We updated this research article. Visit the link to view the latest insights.

In short

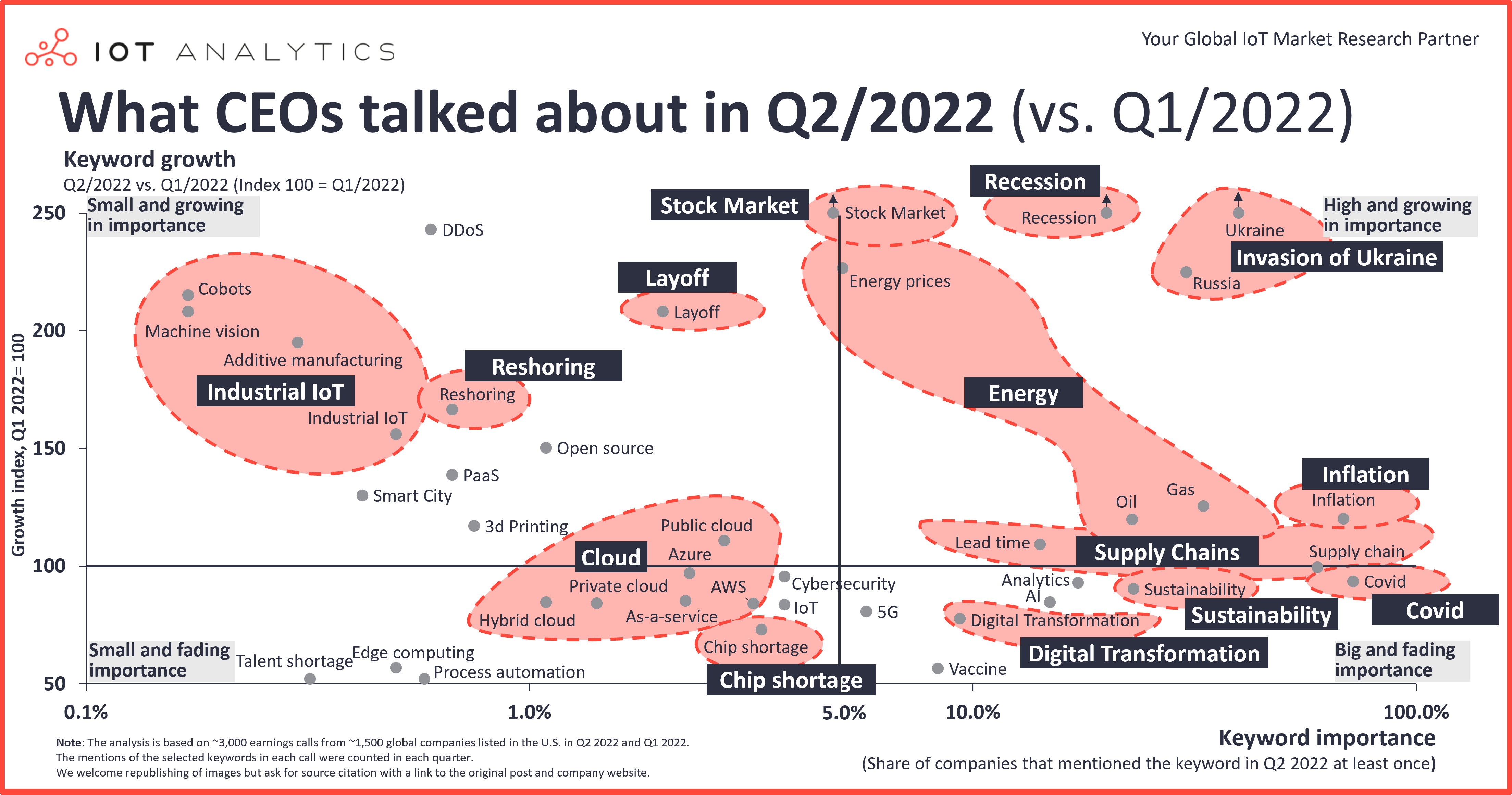

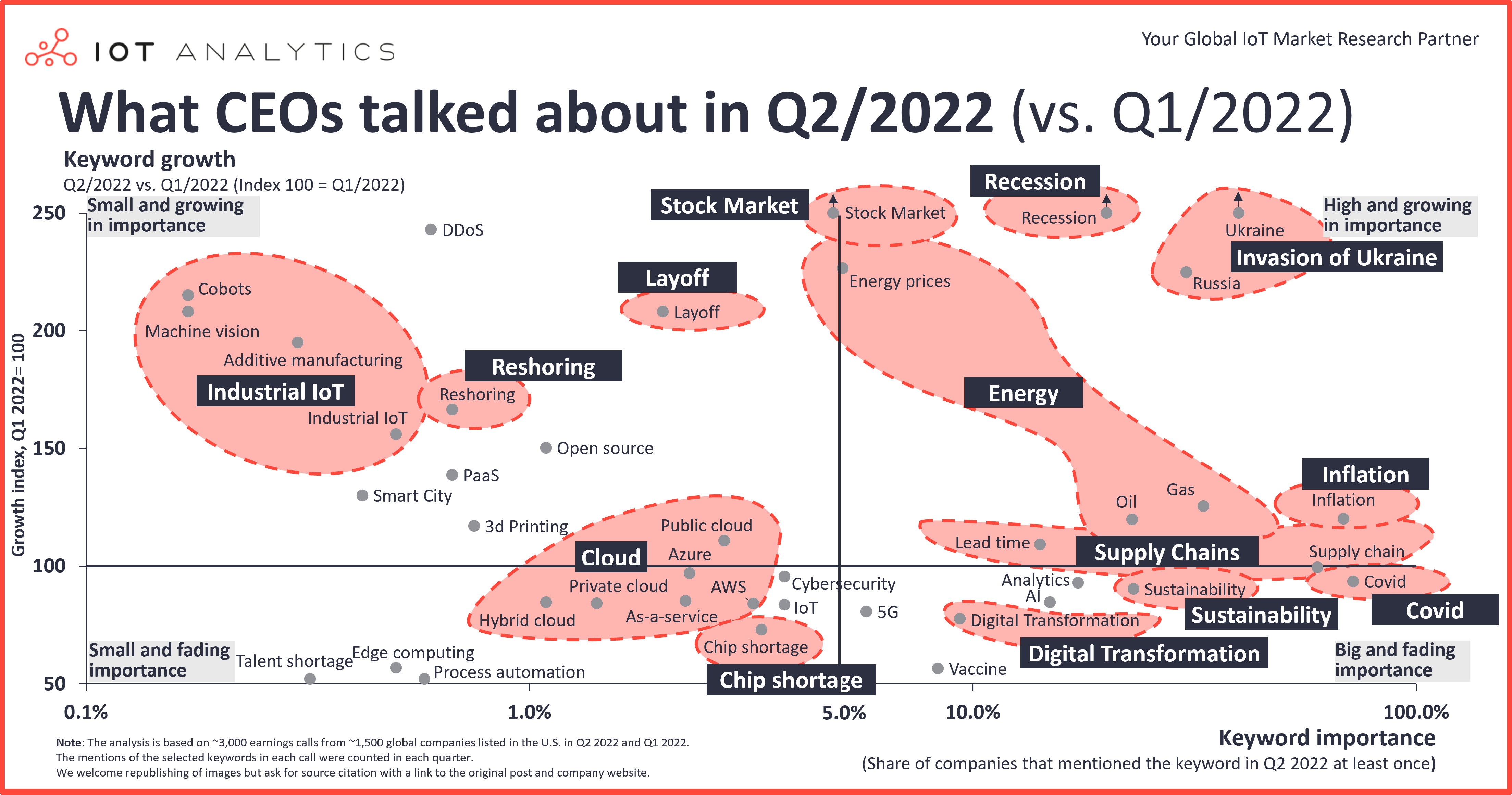

- Five themes noticeably gained traction in Q2/2022, i.e., the invasion of Ukraine, the recession, the stock market, energy prices, and layoffs. Other topic that are rising in importance include the public cloud and industrial IoT.

- Mentions of digital transformation and sustainability-related topics decreased in the last quarter.

Why it matters

- The prioritization of specific topics by CEOs will likely lead to further investment in these areas.

Overview

Key upcoming themes. 40% of CEOs talked about Ukraine in their earnings calls in Q2/2022 (+164% growth compared to Q1/2022), with the Russian invasion of the country continuing to be a leading topic for CEOs. The looming recession is another major imminent issue that CEOs discussed (20% of CEOs talked about it). The three other themes that drew substantial attention in Q2/2022 (vs. Q1/2022) included energy prices, the stock market, and layoffs (although on a smaller scale).

Most discussed themes. The three most-discussed topics were COVID-19, Inflation, and supply chains (mentioned in 60–72% of all earnings calls).

Declining themes. As topics such as the Ukraine/Russian war and energy prices rose in importance in Q2, a number of other topics that had gained significant attention in previous quarters faded. Sustainability was mentioned by 23% of CEOs (10% less than in Q1 of 2022). Additionally, discussions concerning digital transformation declined by 22% alongside other technology topics such as AI, analytics, and 5G. In Q2/2022, CEOs appeared to be fighting off short-term problems rather than emphasizing long-term solutions.

| About the analysis

The analysis highlighted in this article, titled “What CEOs talked about,” presents the results of IoT Analytics’ research involving the Q2/2022 earnings calls of ~1,500 US-listed companies. The resulting visualization is an indication of the digital and digital-related topics that CEOs prioritized in Q2/2022. The chart visualizes keyword importance and growth.

