In short

- The $11 trillion IoT market potential projected for 2025 has fallen short of expectations, according to IoT Analytics’ latest 228-page IoT Platforms Market Report 2025–2030.

- While IoT adoption advanced over the last 10 years, the market for IoT platforms has gone from a potential “blue ocean” to a “red lake,” as the complexity of IoT deployments proved to be a key inhibitor to scaling and many end users did not see enough tangible value with a horizontal IoT platform.

- The agnostic IoT platform market in 2025 is dominated by cloud hyperscalers, with several pockets of value remaining in a world that is increasingly focused on combining IoT with AI.

Why it matters

- For IoT platform vendors: While the IoT platform market failed to grow as expected, there is still opportunity. IoT platform vendors must understand where value lies for their customers and tailor their platforms to meet these needs.

- For IoT platform adopters: Hundreds of vendors still offer services to help enterprises manage connected devices, collect and process data, and enable the development and management of IoT applications. Adopters should assess their data needs and learn what offerings are available to them to make sound technology investments.

In this article

- IoT Platforms: A decade of inflated hopes and missed forecasts

- Why did the market never take off, and why did so many companies fail?

- The customer angle

- The technology angle

- The competitive angle

- Where IoT platform value lies today

- Value driver 1: The cloud

- Value driver 2: IoT device management

- Value driver 3: IoT data management

- Value driver 4: OEM-specific workflows

- Value driver 5: Connected ecosystems and applications

- Value driver 6: The edge

- IoT platform market size and outlook (Insights+ exclusive)

- General drivers for the IoT platform market (Insights+ exclusive)

- General inhibitors for the IoT platform market (Insights+ exclusive)

- IoT platform competitive landscape (Insights+ exclusive)

- What is ahead for IoT platform vendors (Insights+ exclusive)

