Telco IoT market update Q1 2023

Telecommunication companies made $11 billion in revenue with cellular IoT connectivity services in 2022, according to the IoT Analytics Global Cellular IoT Connectivity Tracker & Forecast. This number grew strongly 15% year-on-year on the back of the first 5G IoT implementations and 4G LTE, Cat1 bis, and LPWA dual mode implementations. However, the Telco IoT market has also been grappling with economic uncertainty and the continued effects of the chip shortage in Q1 2023. While the chip supply situation in Q1 2023 has further improved, lead times and supply availability are not yet back to pre-COVID-19 levels.

Driving 5G IoT adoption is top of the agenda for many IoT businesses of mobile operators, but at the same time, companies remain challenged with huge capital expenditures related to 5G infrastructure build-out, including new vRAN and Open RAN architectures.

The first quarter of every calendar year is always extremely important as the key players in the industry lay out their visions, announce the most important new products, and showcase them at two of the most important conferences: Mobile World Congress (MWC) Barcelona 2023 and Embedded World (EW) 2023. This year also saw two other major announcements related to Telco IoT in Q1 2023: the acquisition of Ericsson’s IoT business by Aeris Communications and the acquisition of Twilio’s IoT business by KORE wireless.

Q1 conference recap: MWC and EW

Here is a quick recap of MWC Barcelona 2023 and EW 2023

Mobile World Congress 2023

MWC Barcelona 2023, which took place from February 27 to March 2, is the telecommunications industry’s main event showcasing the latest technologies and solutions, such as 5G, edge computing, and AI. In 2023, the event was attended by 88,500 people, a 45% increase in attendance compared to the previous year. Still, overall attendance fell short of pre-pandemic participation levels, with a 19% decrease compared to 2019.