X-axis: Keyword importance (i.e., how many companies mentioned the keyword in earnings calls in Q2). The further out the keyword falls on the x-axis, the more often the topic has been mentioned.

Y-axis: Keyword growth (i.e., the increase or decrease in mentions from Q1/2022 to Q2/2022, indexed to 100). A number >100 on the y-axis indicates the topic has gained importance, while a number <100 indicates the topic has decreased in importance.

Read our Q1/2022 analysis here.

In this article we highlight five themes of interest in more depth: Recession, War on Ukraine, Cloud, Industrial IoT, and Digital Transformation:

#1 Recession

20% of all CEOs discussed a potential recession in Q2/2022. That constituted an increase of 399% compared to Q1/2022. A multitude of problems including supply chain disruptions, higher input prices, and low growth in emerging markets weigh on the economic growth in the US and the world economy. Many economic indicators point to the beginning of a recession; Household spending in the US grew at a very slow rate in May 2022, as did consumer spending in Europe and Asia. However, economists disagree on the likelihood of recession. Economists at Deutsche Bank and Wells Fargo consider a recession to be highly likely, while experts at Deloitte and Morgan Stanley consider this a low probability.

The CEO of Bank of America puts it as follows in his earnings call:

“Our economists do not have a recession predicted in terms of this year, it’s around 3% growth, next year, a little over 2%. And even though there may be some quarters that would show modest growth, I think they’re all positive, if I got it right.”

Brian Moynihan — Chief Executive Officer, Bank of America, 18 April 2022

Other executives see the positive side of a recession and expect additional business opportunities, as customers will look for opportunities to cut costs. Two cloud company CEOs believe their businesses to be in great positions.

“And I would say just kind of upfront while there are near term headwinds in the economy such as supply chain disruption, the war in Ukraine, we do not see any recessionary pressure in this business. […] So, cloud is really only accelerating even in the challenging economic environment we’ve seen so far this year. Now if the economy does slip into recession, we think that multi-cloud becomes even more of a must-have for customers because it helps customers save money, quickly scale up or scale down and change their business model.”

Kevin Jones — Chief Executive Officer, Rackspace Technology, 22 May 2022

“And as we talk about the macroeconomic challenges, the fears of a recession, the inflation — customers probably increasingly concerned about saving cost going forward and that could provide some counterbalance as well, [..] we’re in a really good position to help major enterprises decrease their cloud spend.”

Tom Leighton — Chief Executive Officer, Akamai, 3 May 2022

#2 War

40% of earnings calls discussed the situation in the Ukraine, reflecting an increase of 164% compared to Q1/2022. For comparison, in Q4/2021, the country was only mentioned in 0.4% of earnings calls.

The attack let to a widespread introduction of sanctions against Russia and Russian goods. Russia had been a major source for raw materials for the world economy and the Western sanctions as well as Russian export bans brought that trade to a halt. CEOs discussed the need for finding new sources to manufacture their products. Financial service companies such as Visa were affected particularly harshly by Western sanctions against Russia.

“One of the challenges as we think about Russia, for instance, that was a large source of some of our titanium supplies. And because of the sanctions, we are looking to resource a lot of material.”

Greg Hayes — Chairman and Chief Executive Officer, Raytheon technologies, 28 April 2022

“Just as 2021 was a year of two distinct halves due to the recovery, 2022 will be a year of two halves due to Russia. The suspension of our business in Russia will reduce second half revenues by about 4%.”

Al Kelly — Chairman and Chief Executive Officer – Visa, 27 April 2022

#3 Cloud

3% of earnings calls discussed public cloud spending or solutions. CEOs emphasized the significant opportunity that a further cloud adoption brings with it. This quarter (Q2/2022) saw an increase in CEOs’ interest in the public cloud (+11%), while the key terms “hybrid cloud” and “private cloud” were discussed less frequently (−15% and −16%, respectively) compared to Q1/2022. IoT Analytics made the case for a $2 trillion addressable public cloud market earlier this year. The current interest in this appears to point to a bullish scenario for the time being.

“If you think about private cloud growing, you know, mid- to high single digits, public cloud growing high double digits. That’s what’s really going to drive the top line fundamentally, and that’s actually what it got us comfortable with the key business case here”

Tom Krause — President, Broadcom Software Group, 02 June 2022

“Now we’re working with thousands of start-ups, large companies that are building who are using the public cloud. And so it’s driving a lot of demand for us in the public cloud. […] I think we have now 10,000 AI inception start-ups that are working with us and using NVIDIA AI, whether it’s on-prem or in the cloud, it saves money, because the computation time is significantly reduced. […] The thousands of companies around the world that are using NVIDIA AI in the cloud — driving public cloud demand, all of these things are driving our Data Center growth. And so we expect to see Data Center demand remain strong.”

