Update July 2021: IoT Analytics published a more recent blog on: What CEOs talked about in Q2 of 2021: Inflation, chip shortage, and recruiting.

In short

- Corporate CEOs’ mentions of themes related to the effects of the pandemic faded in Q1. Topics relating to vaccines and vaccination increased during this time.

- The automotive semiconductor shortage has catapulted the subject into the center of attention.

- Sustainability topics continue to grow (as highlighted in Q4 2020).

- Other rising keywords in boardroom discussions include digital twins, bitcoin, and edge computing.

Why it matters?

- The fact that CEOs now prioritize these topics will likely lead to further investment and overall spending in these areas.

2021 is a year of hope for most people, including CEOs. In a time when living with the pandemic and accepting certain restrictions have become the “new normal,” the prospect of vaccine availability across the entire population is reversing market sentiment and inspiring a more positive outlook. With mass-vaccination programs on every continent, lockdown and layoff scenarios have lost steam again (see our last article for comparison).

However, recent developments also show that the economy is still vulnerable. The semiconductor shortage, for example, is affecting the automotive and manufacturing industry in particular and is likely to last beyond 2022, according to Intel CEO Pat Gelsinger. Cybersecurity attacks have seen a fourfold increase since the beginning of the pandemic, according to FBI reports. Attackers are becoming more and more creative, as the recent example of a casino being hacked through a fish-tank thermometer shows.

