We updated this research article. Visit the link to view the latest insights.

In short

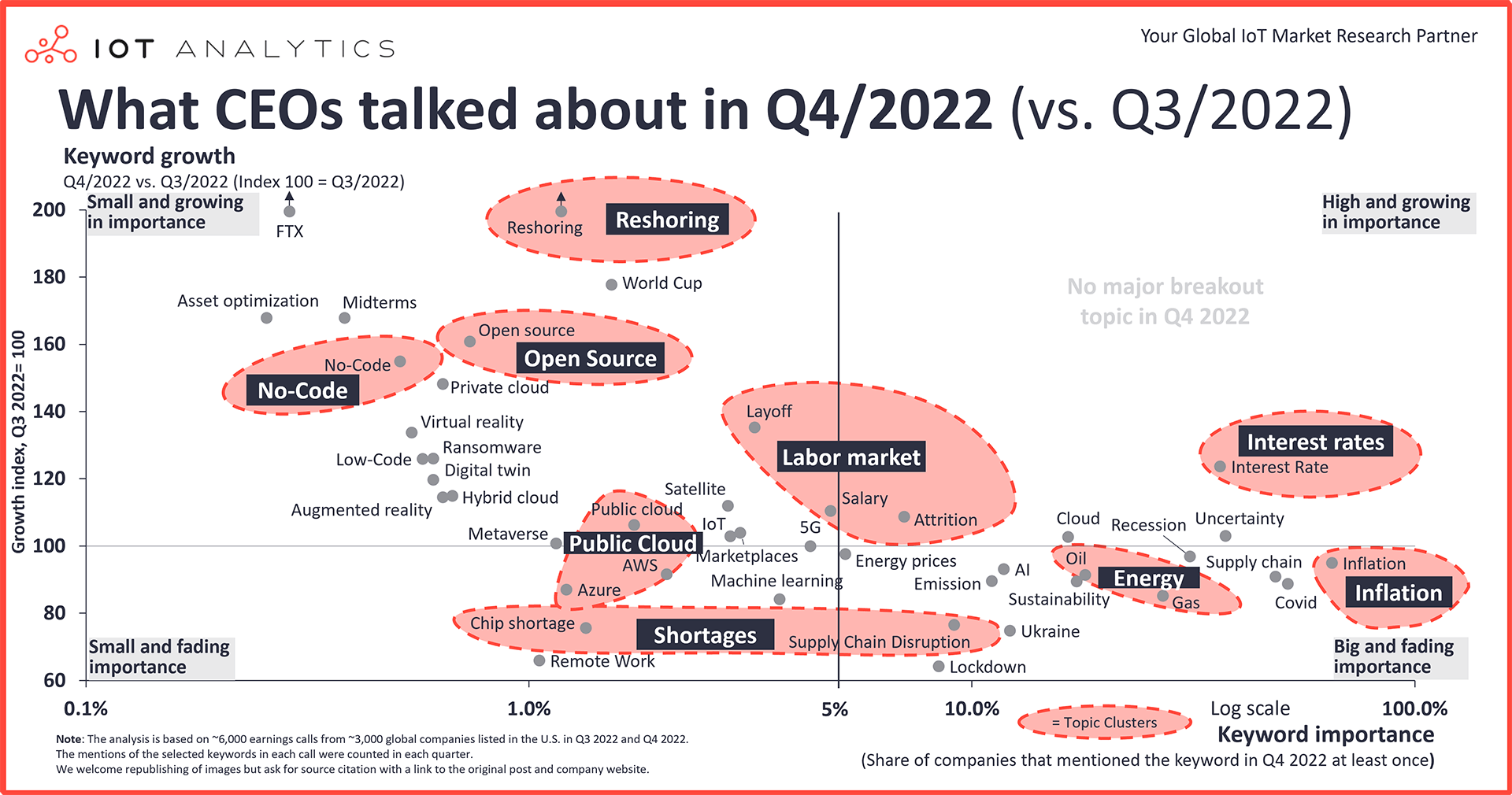

- In Q4/2022, three themes noticeably gained traction (i.e., interest rates, the labor market, and reshoring). Some of the smaller technology topics that are rising in importance include open source and no-code.