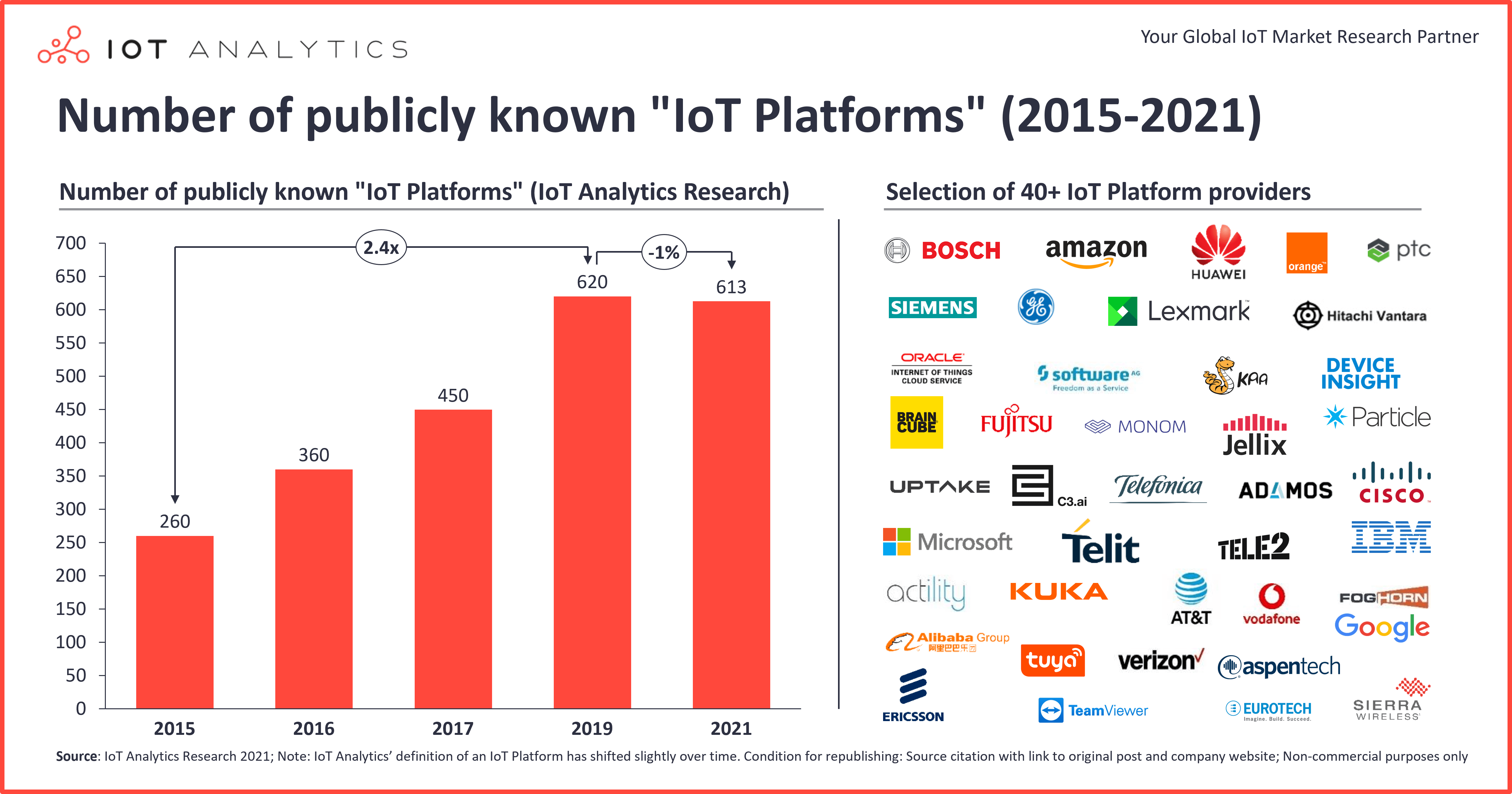

IoT platforms market competition peaked in 2019. In 2019, IoT Analytics published an analysis showing that 620 IoT platforms were operating globally, 450 more than a similar analysis had revealed in 2017. That marked a high that was never reached again, as many platforms started to disappear or quietly pivot in the years that followed. Notable exits include SAP, Google Cloud, and IBM, all of which recognized that McKinsey’s much-touted $11 trillion IoT opportunity was not materializing for them.

So what happened to the vision that IoT platforms could be the next “Google for connected devices,” and where does the market stand today?

The latest IoT Analytics’ 228-page IoT Platforms Market Report 2025–2030 (published August 2025), discusses how the IoT Platform market evolved from a vast “blue ocean opportunity” to a congested “red lake reality” and takes a look at the IoT Platform market today and its outlook.

Insights from this article are derived from

IoT Platforms Market Report 2025-2030

A 228-page report detailing the market for enterprise and industrial IoT platforms, incl. market size, competitive landscape, key trends and challenges.

Already a subscriber? View your reports and trackers here →

What is an IoT platform?

IoT Analytics defines IoT platforms as software-based technical platforms that act as a middleware layer between connected hardware and IoT applications. They are designed to:

- Manage connected devices

- Collect and process data

- Enable the development and operation of IoT applications

These platforms are typically characterized by their openness, extensibility, and support for third-party integration, traits that allow ecosystems to grow around them. While definitions vary, virtually all IoT platforms offer a north- and southbound connectivity layer, and most platforms offer device, data, and application management.

IoT Platforms: A decade of inflated hopes and missed forecasts

The once-in-a-decade business opportunity. In 2015, McKinsey forecasted an $11 trillion IoT opportunity by 2025, and Sweden-based telecommunications technology company Ericsson projected 50 billion connected devices by 2021. These projections prompted companies to decide that they should place some bets on what might become a billion- or trillion-dollar business.

2014–2017: The land grab. As a result of these projections, hundreds of vendors (startups, telcos, IT giants, and industrial OEMs) rushed in to capture a share of what some considered the opportunity to build the next “Google for IoT.” Early IoT platform market leaders included:

- ThingWorx, based in the US (acquired by PTC, a US-based industrial software company, in December 2013)

- Cumulocity, based in Germany (acquired by Software AG, a Germany-based enterprise software company, in March 2017 and returned to independence after being bought out by its management team in January 2025)

- Xively, based in the US (first acquired by US-based remote access software company LogMeIn in 2011, then acquired by Google Cloud in February 2018)

- SeeControl, based in the US (acquired by Autodesk, a US-based engineering software company, in August 2015)

US-based diversified industrial conglomerate General Electric (GE) was one of the first large companies to make a strategic bet on the industrial internet with the public announcement of its GE Predix platform in October 2014. AWS also joined the IoT platform race in 2015, and Microsoft in 2016.

In September 2015, GE fueled the IoT platform fire when it announced that Predix was already generating $5 billion in revenues and had $6 billion in orders. In reality, Predix never reached this much external revenue, and it turned out that much of that figure reflected internal billing within GE’s industrial units rather than third-party adoption.

2017–2019: Reality bites. By 2019, over 620 IoT platforms were on the market, all vying to become the Google of connected devices. However, the reality looked different: many enterprises resisted generic platforms (reasons discussed further below). As companies came to realize that perhaps the opportunity was not as vast, some of them began to make strategic moves, primarily aiming to preserve the technology they had developed but utilizing it for specific, ROI-generating applications rather than a single, generic cross-industry platform.

- GE: In November 2017, GE was one of the first to make a move, announcing a refocus on internal, vertical-focused deployments.

- Relayr: In 2018, Germany-based IoT platform provider Relayr was acquired by Munich Re, a Germany-based insurance group, and began focusing on customized IoT business outcome solutions, such as equipment-as-a-service. The company’s operations ceased in July 2025.

