. The company has a strong presence in North America (47% of all AWS projects) and a large share of customers in the ICT industry (40%). Notable North American customers include Salesforce, Adobe, and Infor. For instance, Salesforce’s public case study discusses their initial choice of AWS in 2016 and how the relationship evolved into a strategic partnership focused on technical alignment, joint development, enterprise transformation, data solutions, and sustainability. Manufacturing is the second-largest customer industry for AWS (e.g., Coca-Cola, and Nike), followed by finance & insurance (e.g., JP Morgan Chase), and retail. AWS has a well-balanced portfolio of both large enterprises and smaller companies.

AWS provided the following statement regarding the results of the global cloud project analysis 2023:

“AWS, a leader in the global public cloud space, has the largest number of industry-specific use cases of all vendors of public cloud services analyzed here. It is a testament to AWS’ deep industry experience, stemming from over 15 years of experience of working with customers from a broad spectrum of industries, supporting industry leaders such as BMW, Goldman Sachs, Georgia-Pacific, Moderna, Nike, Netflix, Siemens, Volkswagen and many more. In recent years, the company has also added industry-specific purpose-built services and solutions to its portfolio: In the manufacturing industry, for example, there are purpose-built AWS services such as AWS IoT TwinMaker for digital twin scenarios, or Amazon Lookout for Equipment for predictive maintenance scenarios. There are similar examples of purpose-built services for other industries, for example Amazon Just Walk Out for frictionless check-out in physical stores, or Amazon FinSpace for financial services data & analytics. AWS has continuously expanded its partner network and offers the largest community of partners to help customers at all stages of their cloud transformation journey.”

2. Microsoft: Strong presence with large corporates and manufacturers, especially in EMEA

Microsoft Azure holds a strong second position in the market and is particularly well-positioned with large corporates, many of which already use Microsoft software. EMEA is a significant strong point for Microsoft. 44% of all Microsoft cloud projects are in EMEA with a notable strong presence in Germany, the UK and the Netherlands. Examples of customers in this region include Bosch, Schneider Electric, and Uniper. Microsoft is well-versed in the manufacturing segment, with almost a quarter (24%) of their projects involving customers from this industry. For instance, Kuka AG migrated most of its IT operations in North and South America to the Azure cloud platform, resulting in increased speed, security, and scalability of their operations.

3. Google: The choice for smaller companies, especially in the ICT industry

While it may be a distant third, Google Cloud is favored by smaller IT companies who perceive Google as the most innovative and developer-friendly option. Around 40% of projects involving small customers in the ICT industry are Google projects. Additionally, 68% of all Google Cloud projects are with smaller companies employing less than 1,000 employees. Google also has a strong presence in Latin America, including Brazil, Chile, and Argentina. Its customer base includes retail giant Carrefour, fintech Revolut, and semiconductor machinery manufacturer ASML. ASML leveraged Google Cloud and products like BigQuery, Google Kubernetes Engine and Cloud Datalab (now deprecated) to achieve a 40% improvement in overall engineering efficiency, including time to market.

4. Oracle: Diverse customer base with a strong footprint in South America

Oracle, known for its database technology, has gained traction in cloud services by offering unique value propositions, particularly to its existing database and ERP customers. Oracle has a larger regional footprint in South America compared to other providers, with 15% of its cloud computing projects located in this region. This percentage is higher than those of Google (9%), Microsoft (5%), and AWS (2%). Across industries, the majority of Oracle’s projects fall within the ICT (43%) and manufacturing (16%) segments. Noteworthy Oracle customers from our list include Cognizant, NEC, and FedEx. For example, Cognizant utilized Oracle’s Exadata Database on Oracle Cloud Infrastructure to manage over 24 terabytes of HR and finance data, enhancing its agility.

5. Alibaba: Strong presence in China and some other Asian countries

Alibaba Cloud, the leading cloud provider in the APAC region, has made significant strides, particularly among Chinese and Asian businesses seeking to expand their digital presence. APAC accounts for 87% of Alibaba’s projects, with 43% of them belonging to the ICT industry. When compared to the other four vendors, Alibaba has the lowest share of customers with more than 1,000 employees. Two notable large customers working with Alibaba include Ford and Casio. Casio collaborated with Alibaba to improve their marketing strategy, while Ford collaborated to deliver customized digital solutions for Chinese customers.

Other notable findings from the analysis:

- On average, each cloud project utilizes 4.5 different cloud services.