- References to chip shortages, supply chain disruptions, and energy prices decreased in the last quarter.

Why it matters

- The prioritization of specific topics by CEOs will likely lead to further investment in these areas.

Overview

Key upcoming themes

In their earnings calls in Q4/2022, 36% of CEOs focused on interest rates, as central banks around the globe tried to curb inflation (+24% growth in keyword mentions compared to Q3/2022). The labor market was another priority issue that CEOs discussed (3.2% discussed layoffs [+35% compared to Q3/2022] and 4.8% discussed salary [+10% from Q3/2022]). Moreover, reshoring discussions grew by 122% in Q4/2022, as many enterprises plan to shift production to their home countries or closer regions.

Three other topics that gained increased attention in Q4/2022 (vs. Q3/2022) included FTX, the World Cup, and the U.S. midterm elections.

For the first time since IoT Analytics started tracking Q4/2020 earnings calls, there have not been notable global breakout topics, such as the vaccination effort in Q1/2021, the Russian invasion of Ukraine in Q2/2022, and inflation in Q3/2021. Conversely, changes in Q4/2022 were more gradual.

Declining themes

As supply chains slowly improved and supply shortages eased, the discussions around chip shortages and supply chain disruptions decreased strongly in Q4/2022 (mentions of both keywords fell 24% compared to Q3). Energy prices (e.g., the keywords oil and gas) also declined in importance. Unfortunately, besides major weather events in the last quarter, the keywords sustainability and climate also lessened.

| About the analysis

The analysis highlighted in this article, presents the results of IoT Analytics’ research involving the Q4/2022 earnings calls of ~3,000 US-listed companies. The resulting visualization is an indication of the digital and digital-related topics that CEOs prioritized in Q4/2022. The chart visualizes keyword importance and growth.

X-axis: Keyword importance (i.e., how many companies mentioned the keyword in earnings calls in Q2). The further out the keyword falls on the x-axis the more often the topic was mentioned.

Y-axis: Keyword growth (i.e., the increase or decrease in mentions from Q3/2022 to Q4/2022, indexed to 100). A number >100 on the y-axis indicated that the topic had gained importance, while a number <100 indicated a decreased importance.

Read our Q3/2022 analysis here.

Three themes of interest are highlighted in this article in greater depth: Interest rates, the labor market, and reshoring.