- Honeywell: In 2019, US-based technology conglomerate Honeywell, with its Forge platform, started to branch into verticals like aerospace, buildings, and industrials.

2020–2023: Commoditization and exits. In November 2021, an IoT Analytics analysis found that the IoT platform market had started to consolidate. With 12.2 billion IoT connections reached that year (and not 50 billion), it had become clear that the once-appealing blue ocean opportunity had turned into a red bloodbath, with the ocean becoming more like a lake. Then, in August 2022, in a shock announcement to many customers, Google Cloud exited the IoT platform market, leaving customers scrambling for alternatives. Other notable exits include Germany-based enterprise software company SAP in 2022, US-based IT hardware and software company IBM in 2023, and Germany-based technology and services company Bosch in 2024.

2023–2025: Cloud domination and solution focus. In subsequent years, some media declared IoT dead. But the reality is different. Cloud companies have emerged as the “winners,” with AWS and Microsoft, both managing several billion connected IoT devices, becoming market leaders. Much of the value of an IoT platform has moved toward digital twins, data, and end-to-end solutions, prompting some of the other remaining companies to adjust accordingly. For example, in 2023, Germany-based industrial automation company Siemens’ Mindsphere rebranded as Insights Hub and shifted its focus from becoming the “operating system for IoT” to a software application for manufacturing excellence.

Why did the market never take off, and why did so many companies fail?

It is important to understand that the market for IoT platforms did grow steadily from 2010 to 2025; however, the core assumption of exponential platform-scale demand never materialized.

There is not one but many factors that contributed to this development. Here are 3 key angles:

1. The customer angle

“Over time, we heard more and more from the market that, while offering an IoT platform was useful, it didn’t fully meet customer needs. We listened to the customer feedback and recognized that what they wanted were out-of-the-box integrated solutions.

SVP at company that exited the agnostic IoT platform market

Generic horizontal platforms failed to resonate with customers due to lack of tangible value. Many enterprises reported unclear or non-existent ROI, as platforms were often too broad, too rigid, or simply too abstract to support real-world operational workflows. Rather than offering pre-packaged solutions, these platforms delivered middleware and APIs, leaving customers with the burden of development, integration, and orchestration.

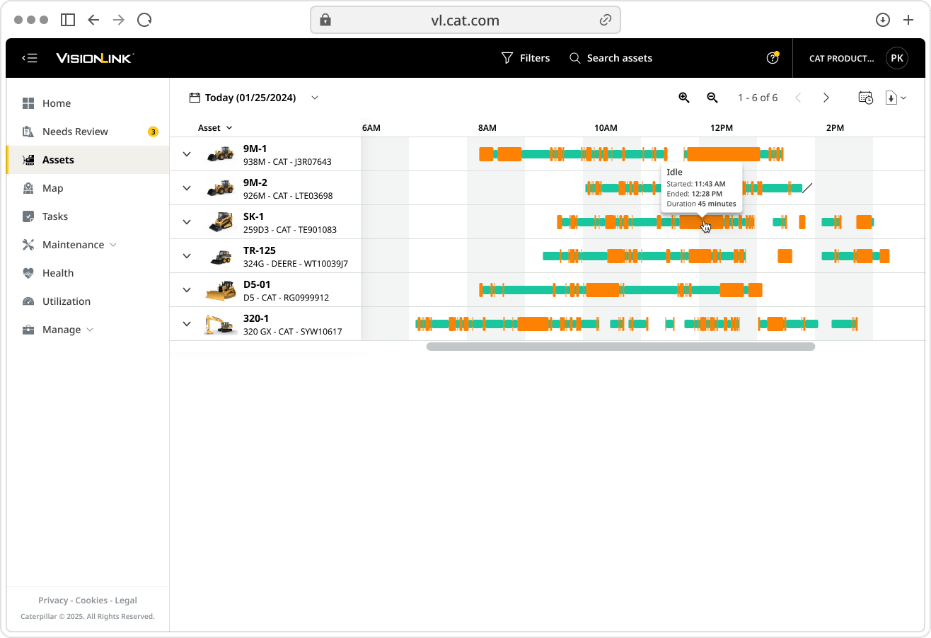

This disconnect drove many customers to build their own stacks or rely on system integrators. Using open-source components like Node-RED, Kafka, and ThingsBoard, companies assembled tailored solutions that mapped more closely to their business logic, often at lower cost and with fewer vendor dependencies. In this landscape, the role of the IoT platform narrowed to basic plumbing: managing device lifecycles, handling OTA updates, and routing data. Value creation moved elsewhere, into cloud-native developer tools and vertical-specific SaaS, particularly those bundled with industrial equipment, such as in the construction or mining machinery industry (e.g., Caterpillar’s VisionLink or US John Deere’s Operations Center).