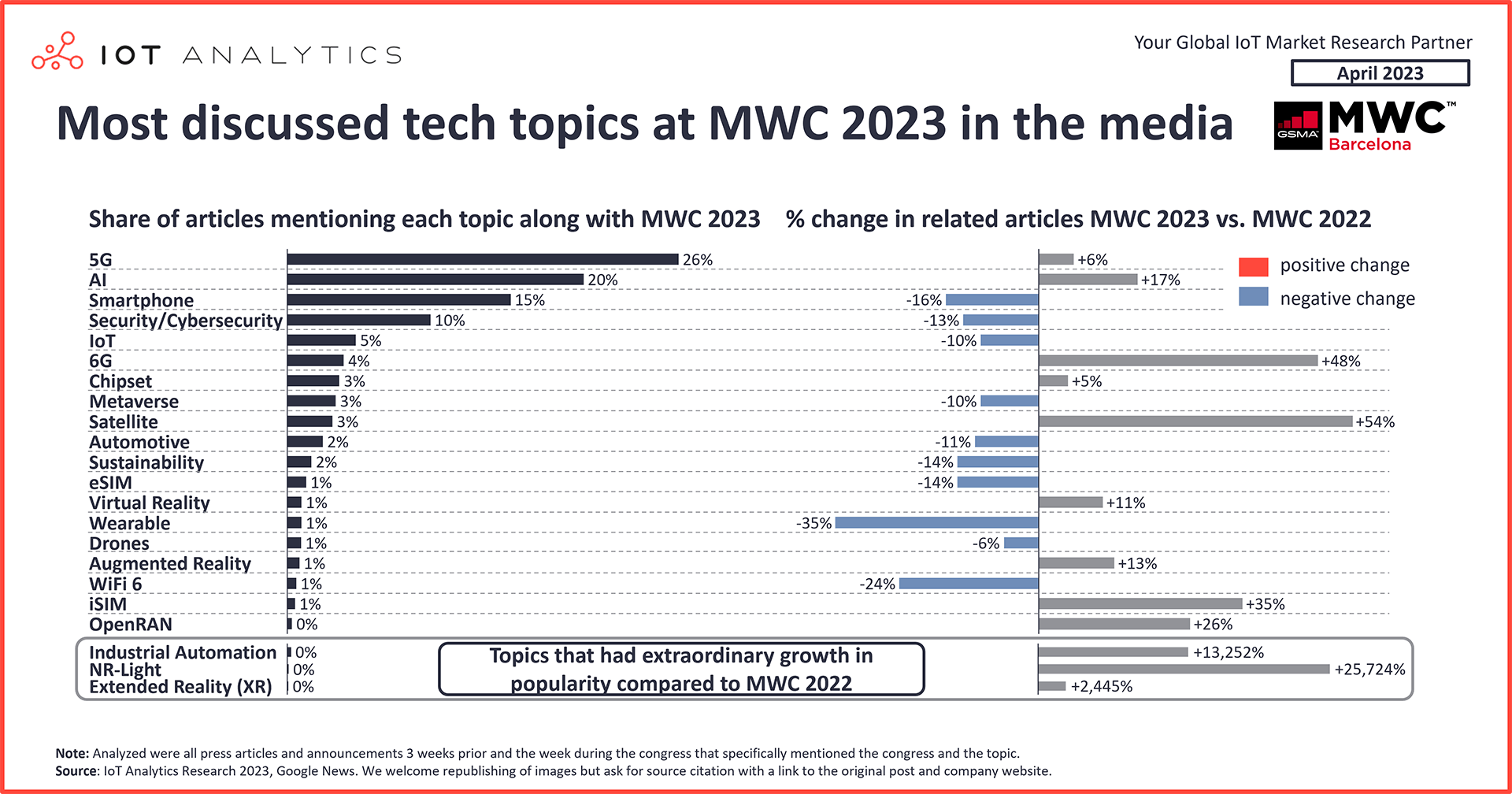

Our analysis of media discussions and announcements around the fair shows that 5G and AI were the dominating themes of 2023, with two notable breakout topics compared to the 2022 edition: 6G (yes, companies have started preparing for it, and there were some first interesting showcases at the fair) and satellite connectivity. Topics such as smartphones and wearable devices decreased in importance, continuing a trend that we have witnessed for a few years.

The media analysis and much more is part of our 46-page 2023 MWC Event Report.

This article is based on our 47-page MWC Barcelona 2023 Event Report.

Already a subscriber? Browse your reports here →

Click on the button to load the content from .