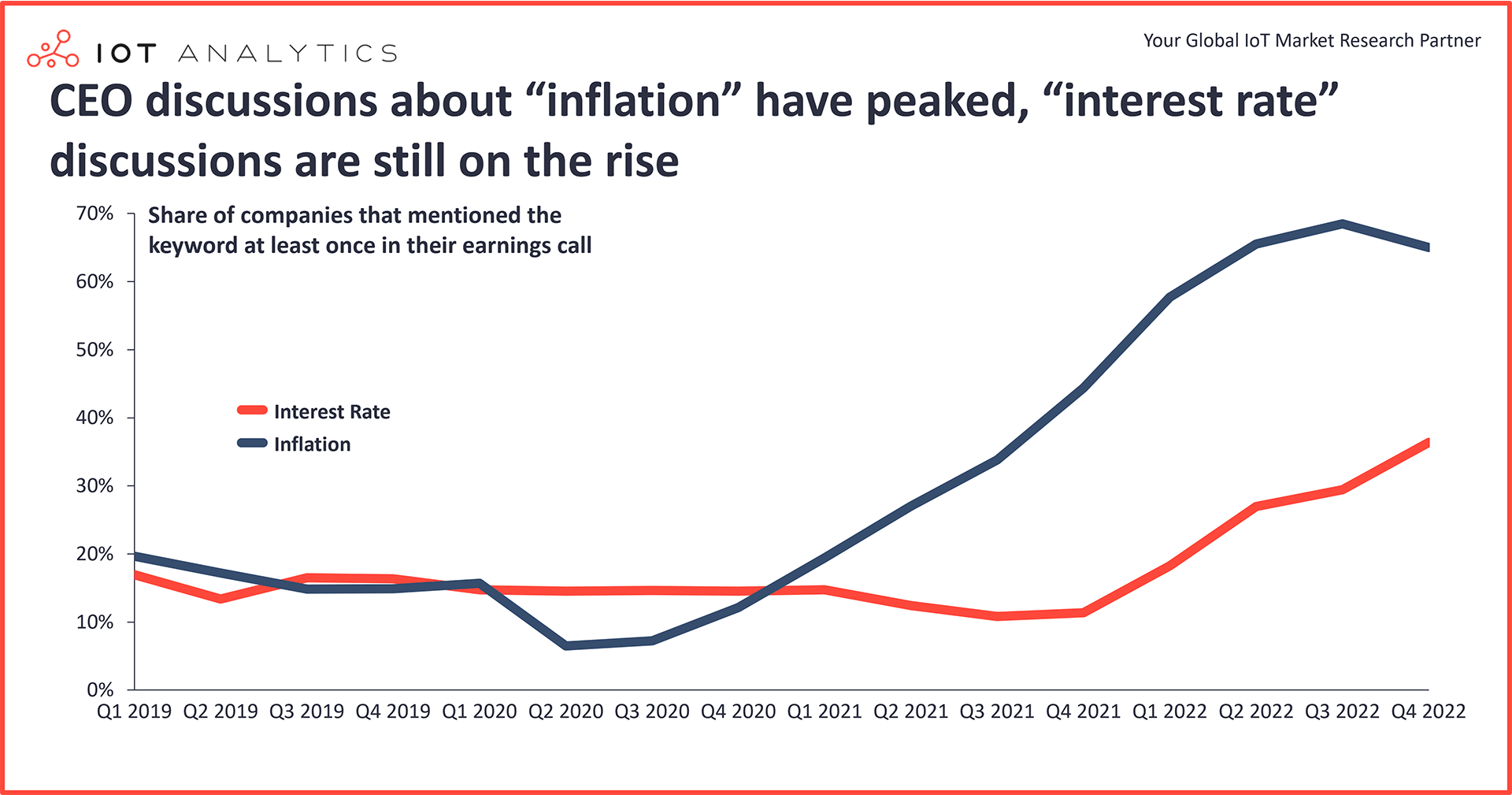

#1 Interest rates

In Q4/2022, 36% of CEOs discussed interest rates and their resulting effects on business, which constitutes an increase of 24% compared to Q3/2022.

Two years ago, in Q2/2020, only 6.5% of companies discussed the keyword inflation. However, in 2022, when inflation rates reached heights not seen in decades, the topic became a centerpiece of discussion. Policy reaction followed quickly. Many central banks kept increasing interest rates to fight inflation in the last months. The US Federal Reserve increased the federal funds’ target rate from 0.125% at the beginning of 2022 to 4.375% by the end of 2022. To fight inflation, other central banks followed suit (e.g., the European Central Bank [0%–2%) and the Bank of England [0.1%–3.5%]).

Higher interest rates have multiple effects, as they increase the cost of borrowing capital and company margins and put pressure on future cash flow, which leads to pressure on stock markets, Of course, housing loans grow more expensive. Therefore, many CEOs are discussing potential side effects. However, some companies benefit unexpectedly. For example, platforms like eBay and Expedia, where consumers can monetize unused assets to gain extra income, realize upside potential.

Key CEO quotes on interest rates

Ebay:

“As consumers in our major markets face persistent inflation, higher interest rates and rising home energy costs, they are increasingly turning to eBay for better value. This is leading to growth in GMV of used and refurbished goods.“

Jamie Iannone, CEO, Ebay 3 November 2022

Expedia:

“I wish we had a quick enough twitch muscle to tell you that interest rates are driving homeowners to us. […] So, I think we’re in a great place for homeowners who want to monetize their assets to come, assuming it’s in places that are interesting to us and where we can drive business. […] And presumably, people are maybe a little less flush with the cost of capital and may want to monetize that.”