2. The technology angle

IoT platforms faltered under complexity and costs. The technical complexity of IoT deployments, particularly in brownfield environments, proved to be far greater than anticipated. Legacy protocols like Modbus and BACnet, patchy documentation, on-premise-only assets, and diverse connectivity setups made the promise of standardized integration nearly impossible. Security requirements such as certificate handling, zero-trust provisioning, and firmware lifecycle management added further overhead. As a result, the “easy onboarding” narrative promised by platform vendors quickly broke down when confronted with the realities of industrial infrastructure.

Equally problematic was the ambition to offer all-in-one “application-enablement platforms” (AEPs). Attempts to bundle application enablement, analytics, and AI into a single stack backfired. Developers rejected proprietary modeling tools in favor of mainstream environments like VS Code, AI/ML teams worked with separate tools (e.g., AWS SageMaker or [Azure] Databricks), and customers were wary of vendor lock-in. Maintaining a full-stack platform, complete with edge runtimes, twin engines, UX tooling, and analytics, became financially unsustainable for most vendors. As one former Microsoft product lead put it, “IoT services themselves don’t make enough money… and with all the technical and operational complexity, ROI is difficult to establish.”

“IoT services themselves don’t make enough money… The sales cycles are very long… and with all the technical and operational complexity, ROI is difficult to establish for the IoT solutions.”

Former IoT Product Lead, Microsoft (source)

3. The competitive angle

Hyperscalers consolidated IoT platform dominance. The AEP boom led to too many vendors chasing a market that never scaled. The result was inevitable: exits, pivots, and consolidation. Google Cloud IoT Core, Cisco Kinetic, and SAP Leonardo were shut down or absorbed, while GE Predix and others were repositioned into niche solutions. The total addressable market for hardware-agnostic platforms simply was not large or fast-moving enough to support so many players.

In parallel, hyperscalers became the gravitational center of the IoT infrastructure stack. Most workloads shifted to AWS, Microsoft Azure, or (to a lesser extent) Google Cloud, where customers found not only scalable infrastructure but also pre-built services like MQTT brokers, rules engines, and digital twin graphs. These offerings commoditized many core platform features, forcing smaller vendors to either specialize in verticals, such as energy management or fleet telematics, or integrate directly with cloud ecosystems.

“There is a general trend in the market towards cloud providers, their large service ecosystems and comprehensive tooling landscapes. Our customers frequently indicate a similar demand, and we are already serving them by being more and more technology agnostic.”

Bosch official announcement (source)