Embedded World 2023

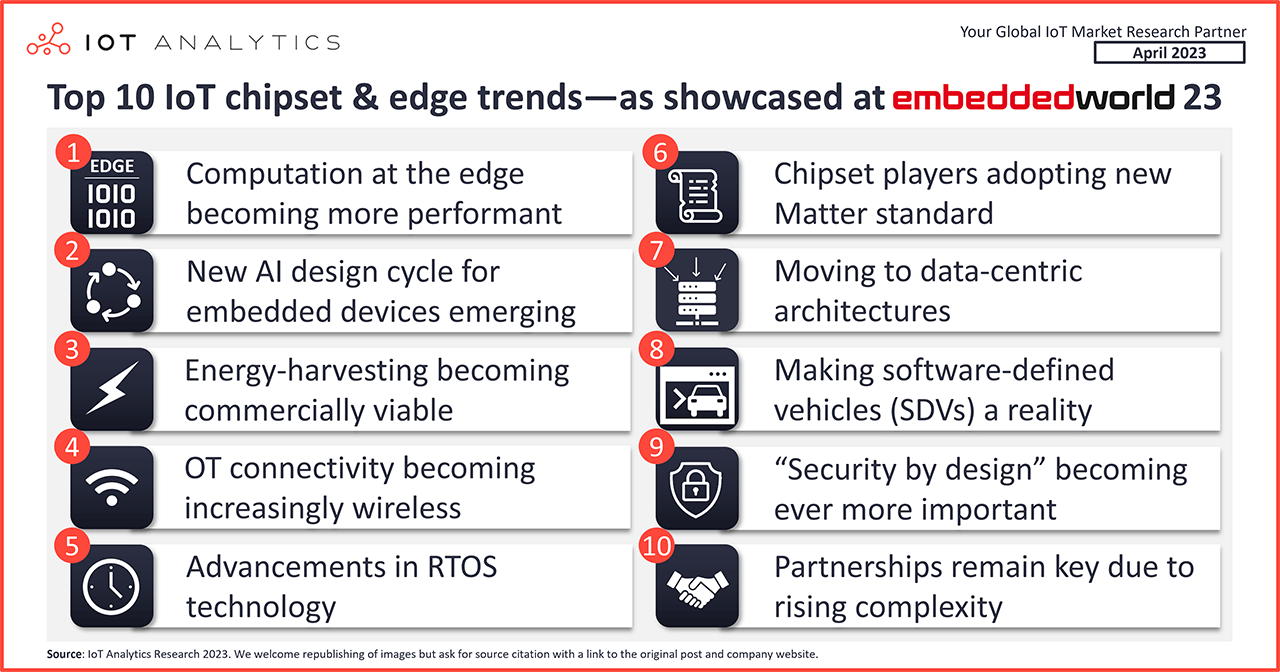

EW 2023, which took place from March 14 to March 16, is considerably smaller than MWC, with a more hardware-centric focus on embedded systems, IoT, and connected devices. In 2023, 27,000 people attended the event. We already published our 10 takeaways from the event (not necessarily Telco IoT focused) a couple of weeks ago here.

The 10 EW takeaways and much more are part of our 36-page 2023 Embedded World Event Report.

10 notable telco IoT trends in Q1 2023

1. Market consolidation of IoT Telco companies

Two major Telco IoT acquisitions in Q1 2023 show the ongoing market consolidation and the quest of some companies to build out a superior end-to-end Telco IoT portfolio. In March 2023, Aeris Communications completed the acquisition of Ericsson’s IoT assets; in March 2023, KORE Wireless announced its acquisition of the IoT unit of Twilio.

Aeris Communications

Aeris acquired Ericsson’s IoT Accelerator and Connected Vehicle Cloud businesses, along with some related assets. This allows Aeris to complement its “Intelligent IoT Network” product—a network management software—with the “IoT Accelerator” platform, an IoT platform for enterprises, thereby creating potential for new revenue streams for communication service providers (CSPs). In addition, Ericsson’s Connected Vehicle Cloud complements the Aeris’ Mobility suite. At MWC 2023, the combined teams also showcased new security features that protect IoT deployments against cyber threats and other vulnerabilities. We can expect Aeris to further integrate these three solutions in the coming months to create a more comprehensive IoT portfolio that better addresses the demands of the cellular IoT market.

KORE Wireless

KORE Wireless announced its intent to acquire Twilio’s IoT business unit. The objective of the acquisition is for KORE to strengthen its position as a leading provider of IoT connectivity solutions. By combining KORE’s “OmniSIM” eSIM enablement software with Twilio’s “Super SIM” IoT SIM management tool—and by combining KORE Hypercore with the Cloud Native Core of Twilio—KORE is set to create an optimized end-to-end IoT connectivity solution that could lead to better user experiences and faster IoT deployment time for KORE customers.

2. Democratization of network access

The new “Open Gateway” initiative by GSMA, launched at MWC 2023, aims to set a universal framework of network APIs that provides developers federated access to global mobile network capabilities. The initiative has the support of 21 major mobile network operators. For now, eight universal network APIs have been announced (e.g., API for device status), but more are planned. The framework is set to simplify service delivery and promote much-needed collaboration among telecom operators and cloud providers. The initiative may also support immersive technologies and Web3 in better reaching critical mass.

