In short

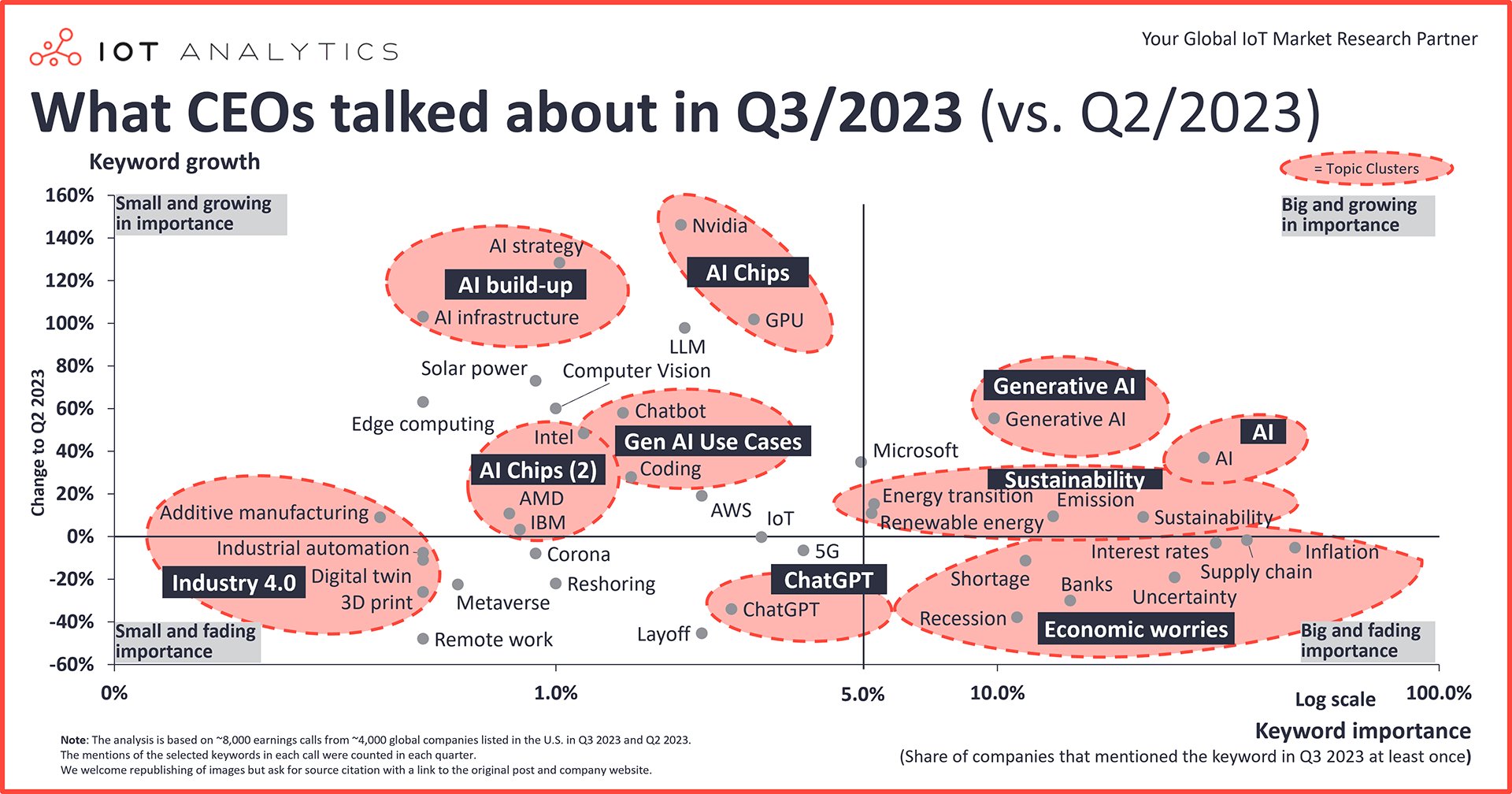

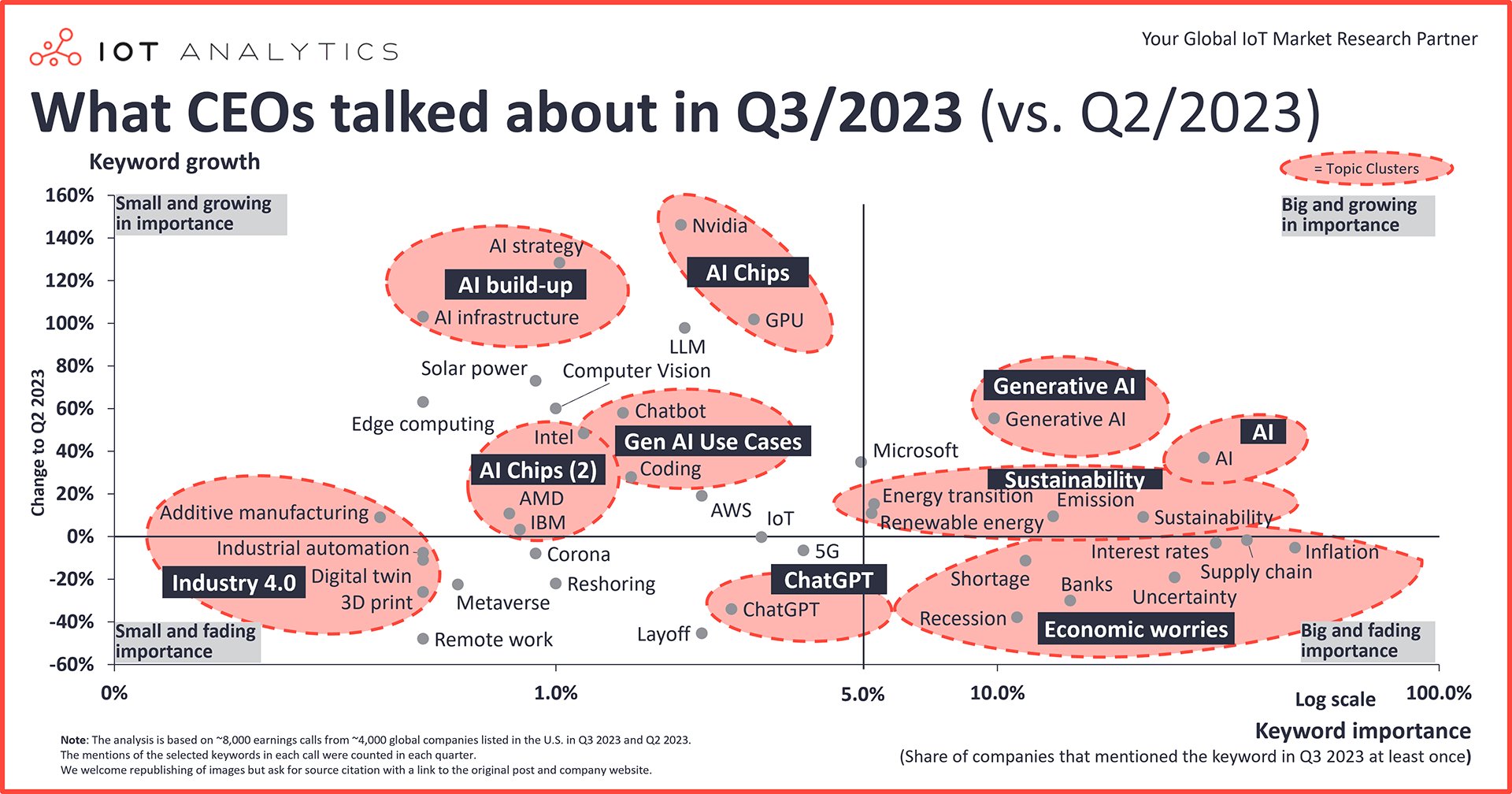

- According to the latest “What CEOs talked about” report, three themes gained noticeable traction in earnings calls in Q3 2023: 1) AI and most of its related application topics, 2) AI chips, and 3) sustainability.

- ChatGPT is losing traction as the AI keyword of choice, and economic worries and uncertainty appear to be easing.

Why it matters

- The prioritization of specific topics by CEOs will likely lead to further investment in these areas.

The big picture

In Q3 2023, topics related to economic worries remained prominent in boardroom discussions globally but continued to decline quarter-over-quarter (QoQ). Mentions of the most talked about topic, inflation, dropped 5% QoQ to 47% of calls. Supply chain worries saw the smallest drop, 2% QoQ, while recession experienced the largest drop of 38% QoQ, now appearing in 11% of earnings calls.