Where IoT platform value lies today

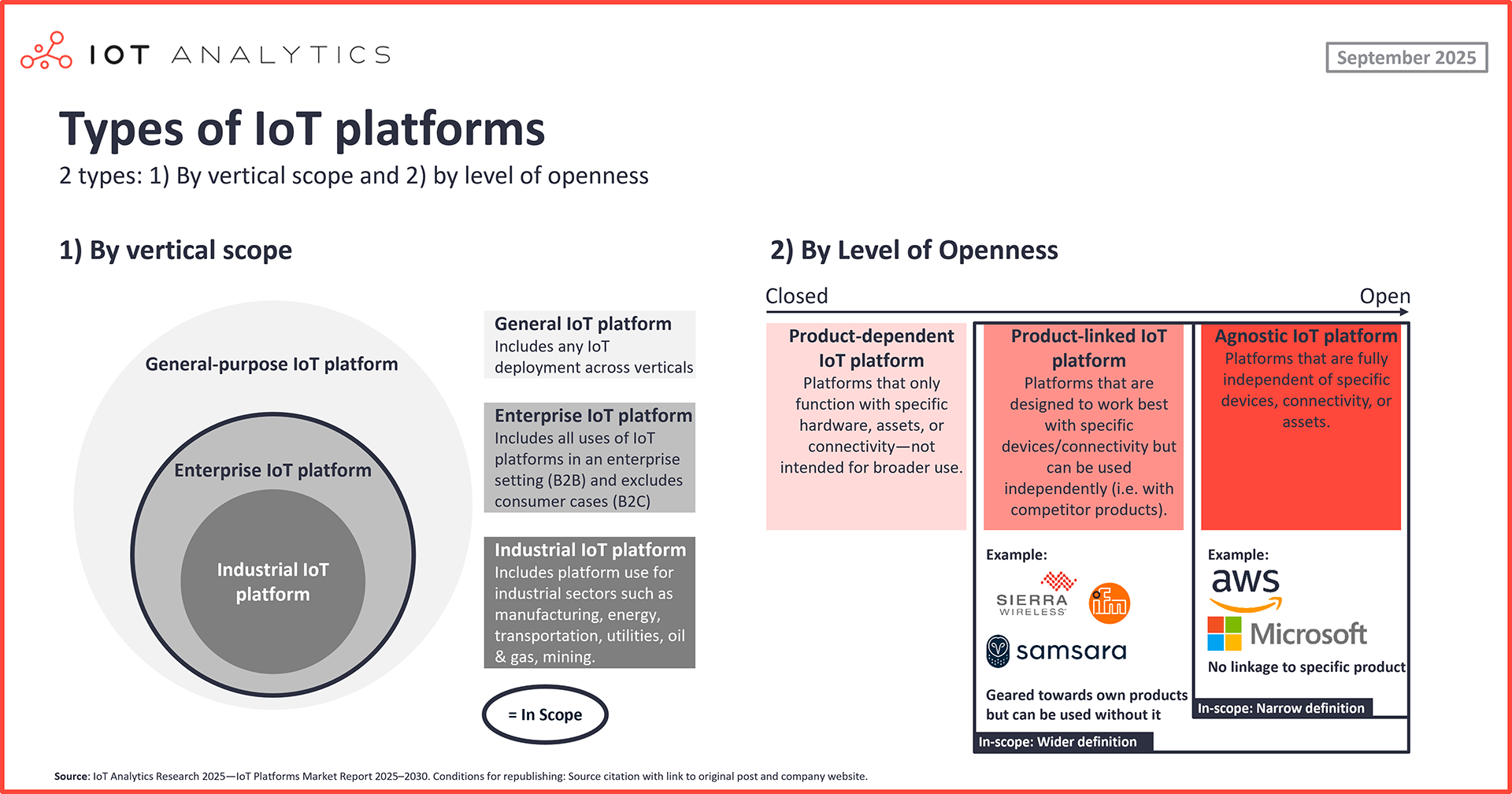

When considering the IoT platform market, IoT Analytics considers enterprise IoT platforms (which include the subset of industrial IoT platforms) and distinguishes between two market segments:

- Narrow, agnostic: IoT platforms that are fully independent of specific devices, connectivity, or assets (i.e., these platforms are agnostic). These platforms have the highest level of openness.

- Wide, product-linked: IoT platforms that are designed to work best with specific devices/connectivity but can be used independently (i.e., with competitor products). These platforms are often tied to a specific industry, such as industrial automation or machinery.

While the story above presents a bleak view of the IoT platform market in general, the report makes clear that not only is there still a market, it is also projected to see steady growth through the remainder of the decade (more on this in Insights+ below). Further, the points about why IoT platform companies failed also underscore areas where market opportunities exist: in the cloud, in device and data management solutions, in vertical/OEM-specific workflows, and in connected ecosystems and applications.

Even in 2025, there remain several hundred IoT platforms, many of which have given up on the vision to be the all-encompassing IoT platform for everyone but instead are focusing on a set of use cases and/or industries.

Value driver 1: The cloud

Hyperscalers hold tight grip on the market. Today, the public cloud represents an important avenue of value for agnostic IoT platforms, largely by acting as an add-on that helps enterprises manage data exchange with their broader cloud environments. Instead of competing with domain-specific SaaS or vertical OEM platforms, hyperscalers provide foundational services (e.g., device registries, MQTT brokers, twin graphs, and rules engines) that enterprises use to integrate IoT data with their existing IT stacks.