Peter Kern, CEO, Expedia, 4 November 2022

Palo Alto Networks:

“The impact is not uniform across all sectors, but those feeling the impact of interest rate increases are more likely to scrutinize their budgets than those prospering in the high interest rate environment. Technology, CPG and some parts of retail are feeling an impact, while utilities, oil and gas, defense and public sector verticals continue to be on course of their plans. […] I think 50% market is not feeling any pain with the interest rate increases.”

Nikesh Arora, CEO, Palo Alto Networks, 18 November 2022

“Now with the Fed increasing interest rates, I’ll tell you, one of the easiest decisions for our customers to make is to sweat their assets a little longer. Because it’s not like these firewalls suddenly blow up at the end of life. They can be extended.”

Nikesh Arora, CEO, Palo Alto Networks, 18 November 2022

Tesla:

“North America is in a pretty good health, although the Fed is raising interest rates more than they should, but I think they’ll eventually realize that and bring back down again.”

Elon Musk, CEO, Tesla, 20 October 2022

#2 Labor market

In Q4 2022, 3.2% of all earnings calls discussed layoffs (an increase of +35% compared to Q3/2022), 4.8% discussed salaries (+10%), and 7% discussed attrition (+9%).

The labor markets of many economies are currently in an awkward position. The markets are looking strong, as many positions cannot be filled, salaries are still increasing, and unemployment is at all-time lows. However, companies report mass layoffs and voluntary attrition is still high. Many large and small tech companies have announced layoffs in recent months. To highlight a few Q4/2022 layoffs:

- Meta announced the layoff of 11,000 employees in November 2022

- Amazon announced the layoff of up to 20,000 employees in early December

- Cisco will let go 4,000 employees

- Salesforce announced to kick out 8,000 employees.

However, there are also some beneficiaries of the labor market changes. Boeing reports that it has become increasingly easy to find software developers and Fiverr expects the supply of freelancers to increase due to the layoffs.

Key CEO quotes on the changing labor market

Boeing:

“I think it’s going to take probably all of next year before things really do begin to stabilize because we begin to see layoffs in other industries. We definitely feel that in the software world, we’re not having any kind of trouble bringing in the engineering resources that we need, particularly as it relates to software development because the rest of the industry that competes with us is beginning to soften considerably.”

Dave Calhoun, CEO, Boeing, 26 October 2022

Fiverr:

“So usually, supply comes first. That is a result of both the layoffs, which I think is just going to drive our supply much more meaningfully in the next few quarters if the current layoffs continue to happen, because a lot of the people that were laid off unlike before are facing with other companies that are in freeze, which means that some people are going to find themselves without option. And I think that Fiverr is a very viable and a great option for them.”

Micha Kaufman, CEO, Fiverr, 9 November 2022

C3.ai:

“There is no question that there is pervasive economic uncertainty in the global business community that continues to provide bookings headwinds. This has been especially significant in the tech markets that are experiencing a blood bath in equity prices, with significant layoffs at companies, including Amazon, Meta, Salesforce, Google, Snap and many others. I believe this is just the start of what will be a significant tech market correction. Layoffs of established companies will accelerate. The many Series A, B, C and D companies that are hemorrhaging cash will simply not survive.”

Tom Siebel, CEO, C3.ai, 8 December 2022

Gitlab:

“Some of the things that we are seeing is, as I mentioned, some of the watch points is we’re seeing a slight uptick in contraction. And so maybe some of those companies who did a layoff where we were more fully penetrated, they’ve cut back in a couple of licenses.”

Brian Robbins, CFO, Gitlab 6 December 2022

Wipro:

“Why has the margin been impacted? Because of the evolution of the cost of employees. Why the cost of the employees have gone up? Because in a high demand market, attrition has gone up. And attrition, we need to be backfilled, and backfill was with more expensive resources. I think it’s what anybody in our industry has experienced, but also our clients have experienced in the last 12 months.”