The 7,000 analyzed projects mentioned a total of 31,790 different cloud services/products, resulting in an average of 4.5 services per project. Among these services, 47% are PaaS, 28% are IaaS, and 16% are applications. The remaining percentage is divided among other management tools, services, and hardware products associated with the cloud computing projects. The most commonly used services include Azure IaaS, Amazon EC2, and Google Big Query. - IoT services are used in 4% of all projects.

Out of the 7,000 projects analyzed, 269 of them utilize an IoT service such as Azure IoT Hub, AWS IoT Core, or Google IoT Core (to be retired on August 2023). Stay tuned for a follow-up analysis specifically focused on this topic. Note that a number of projects falling under the IoT category do not utilize a specific IoT service and thus are not included in the 4% figure. - AI services are used in 14% of all projects.

Out of the 7,000 projects, 964 of them employ a machine learning/AI PaaS service, such as Azure Machine Learning, Google’s AI Platform, and Amazon SageMaker. - Cloud-vendor footprints vary significantly by country.

For example, Microsoft dominates in Japan (74% of all case studies there), AWS leads in India (44%), Google is prominent in France (53%), and Alibaba takes the lead in Indonesia (39%). These differences highlight the local successes of each vendor across the 105 countries covered in the analysis. - Multi-cloud is a reality in large organizations.

The data indicates that many large corporations have different cloud projects with two or even more cloud providers. For example, Siemens has public projects with AWS, Microsoft, and Google, while Vodafone has projects with Microsoft, AWS, and Oracle.

Using the data for industry insights

We believe that the data provides significant value for various purposes. Here are some ideas:

- Forecasting market share development (e.g., will Microsoft continue to gain market share?).

We believe recent cloud market share gains by Microsoft can be (partially) attributed to Microsoft’s unique customer footprint with larger corporates and its lower dependency (relative to competitors) on the ICT industry, which has aggressively reduced costs recently. Mapping end-user industry growth based on the data may provide investors with a better understanding of where some of these companies may be headed in the next three to five years. - Mapping cloud customers to target markets (e.g., which vendor serves the machinery sector most?).

Developing and maintaining integrations into public cloud vendors is expensive, and many companies that sell hardware or software that is connected to the public cloud focus on one lead vendor (Mostly AWS, Microsoft, or Google) in their development. By mapping a company’s own regional or industry footprint to that of the public cloud providers, those companies can develop an understanding of how prevalent each of the cloud providers is in their target markets. - Benchmarking cloud services in use (e.g., what services are our competitors using?).

There are many architectural choices when it comes to the cloud. Understanding what cloud services other companies use and in what context may provide to be an insightful benchmark into what else is possible. - Understanding the target market (e.g., what kind of cloud projects are going on in the telecommunications industry in North America?).

Different industries have different operational goals and deploy cloud projects for different uses. By examining the cloud projects in one specific target market, companies can gain a better understanding of the nature and types of projects.

The database is fully filterable, and our team has prepared a comprehensive 148-page report summarizing and visualizing some of the most interesting findings, including market share by country, customer footprint in specific industries by vendor, and the main services used for each vendor.

More information and further reading

Are you interested in learning more about the cloud market?

Global Cloud Projects Report and Database 2023

A comprehensive database accompanied by a 145-page report analyzing 7,000 customer implementations of the largest cloud vendors, including a deep dive into IoT cloud projects.

Download the sample to learn more about the report structure, select definitions, select data, additional data points, trends, and more.

Click on the button to load the content from .

Related publications

You may also be interested in the following reports:

- State of the IoT – Spring 2023

- IoT Software Adoption Report 2023

- Digital Twin Market Report 2023-2027

- Cloud Computing for IoT Market Report 2021–2026

- Cloud Computing Market Report 2021–2026

Related articles

You may also be interested in the following articles:

- Winning in IoT: How the enterprise IoT market is evolving

- State of IoT 2023: Number of connected IoT devices growing 16% to 16.7 billion globally

- Decoding Digital Twins: Exploring the 6 main applications and their benefits

- The IoT cloud: Microsoft Azure vs. AWS vs. Google Cloud

- The case for a $2 trillion addressable public cloud market

Related dashboard and trackers

You may also be interested in the following dashboards and trackers:

- Global Cellular IoT Module and Chipset Market Tracker & Forecast

- Global Cellular IoT Connectivity Tracker & Forecast

- Global IoT Enterprise Spending Dashboard

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.