Key quote on the macro environment

“Our base case today assumes a mild recession.”

Mark Mason, CFO, Citigroup, July 14, 2023

Key rising themes in Q3

AI

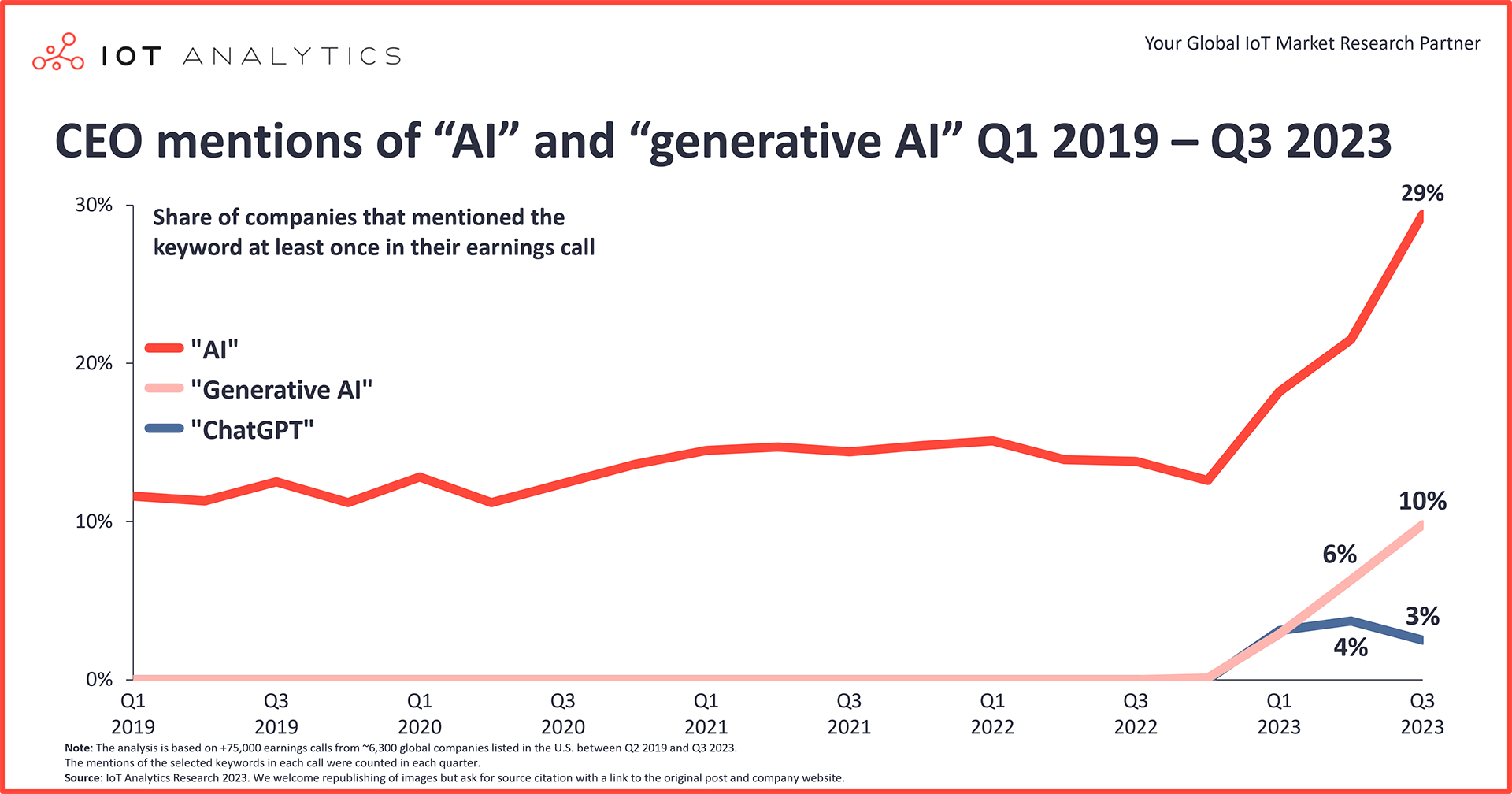

In Q3 2023,the broader topic of AI rose fairly steeply to 29% (+37% QoQ), and its subfield generative AI continued to rise in importance to 10% (+56% QoQ). During their quarterly earnings calls, CEOs appeared to be separating AI and many of its subfield topics from discussions about ChatGPT, which declined this QoQ (as discussed below in “Declining themes”).