Jensen Huang — President and Chief Executive Officer, NVIDIA, 26 May 2022

#4 Industrial IoT

Industrial IoT was mentioned by 0.5% of all earnings calls in Q2/2022, which constituted an increase of 56% compared to the preceding quarter. Furthermore, Q2 also saw the leading global industrial fair, Hannover Fair, being held again. After three years of virtual fairs, 75,000 visitors attended the fair in Hannover (Germany) and showed an interest in industrial IoT. The IoT Analytics analyst team brought nine analysts and visited +230 booths over the course of four days (Find our key takeaways from the fair here).

Key themes at the fair included the move towards industrial software solutions as well as wireless software-based control. Siemens, for example, had a heavy focus on showcasing a number of solutions, each as a combination of diverse products from the Siemens portfolio. Nokia exhibited wireless connectivity between the I/O and PLC, leveraging a private 5G network. AWS, Software Defined Automation (SDA), and Tulip Interfaces collaborated to show how a virtual PLC, running on a standardized Lenovo server with a VMware Edge Compute Stack, could run manufacturing operations on a single IT server instead of several IPCs and PLCs.

“Industrial IoT experienced the fastest year-over-year revenue growth within IoT this quarter driven by continued demand for both connectivity and advanced processing at the edge.”

Cristiano Amon — President and Chief Executive Officer, Qualcomm, 27 April 2022

“[…] It’s very encouraging to see how customers are actually making that permanent switch from their traditional manufacturing to additive. We highlighted a few of the customers in the slides, but there’s dozens and dozens and I think that really is the strongest demonstration from the market that they believe in the technology, they believe that we can help them improve their production lines. “

Yonah Lloyd — Chief Communications Officer and Vice President of Investor Relations, Stratasys, 18 May 2022

#5 Digital Transformation

The increase in focus on potential problems appeared to come at the expense of more long-term topics, such as digital transformation (−22% mentions compared to Q1/2022) and sustainability (−10% mentions compared to Q1/2022), which both lost attention during the most recent quarter.

Nonetheless, many CEOs view digital transformation as a hedge against a cooling global economy and other crises.

“And again, the key thing for investors is that we’re going to continue to invest in top line growth in the business. We see no reason to slow it down. We’ll be cognizant related to operating profitability. But you’re all aware, base the SaaS model with 80% gross“We’ve seen a lot of high-multiple companies go through some layoffs and some challenges in trying to conserve cash. I think from an M&A perspective, we are always looking at companies, and we will buy good companies with good people irrespective of the current environment. Obviously, as we think about what’s coming up, multiples compressing in various areas, including the private markets, we certainly will be disciplined as we look at those.” margin, getting to operating profitability, high operating profitability, it’s not a difficult thing. Really trying to take advantage of this market is what we’re after.”

George Kurtz — President and Chief Executive Officer, Crowdstrike, 03 June 2022

“And the common theme from the customers I’ve met with, from Singapore to New York to the 30 CEOs I met one-on-one with at Davos last week, is the digital transformation trends that dramatically accelerated during the pandemic, they continue full steam ahead despite all the volatility in the global economy.”

Bret Taylor — Vice Chairman and Co-Chief Executive Officer, Salesforce, 01 June 2022

“We’re certainly aware of the macro environment and the uncertainty that is out there today. So that’s one thing that we’ve considered. I think that uncertainty though, [..] I think that’s offset by the trends in digital transformation. Companies need to transform. And the value that our software delivers helps companies operate more efficiently and drive higher ROI.”

Kevin Burns — Chief Financial Officer, Dynatrace, Inc., 18 May 2022

More information and further reading

Are you interested in learning more about the latest technology market developments?

IoT Analytics is a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), AI, Cloud, Edge, and Industry 4.0.

Related publications

You may be interested in the following publications:

- Hannover Messe 2022 — the latest Industrial IoT / Industry 4.0 trends

- State of IoT—Spring 2022

- Cloud Computing Market Report 2021–2026

- Industrial Software Landscape 2022–2027

- Virtualization in Industrial Automation | Adoption Report 2021

Related articles

You may also be interested in the following recent articles:

- The top 20 industrial technology trends – as showcased at Hannover Messe 2022

- State of IoT 2022: Number of connected IoT devices growing 18% to 14.4 billion globally

- The case for a $2 trillion addressable public cloud market

- The top 10 industrial software companies

- Soft PLCs: Revisiting the industrial innovator’s dilemma

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.