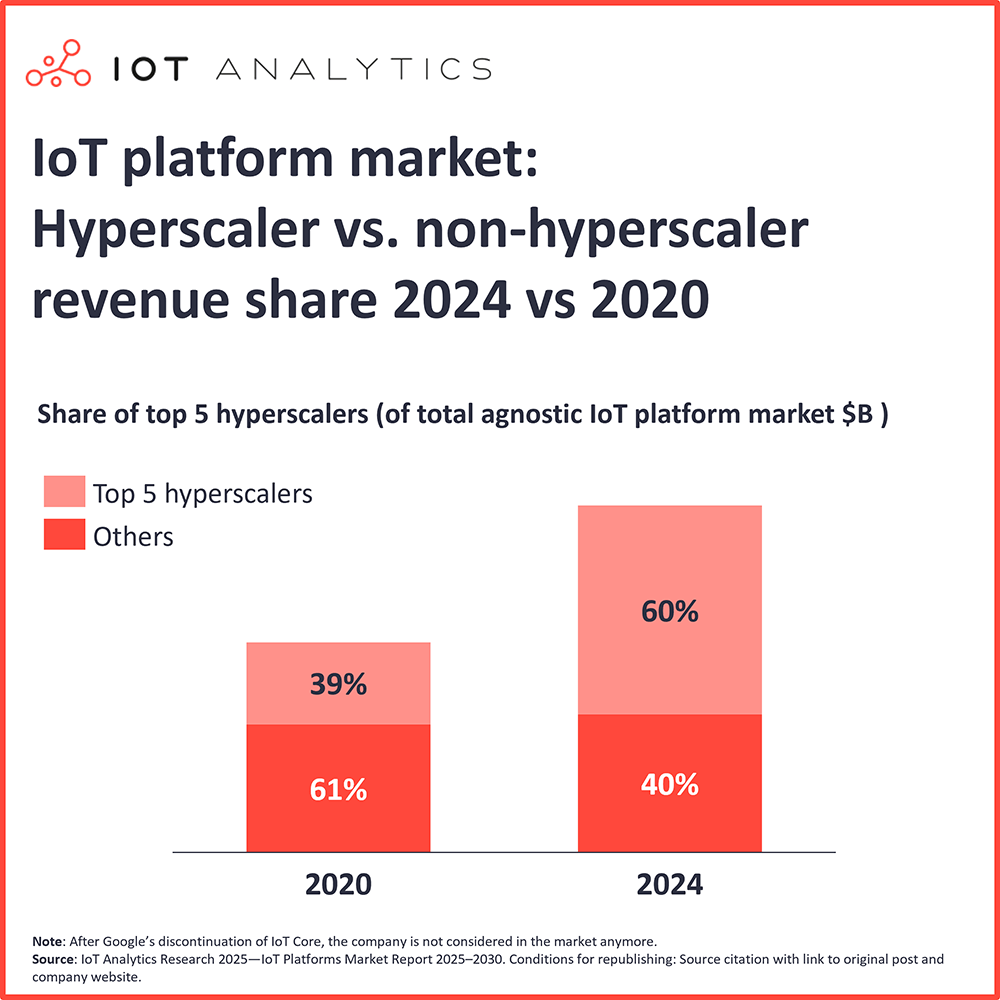

According to the report, in 2024, the top 5 hyperscalers (Microsoft, AWS, Huawei, Alibaba, and Oracle) held 60% of the total agnostic IoT platform market. This represents a significant increase from 39% in 2020, underscoring the substantial consolidation of the IoT infrastructure stack around hyperscalers.

Value driver 2: IoT device management

Device management remains top challenging aspects of IoT. Enterprises struggle with onboarding heterogeneous devices, handling legacy protocols, and ensuring secure connections. Lifecycle tasks such as provisioning, certificate handling, OTA updates, and firmware patching are especially difficult in brownfield environments, where assets often lack reliable connectivity or documentation. This is exactly where IoT platforms have continued to provide real value, and why device management remains a core capability within the market.

The opportunity for vendors lies in mastering these foundational functions. While analytics and application enablement have shifted to broader cloud ecosystems, device management (covering secure provisioning, connectivity, telemetry, and updates) remains the central value proposition of agnostic (and also IoT-product linked) IoT platforms. Growth is modest, but enterprises will continue to depend on this utility layer.

An example of an agnostic IoT Platform with a strong focus on device management is Cumulocity, which remains a significant player in the IoT platforms market thanks to its long-standing strengths in device onboarding and lifecycle management. This demonstrates how platforms with in-depth expertise in this area remain crucial for enterprise IoT deployments.