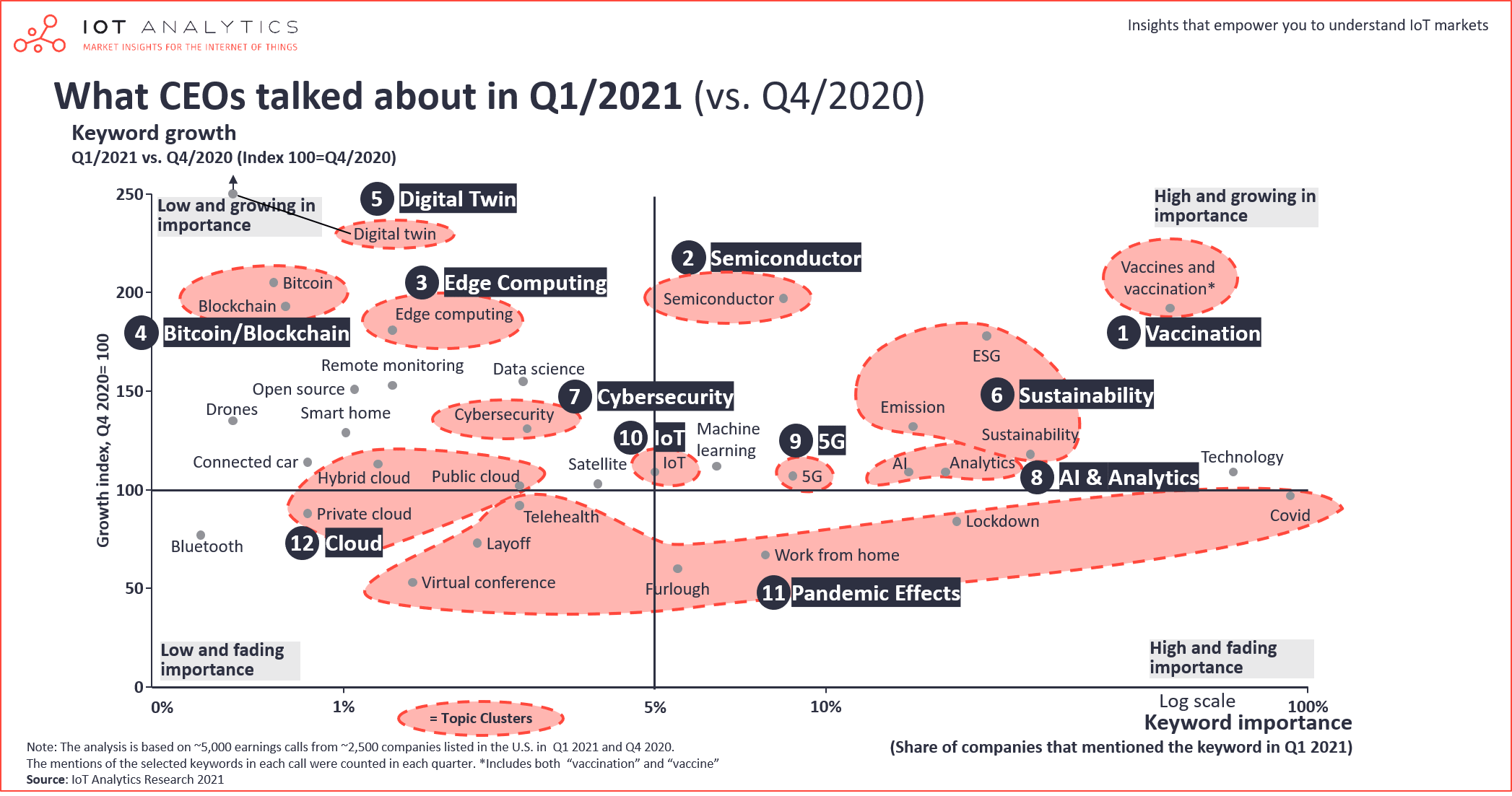

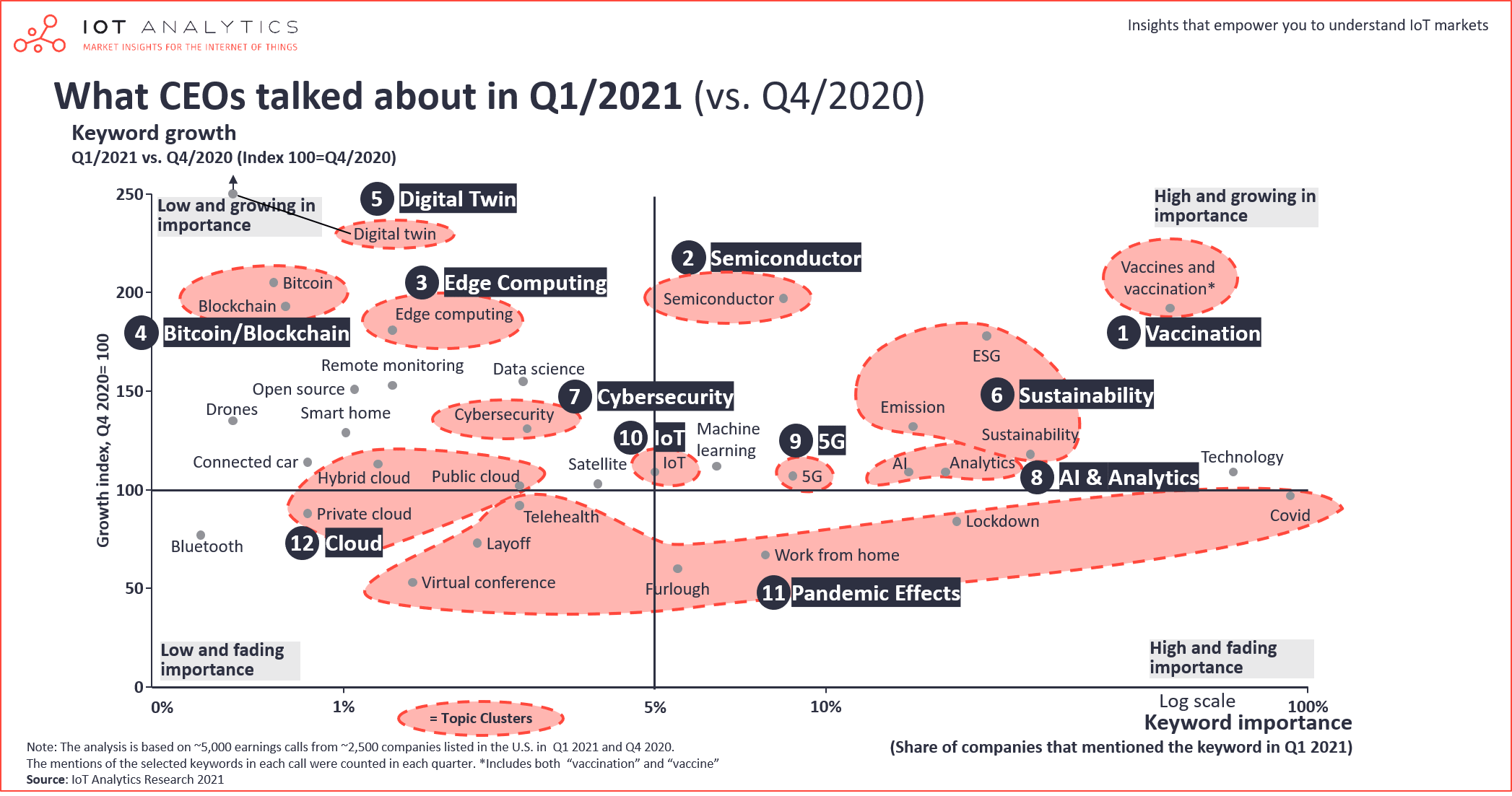

The analysis highlighted in this article presents the results of IoT Analytics’ research involving the Q1 earnings calls of ~2,500 US-listed companies. The resulting visualization is an indication of the digital and technology topics CEOs prioritized in Q1 2021.

The chart visualizes keyword importance and keyword growth:

X-axis: Keyword importance (i.e., how many companies mentioned the keyword in earnings calls in Q1). The further out on the x-axis, the more often the topic has been mentioned.

Y-axis: Keyword growth (i.e., the increase or decrease in mentions from Q4/2020 to Q1/2021, indexed to 100). A number >100 on the Y-axis indicates the topic has gained importance, while a number <100 indicates the topic has decreased in importance.

These were some of the hottest topics discussed by CEOs:

#1 Vaccination

The terms “vaccination” or “vaccine” were mentioned in over 52% of earnings calls in Q1 2021, a 98% increase compared to Q4 2020. These terms have replaced terms such as “lockdown” or “work from home,” which dominated conversations in Q4/2020. The successful rollout of the different vaccines has allowed companies to again view the future more optimistically, unleashing investments and therefore fueling the growth rates of the world’s biggest economies this year. While the delayed bounce-back in Europe is likely to be modest, GDP in America is expected to expand by close to 6% in 2021—the fastest pace since 1984. However, CEOs see the risks as well. Variations in the speed of rollout in different locations and problems in vaccine supply chains have made them cautious.

“And although we still have a tough winter ahead of us, we’re encouraged by the progress that’s been made on the vaccine front and are confident that Delta is positioned to successfully lead our industry into recovery as the year unfolds. “

Ed Bastian – Chief Executive Officer, Delta Air Lines 01/14/2021