Thierry Delaporte, CEO, Wipro, 12 October 2022

#3 Reshoring

Compared to Q3/2022, 1.2% of earnings calls discussed reshoring: an increase of 122%. Reshoring is the process of returning manufacturing processes or other business operations to a company’s home country. Reshoring is not necessarily new. In 2021, a survey showed that 83% of North American manufacturers were likely to reshore. The trend gained additional importance due to strained supply chains, trade wars, and international tensions. However, the reshoring trend is not limited to North America but present in many countries with a major manufacturing footprint. For example, in Europe, France is expected to announce a package to boost reshoring. Furthermore, in 2022, reshoring investments of South Korea-based companies increased by 43%, while their offshore investments decreased in the same period.

Key CEO quotes on reshoring

Rockwell Automation:

“I like talking about shoring rather than reshoring because it’s really more about the U.S. being an outsized beneficiary of new CapEx as opposed to shuttering plants in China and other parts of Asia and bringing it back to the U.S. It’s really about new lines of business, new capacity, filling out a little more of a local-for-local strategy, got a lot of manufacturers are providing, and I don’t see anything with the current economic headwinds that would cause people to say just kidding.”

Blake Moret, CEO, Rockwell Automation 2 November 2022

Applied Industrial:

“The underlying fundamental backdrop is further supported by increasing evidence of reshoring and localizing production back to North America. This is evident when considering U.S. manufacturing capacity utilization was at a 22-year high in September. At the same time, U.S. manufacturing infrastructure is aged and our customers’ technical service and support requirements are increasing.”