Value driver 3: IoT data management

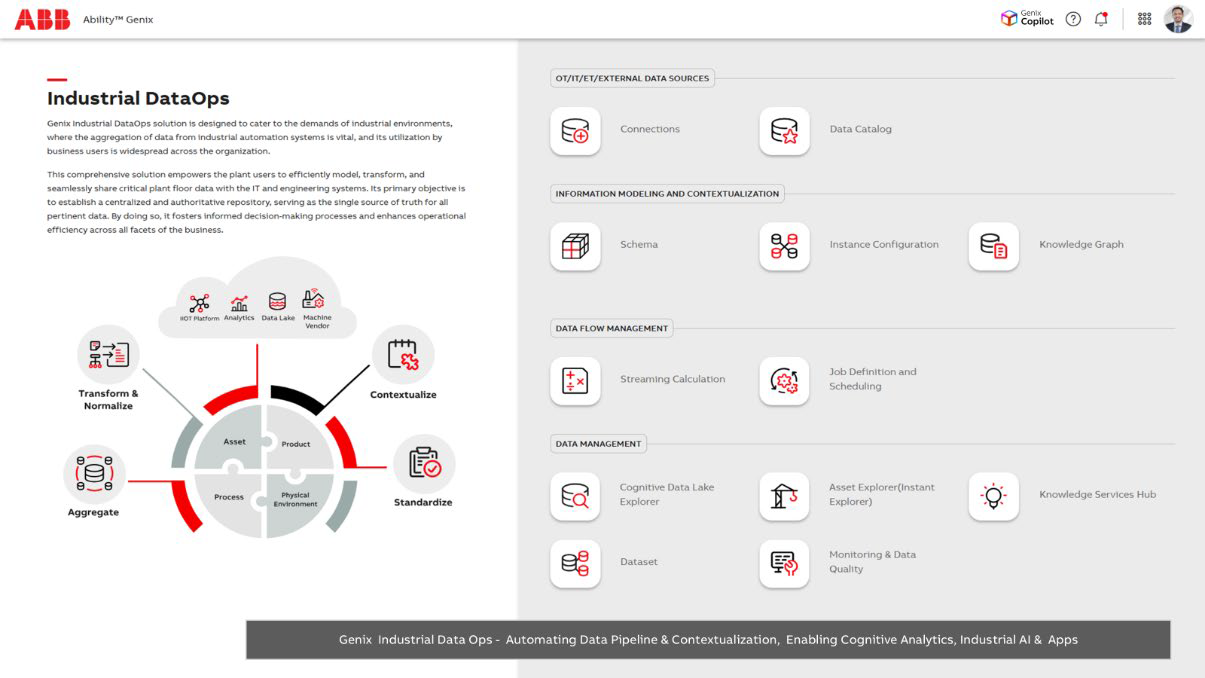

Data harmonization is critical for IoT integration. Data management has become increasingly important in recent years, driven by the rise of digital twins and the need for clean and usable data for AI. While earlier challenges focused on connecting industrial devices and handling protocols, today the primary issue is data harmonization, i.e., aligning data from disparate assets and systems to ensure consistency and accuracy. This shift has moved data management from a secondary concern to a core capability, enabling better integration and actionable insights across IoT environments.

The problem is that connected devices still speak different “languages.” Misaligned data models prevent the seamless flow of information across systems, blocking the effective use of digital twins and other analytics applications. To address this, industrial DataOps practices are emerging, focusing on unifying models, automating pipelines, and ensuring interoperability between OT and IT systems. Platforms that provide data-management capabilities, such as Switzerland-based electrification and industrial automation company ABB’s Genix Industrial IoT and AI Platform Suite and its Genix Industrial DataOps component, are becoming increasingly important as they enable organizations to create consistent, high-quality data streams essential for successful IoT deployments.

Value driver 4: OEM-specific workflows

OEM-specific workflows tie IoT directly to domain-specific business outcomes. While agnostic platforms focus on generic device and data management, product-linked IoT platforms link IoT software to OEM equipment, offering services that directly support the customer’s workflow while also being open to third-party integrations. This segment is significantly larger than the agnostic platform market because OEMs are increasingly taking platforms to their customers, bundling connectivity, analytics, and domain logic into outcome-driven SaaS solutions.

In the construction machinery industry, for example, Caterpillar’s VisionLink platform integrates asset telemetry with fleet management tools, giving customers actionable insights on uptime and utilization. Platforms like this, often built on hyperscaler infrastructure, succeed because they tie IoT directly to business outcomes—something horizontal platforms have struggled to do.