“Searches on the Marriott Vacation Club Owner website show a rising interest in getting back on vacation with January searches for keywords such as book and make a reservation, four times higher than the prior year, […]. However, more than half of the people we’ve surveyed have also stated they will not travel until they get their vaccination.”

Stephen P. Weisz - Chief Executive Officer, Marriott Vacations Worldwide Corp 02/25/2021

#2 Semiconductors

The keyword “semiconductor” was mentioned by roughly 8% of all companies in Q1 2021, an increase of 104% from Q4 2020.

The strong increase in demand for semiconductors and the (short-term) shortage have impacted many industries, as semiconductors are in virtually every product. Just a few months ago, IoT Analytics reported that active IoT device connections increased from 3.6 billion in 2015 to 11.7 billion in 2020. Considering that every IoT device contains at least one and often many chips, the growth in IoT has contributed to the current shortage. By the end of 2025, IoT Analytics forecasts a total of 30 billion IoT connections.

Car manufacturers were hit especially hard, as they cut semiconductor orders in response to the abrupt decrease in global auto demand in early 2020, while IT and consumer electronics industries maintained steady orders. Now that the demand for cars has revived, automotive companies face a costly shortage in semiconductor supply, and a short-term solution is not in sight.

“We estimate a 2021 impact from the semiconductor shortage in the $1.5 billion to $2.5 billion range.”

Paul Jacobson - Executive Vice President and Chief Financial Officer, General Motors Company 2/10/2021

“Then, are we secured for the mid, long-term? No. We do see the risks. That is why every day, every week, every month, not just Tier 1 suppliers, but the conductor manufacturers, semiconductor makers included, we are communicating to understand the situation on a daily, weekly basis.”

Kenta Kon - Operating Officer and Chief Financial Officer, Toyota Motor Corporation 2/10/2021

Many small and unrelated incidents have caused problems for the semiconductor market in the past year, including a fire in a factory of Japanese chipmaker Renesas Electronics, a global shortage of shipping containers, and, most recently, a severe drought in Taiwan.