Neil Schrimsher, CEO, Applied Industrial, 30 October 2022

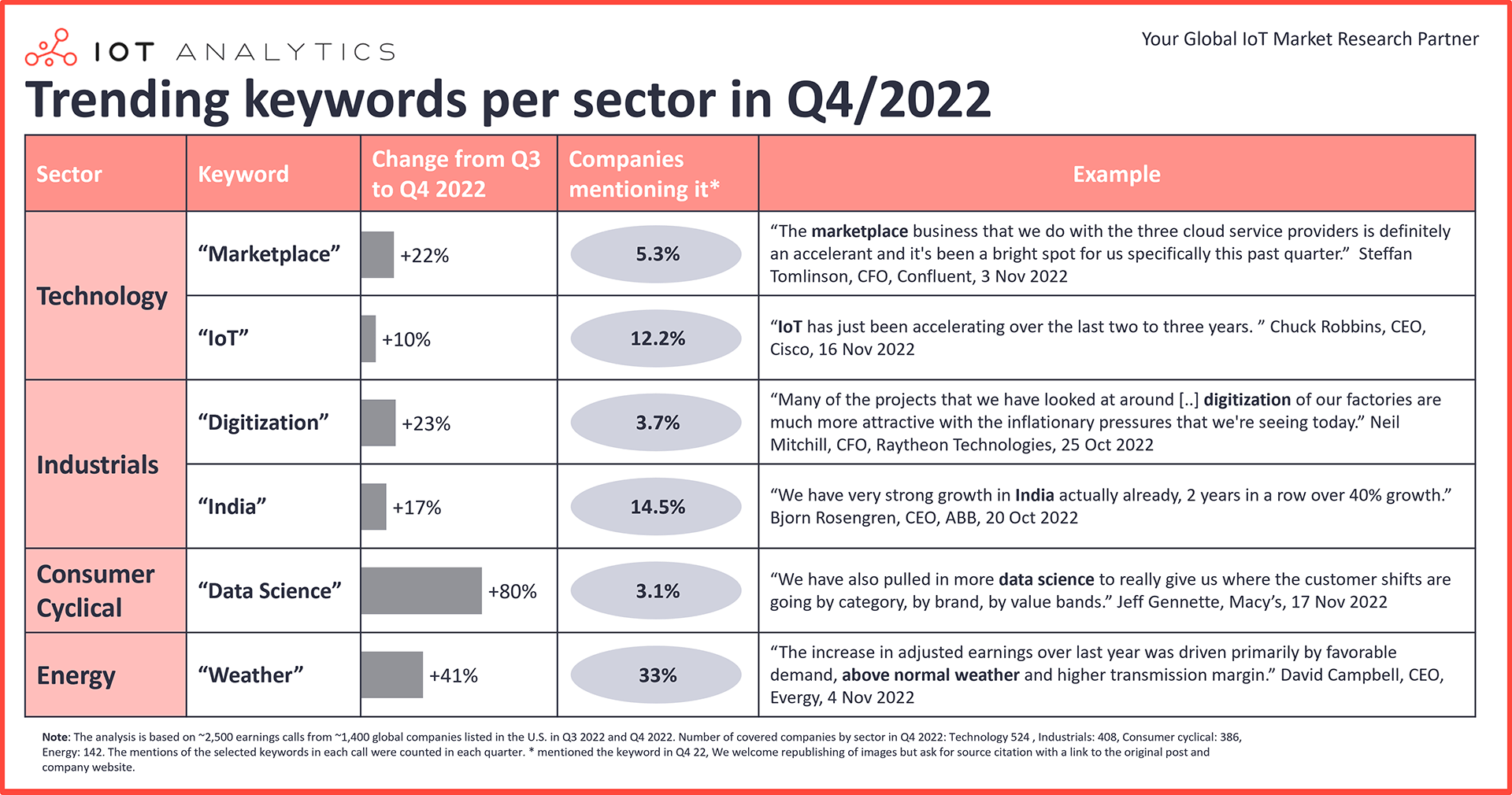

Trending keywords per sector in Q4/2022

While some topics like interest rates or the labor market are discussed across sectors, others are specific to certain industries. The following examines some notable increases.

Tech sector

In Q4/2022, 5.3% of all tech companies mentioned marketplaces (an increase of 22% compared to Q3/2022). For many software vendors, cloud marketplaces, such as Azure, AWS, and GCP, gained importance in the last year. Steffan Tomlinson (CEO of Confluent) emphasized the positive impact marketplaces had on business.

Industrial sector

In Q4/2022, 14.5% of all industrial companies mentioned India in their earnings calls, which constitutes an increase of 17% compared to Q3/2022. Industrial companies like ABB are increasingly citing the country’s growth and potential for manufacturers. Which makes sense, as in 2023 India is expected to be the second fastest-growing economy in the G20.

Consumer cyclical sector

Of consumer cyclical companies, 3.1% discussed the use of data science and AI to better understand their customers and decrease costs (an increase of 80% compared to Q3/2022). The Americana Group (a leading quick service restaurant operator and food company in the Middle East region), for example, lowered spending on administrative work by 80% since improving visibility and enabling data- driven decision making in various business functions.

Energy sector

Of energy providers, 33% mentioned the weather in Q4/2022 earnings calls (+41%). Climate change is expected to lead to more extreme weather events and make it harder for energy companies and utility providers to forecast demand and supply. For example, the mild winter in Europe reduced heating demand and led to lower gas prices despite less supply due to the war in Ukraine.

More information and further reading

Are you interested in learning more about the latest technology market developments?

IoT Analytics is a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), AI, Cloud, Edge, and Industry 4.0.

Quarterly Trend Report: What CEOs talked about in Q4/2022

A 51-page report on the trends that emerged in Q4/2022 earnings calls. The report is based on data from ~52,000 corporate earnings calls of US-listed companies.

Click on the button to load the content from .

Related publications

You may be interested in the following publications:

- Digital Supply Chain Market Report 2022-2027

- Machine Vision Market Report 2022-2027

- IoT Sensors Market Report 2022-2027

- Industry 4.0 Adoption Report 2022

- IoT Communications Protocols Adoption Report 2022

Related articles

You may also be interested in the following recent articles:

- 5 IoT sensor technologies to watch

- IoT 2022 in review: The 10 most relevant IoT developments of the year

- 8 key technologies transforming the future of global supply chains

- The rise of Industry 4.0 in 5 stats

- 5 things to know about IoT protocols

Related market data

You may be interested in the following IoT market data products:

- Global Cellular IoT Module and Chipset Tracker and Forecast

- Global Cellular IoT Connectivity and LPWA Tracker and Forecast

- Global IoT Enterprise Spending Dashboard

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.