Our analysis also shows a marked incline in the mentions of AI strategy and AI infrastructure, rising 128% and 103% QoQ, respectively.

Key CEO quote on generative AI

“Generative AI is at the forefront of customer conversations. However, enterprises are also realizing that they cannot have an AI strategy without a data strategy to base it on.”

Frank Slootman – CEO, Snowflake, August 23, 2023

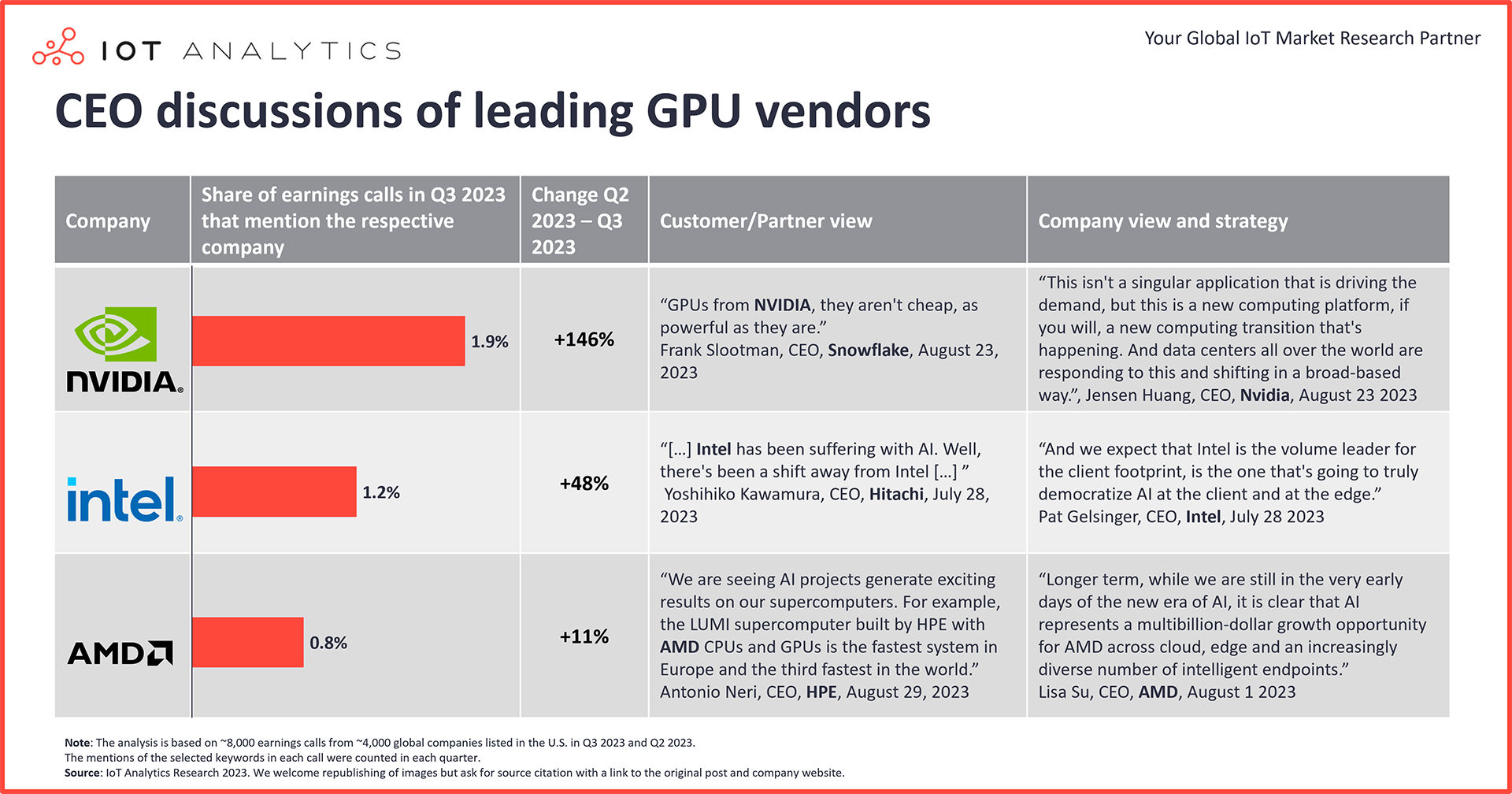

AI chips

Mentions of GPUs greatly outpaced mentions of CPUs, with the former climbing 102% QoQ to 2.8% in Q3 2023 earnings calls and the latter climbing 47% QoQ to 1.7%. Coinciding with this trend is GPU chipmaker Nvidia climbing 146% in mentions to 1.9% compared to Intel only climbing to 1.2% (+48% QoQ) and AMD to 0.8% (+11% QoQ) in reference to AI chips.