3. Operators investing in vRAN architectures

The vRAN ecosystem is expanding, with more players announcing that they are entering the market, including industry giants such as Samsung, Ericsson, Mavenir, Rakuten Symphony, and Nokia. NEC and Fujitsu also anticipate vRAN revenue to ramp up in 2023. The performance of vRAN is also improving due to better energy efficiency and a reduced performance gap between traditional RAN and new vRAN solutions. This is evidenced by Qualcomm’s confirmation of Vodafone’s positive views on Mavenir’s OpenBeam Massive MIMO AAU. Samsung also reiterated that its vRAN solution has similar performance levels as its purpose-built RAN for Verizon.

4. Intel’s SoC threatens accelerator players

Intel’s new 4th Gen Intel Xeon processors have integrated vRAN accelerators (vRAN Boost), thereby eliminating the need for custom Layer 1 accelerator cards. By eliminating the need for an external accelerator card, CSPs can reduce the component requirements of their virtualized RANs. This, in turn, leads to significant compute power savings, simplified solution design, and a reduction in the total cost of ownership for CSPs. Other vRAN accelerator players in the market will have to up their game to remain competitive in the face of Intel’s new offering.

5. Private 5G adoption in enterprises outside the industrial space

Private 5G networks have gained significant traction in the enterprise sector, with the emergence of affordable and portable solutions such as Vodafone’s miniature 5G base station enabling small businesses and households to benefit from the technology. The development of new protocols and frequencies, including NR+ and 1.9 GHz, is further enhancing the capabilities and performance of private 5G networks, with a particular focus on addressing customized indoor applications for IoT, autonomous vehicles, and AR/VR. However, the adoption rate of private 5G in the industrial space remains low, despite the significant promise a private wireless ecosystem has. Hundreds of industrial companies have started private 5G trials, but very few have rolled out the technology further at this point.

6. New LPWA cellular modules threaten incumbents

A new generation of LPWA cellular modules has been launched by companies that were previously just providing chipsets (MCUs) for modules (based on the Open MCU architecture). At MWC 2023, both ST Microelectronics (ST87M01) and Renesas (RYZ024A) showcased their own modules based on their own MCUs. These new LPWA cellular modules are in competition with traditional cellular module players such as Quectel or Fibocom, especially because they promise better scalability, reduced bill of materials (BoM), and accelerated time-to-market while maintaining full control over the supply chain.

7. The rise of 3GPP-based satellite connectivity

The implementation of 3GPP-based satellite connectivity is becoming increasingly popular, with major chipset manufacturers such as Mediatek, Qualcomm, and Sony Semiconductor showcasing their latest developments in this area. For instance, MediaTek’s MT6825 is a dedicated standalone 3GPP NTN-standard modem that powers the Motorola Defy Satellite Link, a compact and rugged accessory device with a credit card-sized form factor. This device enables two-way satellite communication, which is particularly useful in areas with limited terrestrial network coverage. Meanwhile, Sony Semiconductor’s ALT1350 is the first cellular IoT LPWA chipset to offer satellite connectivity, opening up new possibilities for IoT devices to communicate beyond traditional network boundaries. These developments highlight the growing importance of satellite connectivity in the telecommunications industry and its potential to enable reliable and ubiquitous connectivity, especially in remote or hard-to-reach locations.

8. New architectures set to accelerate eSIM/iSIM IoT adoption

IoT eSIM adoption has been rather slow at this point, partially due to its complex ecosystem. To tackle this challenge, the GSMA is developing two new eSIM IoT specifications, namely SGP 31 and 32, that will complement the existing M2M (GSMA SGP.02) and Consumer (GSMA SGP.22) eSIM standards. The new specifications will enable remote control and configuration of the eSIM via a dedicated management module, eliminating the need for user interaction and carrier integration. The new architectures promise to simplify IoT connectivity and accelerate time-to-market for IoT deployments. Both Thales and Webbing eSIM solutions are based on the SGP.31 architecture, which eliminates the need for user interaction during provisioning, simplifies IoT connectivity, and reduces the time to deploy.