As the global economy is experiencing stronger demand, supply seems to be shaky for now.

#3 Edge Computing

1.3% of companies mentioned “edge computing” in their earnings call in Q1 2021, which constitutes an 88% increase from Q4 2020.

The primary reason why the edge has become so popular in recent years is that the “edge” as we know it is becoming increasingly intelligent. This “intelligent edge” opens up a whole new set of opportunities for software applications and disrupts some current edge-to-cloud architectures on all layers of the edge. In many boardrooms, expectations regarding edge computing are high, especially in conjunction with 5G.

“5G is going to represent a platform that is redefining edge computing, it will open up smart cities, smart factories, it will displace Wi-Fi.”

Pat Gelsinger - Incoming Chief Executive Officer, Intel 01/21/2021

„And we are on the cusp of widespread 5G connectivity driving real-time, automated, and intelligent outcomes at the edge. This will drive an estimated $700 billion in cumulative spend on the edge — on edge IT infrastructure and data centers within the next decade.“

Jeff Clarke - Chief Operating Officer and Vice-Chairman, Dell Technologies Inc., 02/25/2021

#4 Blockchain / Bitcoin

In Q1 2021, 0.7% of companies talked about Bitcoin during their earnings calls, an increase of 113% from Q4 2020. This increase was driven by a broader revived interest in cryptocurrencies at the end of 2020. Larry Fink of BlackRock, the world’s largest asset manager, said in December that bitcoin could become a “global market.”

This growth is fueled by the democratization of the topic: cryptocurrencies are now appealing not only to Wall Street but the corporate world as well. United Natural Foods, the largest publicly traded wholesale distributor of health and specialty foods in the United States and Canada, launched a bitcoin partnership that allows anyone to participate without needing a bank or debit card.

“Moving beyond our product offerings, we continue to expand our professional services portfolio to offer customers unique solutions beyond selling groceries to them. One recent example involves bringing digital currencies such as Bitcoin to our customers’ stores through a relationship with Coin Cloud. Coin Cloud is a small footprint kiosk that empowers consumers to buy, sell or trade digital currency with cash without the need for a bank account or debit card. To date, we’ve signed 80 contracts and see this potential to grow to 4,000-plus UNFI locations”.

Chris Testa – President United Natural Foods, 03/10/2021

#5 Digital Twin

There are at least 252 different classifications for digital twins, depending on the six different lifecycle phases, six hierarchical levels, and seven most common uses, as discussed here.

The manifold types and different interpretations of digital twins have helped the topic gain attention in the most recent quarter. In Q1 2021, 0.6% of companies mentioned digital twins in their earnings calls, an increase of 250% compared to Q4 2020.

Broadly defined as a digital abstraction or representation of a physical system’s attributes and/or behavior, digital twins are not new. NASA used basic twinning concepts in their space program in the 1960s, managing complex systems for their moon missions in space by employing exact duplications on Earth. These mirrored systems, the precursors of digital twins, were famously used to rescue the Apollo 13 mission when a twinned model of the deployed spacecraft allowed engineers to test potential solutions from ground level.

“Our software is the backbone of BP’s digital twin applications, which has generated over $1 billion of value in 2020. As part of our ongoing partnership, our software will help BP continue its transformation as they work toward their Net Zero ambition.”

Shyam Sankar - Chief Operating Officer Palantir Technologies Inc. 2/16/2021

“And China is a place where digital twins are literally the ambition. And every project starts with the reality modeling survey of the existing condition, the digital context, and is maintained evergreen throughout the project.”

Greg Bentley - Chief Executive Officer Bentley Systems, Incorporated 3/02/2021

More information and further reading

Are you interested in learning more about the latest IoT developments?

Stay tuned for our upcoming reports on IoT Platforms, IoT Startups as well as the latest update on our IoT market outlook.

Related articles:

You may also be interested in the following recent articles:

- What CEOs talked about in Q4 2020

- IoT 2020 in Review – The Most Relevant IoT Developments of the Year

- State of the IoT 2020: 12 billion IoT connections, surpassing non-IoT for the first time

Related reports:

You may also be interested in the following reports:

- IT & IoT Trends – Q1/ 2021

- IoT Semiconductors Market Report 2020-2025

- Enterprise Cybersecurity Adoption Report 2021

- Industrial Edge Computing Market Report

- Digital Twin Insights Report 2020

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.