“We’ll actually take the Nvidia hardware as fast as Nvidia will deliver it to us. Tremendous, tremendous respect for Jensen and Nvidia. They’ve done an incredible job. And frankly, I don’t know if they could deliver us enough GPUs.”

Elon Musk – CEO, Tesla, July 19, 2023

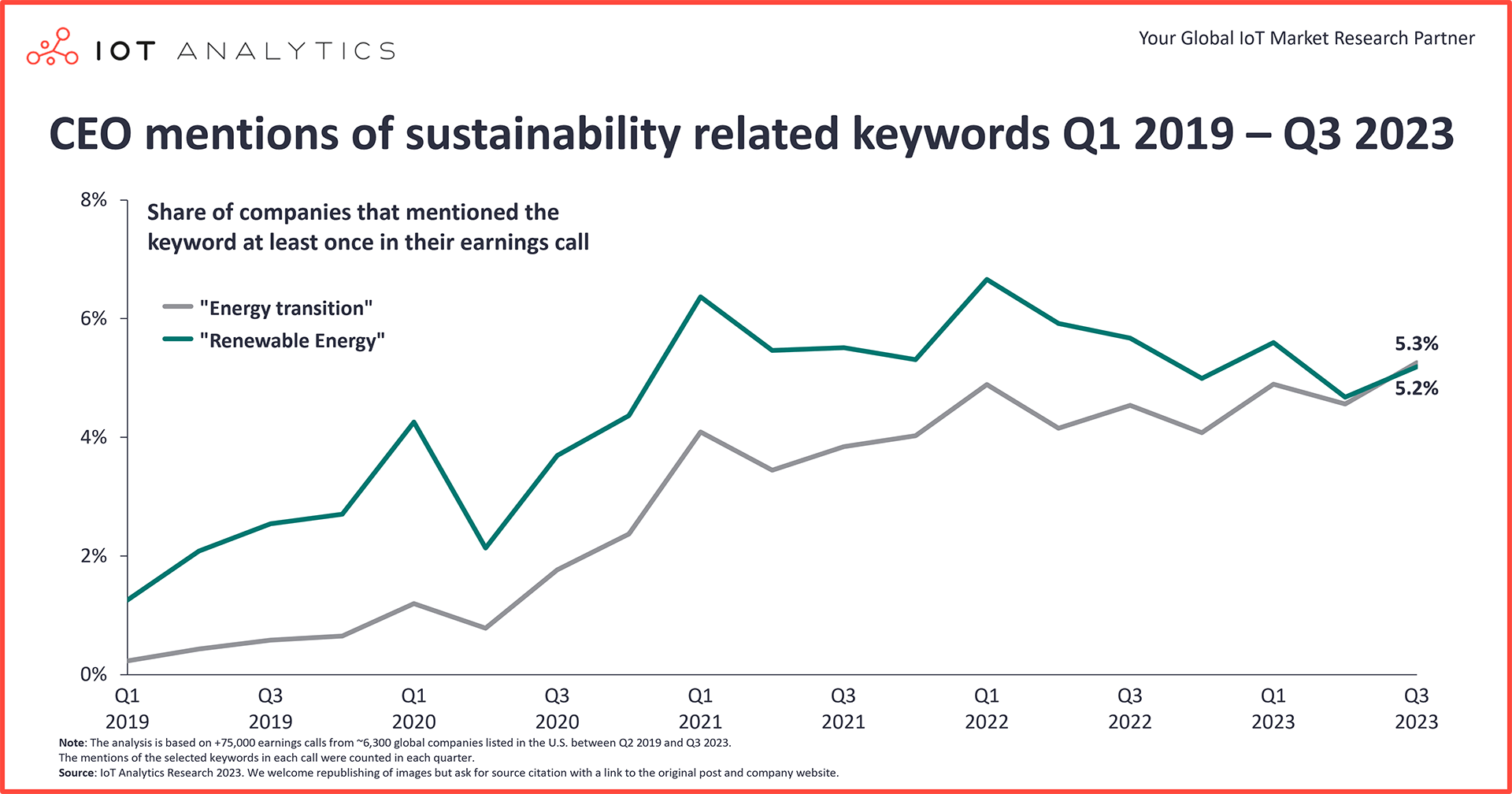

Sustainability, energy transition, and renewable energy

Mentions of sustainability, energy transition,and renewable energy slightly rebounded to 21.4% (+9.2% QoQ), 5.3% (+15.4% QoQ), and 5.2% (+10.9% QoQ), respectively. These topics are lower than their peaks in Q1 2022; however, since Q3 2022, each topic has remained generally consistent in its percentage of earnings call mentions.

“We don’t talk a lot about grid … but increasingly here in the U.S., people appreciate how critical grid modernization will be to the energy transition.”

Larry Culp – CEO, General Electric, August 28, 2023

Declining themes in Q3

ChatGPT

As mentioned, ChatGPT experienced a decline in its number of mentions in the earnings reports, dropping 34% QoQ to 2.5%. Last quarter, we saw a transition from CEOs specifically discussing ChatGPT to them discussing enterprise-wide applications of generative AI. That transition still appears to be occurring, as the other AI topics saw significant rises in mentions:

- LLM rose 98% QoQ to approximately 2%.

- Computer vision rose 60% QoQ to 1%.

- Chatbot rose 58% to 1%.

Remote work

The topic of remote work dropped the most of the key topics we tracked, falling 48% QoQ to 0.5% of earnings calls. This decline comes amid new concerns of a COVID-19 infection surge due to a newly detected SARS-CoV-2 variant. Early studies show that antibodies from vaccinations and past infections may enable immune systems to detect and combat the variant sufficiently, which could be easing boardroom concerns of a significant surge (of note, mentions of Corona dropped 8% QoQ to 0.9% of earnings calls).

This decline in discussions around remote work also comes amid increasing so-called return-to-office mandates, with 90% of US companies expected to require employees to work in person at least a few days a week by the end of 2023.

This article is based on insights from:

Quarterly Trend Report: What CEOs talked about in Q3/2023

Download a sample to learn about the in-depth analyses that are part of the report.