“Webbing is proud to have pioneered the shift to SPG.31 and SPG.32 GSMA standards for IoT connectivity and is continuing to lead the evolution to sustainable global data connectivity with innovative, high-quality, and scalable technology.”

– Yaniv Elron, Co-Founder and EVP Global Sales and Marketing at Webbing

9. eSIM/iSIM leveraged to track the previously untrackable

There is a growing trend toward using eSIM and iSIM technology to track and monitor small and lightweight items, particularly in logistics and supply chain management. Companies such as Kigen, G+D, Sequans, and Sensors are partnering with other industry leaders to develop Smart Label tracking solutions. This paper-thin device allows for tracking small and lightweight items with unprecedented precision, accuracy, and security, which was previously not possible with traditional tracking devices. Such technologies leverage LPWA and satellite connectivity and GNSS and other sensors to collect and transmit real-time data on location, temperature, humidity, movement, and other key metrics. As demand for secure, flexible, and efficient IoT solutions continues to rise, these partnerships and collaborations are poised to drive significant innovation and growth in the industry.

10. Post-quantum security becoming crucial for IoT

As IoT devices evolve and become more interconnected, ensuring their security is increasingly critical for developing a secure future IoT ecosystem. One way to prevent vulnerabilities and minimize risks throughout the devices’ life cycles is by implementing security measures from the design phase. Adopting a security-by-design approach helps businesses build trust among consumers and unlock the full potential of IoT. To ensure the security of IoT devices with a lifespan of 10–15 years, Thales and WolfSSL are advocating a post-quantum security approach with a hybridization strategy. In contrast, Crypto Quantique relies on a quantum-driven hardware root of trust. The latter approach is already commercialized and gaining traction.

Conclusion/Outlook

The cellular IoT market is showing robust growth, despite a global economic slowdown. A renewed end-to-end IoT focus of some of the industry leaders (e.g., KORE Wireless and Aeris Communications) may further simplify adoption in the coming years. In addition, other initiatives highlighted in this analysis, such as the GSMA Open Gateway project, vRAN technology, private 5G networks, MCU-based cellular LPWA modules, satellite connectivity, and eSIM/iSIM architectures, may be the basis for the next growth wave in the Telco IoT space. With strong cellular IoT adoption across verticals such as automotive, supply chain, utilities, and healthcare, we forecast a continued strong growth in the area. We continue to comprehensively monitor the space, e.g., with our two in-depth data products, the Global Cellular IoT Module and Chipset Market Tracker & Forecast, and the Global Cellular IoT Connectivity Tracker & Forecast.

More information and further reading

Are you interested to learn more about our experience at MWC?

IoT Analytics is a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), AI, Cloud, Edge, and Industry 4.0.

MWC Barcelona 2023 Event Report

47-page report presenting a comprehensive summary of the key highlights and themes, 10 in-depth insights assembled by the IoT Analytics analyst team at Mobile World Congress (MWC) 2023.

Click on the button to load the content from .

Already a corporate research subscriber?

Related market data

You may be interested in the following IoT market data products:

- Global Cellular IoT Module and Chipset Tracker and Forecast

- Global Cellular IoT Connectivity Tracker and Forecast

- Global IoT Enterprise Spending Dashboard

Related publications

You may be interested in the following publications:

- IoT Sensors Market Report 2022-2027

- IoT Communication Protocols Adoption Report 2022

- Satellite IoT Market Report 2022-2026

- LPWAN Market Report 2021–2026

- Embedded World 2023—the Latest IoT Chipset and Edge Trends

Related articles

You may also be interested in the following recent articles:

- 5 IoT sensor technologies to watch

- 5 things to know about IoT protocols

- Satellite IoT connectivity: Three key developments to drive the market size beyond $1 billion

- 5 things to know about the LPWAN market in 2021

- The top 10 IoT chipset and edge trends—as showcased at Embedded World 2023

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.