Value driver 5: Connected ecosystems and applications

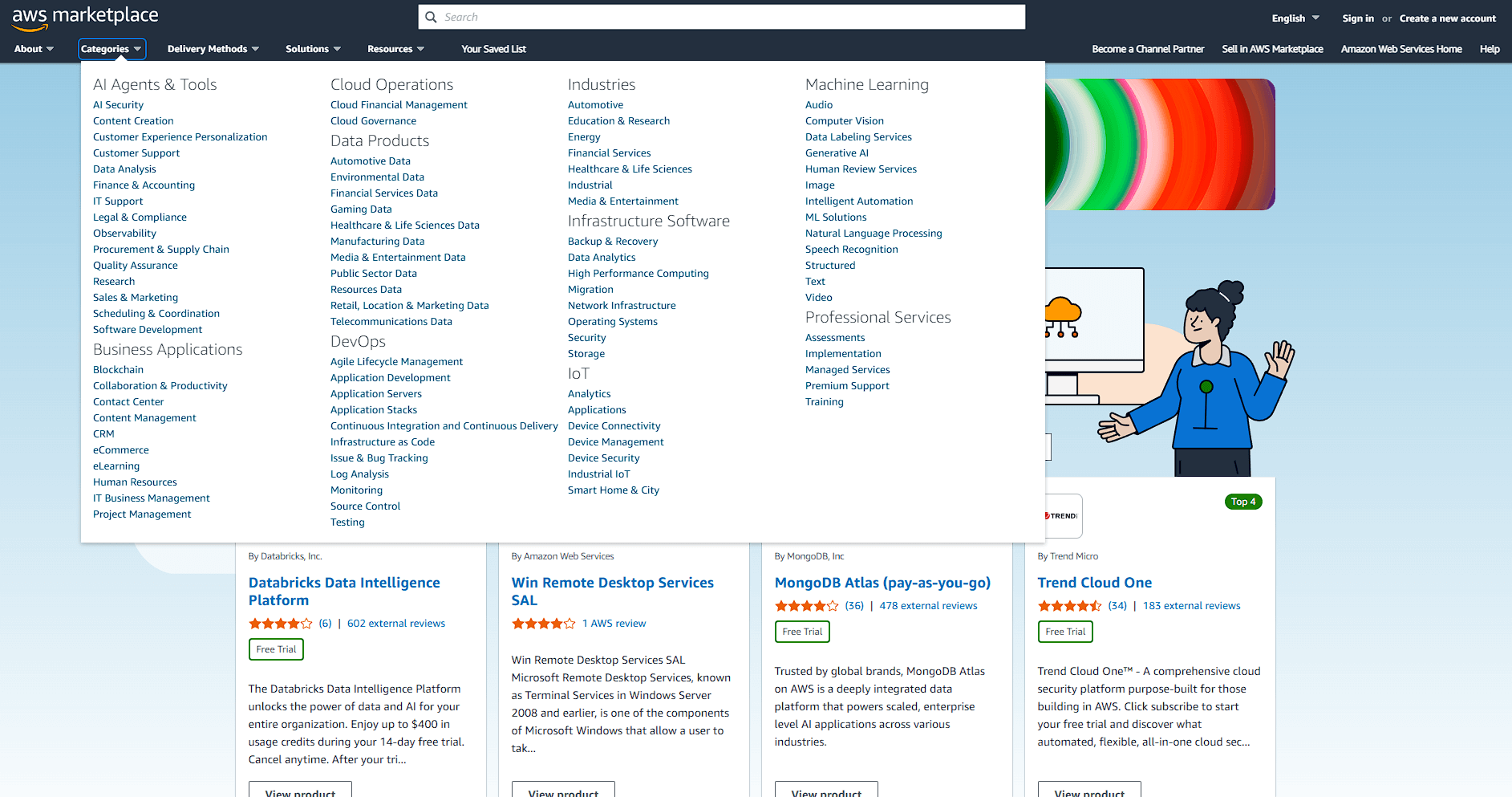

IoT value shifts to application layer. Stemming from OEM-specific workflows, another key opportunity lies in connected ecosystems and vertical-specific applications. Instead of a handful of horizontal winners, the market has fragmented into thousands of IoT-centric applications tailored to specific domains, such as smart buildings, fleet telematics, agriculture, and predictive maintenance. For example, Honeywell’s AI-powered Connected Solutions (released in June 2025) platform focuses solely on the smart buildings vertical, while Siemens’ InsightsHub now targets continuous improvement in manufacturing. This diversity explains why hyperscalers Microsoft and AWS showcase nearly 3,000 IoT offerings combined on their B2B IoT marketplaces as of September 2025, according to IoT Analytics analysis.

This model works because enterprises prefer solutions that map directly to their workflows. Rather than building on top of a generic AEP, they can plug into tested, ecosystem-driven applications that reduce integration risk and speed up time to value. The proliferation of these connected apps (ranging from energy optimization suites to equipment health dashboards) demonstrates how IoT value is increasingly captured at the application layer, not the underlying platform.

Value driver 6: The edge

The edge re-emerging as focal point for IoT platforms. Early IoT platforms were deployed on-premises or at the edge; however, over the last 5–10 years, the market has consolidated around cloud-based SaaS delivery. Now, the rise of AI workloads at the edge (driven by latency, bandwidth, and sovereignty requirements) is bringing the pendulum back. Enterprises increasingly want a consistent data plane across edge and cloud, ensuring that edge deployments offer the same seamless user experience they have come to expect from SaaS.

Hyperscalers are doubling down on this convergence. AWS and Microsoft are expanding their IoT portfolios to strengthen edge–cloud consistency, with initiatives such as Azure IoT Operations that extend cloud-native tooling into factory floors and remote sites. The report suggests this hybrid model will define the next phase of IoT platforms: cloud for scale, edge for intelligence, and a unified management experience across both. Vendors that can replicate the ease of SaaS in edge environments will be best positioned to capture this new wave of growth.

Given these areas of value and growth in the IoT platforms market, below is a deep dive into the current market size and the outlook through 2030.

IoT platform market size and outlook (Insights+)

Access key market data for $99/month per user

The Insights+ Subscription unlocks exclusive facts & figures. You will gain access to:

- Additional analyses derived directly from our reports, databases, and trackers

- An extended version of each research article not available to the public

Full report access not included. For enterprise offerings, please contact sales: sales@iot-analytics.com

Disclosure

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Related publications

You may also be interested in the following reports:

- Digital and ESG Regulations Outlook 2025-2030

- Digital & AI in Industrial Robotics Insights Report 2025

- Generative AI Market Report 2025-2030

- Data Management and Analytics Market Report 2024–2030

Related articles

You may also be interested in the following articles:

- 2025 regulatory landscape: 40+ digital & ESG laws to have on the radar

- The top 10 enterprise generative AI applications – Based on 530 real-world projects

- State of enterprise IoT in 2025: Market recovery, AI integration, and upcoming regulations

- The leading generative AI companies

Sign up for our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.