Already a subscriber? Browse your reports here →

Deep-Dives

#1 AI

In the first quarter of this year, ChatGPT was the hot new (AI) topic for CEOs. In Q2, generative AI shared the stage with ChatGPT as AI proponents discussed other generative LLMs. Now, in Q3, ChatGPT is no longer the hot topic, but rather, generative AI, AI strategy, AI infrastructure, and AI Chips—with companies realizing that ChatGPT is just one tool of many in the new AI portfolio. However, AI is an evolving topic, and OpenAI continues to conduct research and development into ChatGPT, so there is no reason to suspect ChatGPT will completely fade from discussions in the near term.

AI use cases like coding and chatbots are starting to climb

AI use cases like coding and chatbots are also starting to climb, but they have not yet reached the same level as the aforementioned topics. These use cases will likely roll out in the next 6–12 months, so we assess these (and other) topics to grow in Q4 and into 2024.

Of the AI umbrella (not counting AI chips, which we dive into more below), generative AI was the most talked about by CEOs. LLMs, AI infrastructure, and AI strategy saw significant rises in discussions, though they only appear within 1%–2% of the earnings reports overall.

Technology and communication services sectors lead in AI discussions

The technology and communication services sectors lead most AI and AI subfield discussions. 67.6% of technology sector earnings calls mentioned the general topic of AI, while 50.8% of the communications services sector earnings calls discussed it. Generative AI was also fairly high for both sectors, with it mentioned in 33.9% of technology sector earnings calls and 24.2% in communications services sector calls. Of note, the industrial sector showed the third highest interest in generative AI, with 6% of their earnings calls mentioning the topic.

Coinciding with the topic of AI and subfields is a rise in AI strategy and infrastructure discussions. Though hovering between 0.5% and 1% of earnings calls, they rose 128% and 103%, respectively. This could be a sign that as companies look to AI to increase productivity and assess future investments, they are also considering AI implementation strategies.

Key CEO quotes on AI and its subfields

“Generative AI really [instantiated] AI in software, which means developers play a bigger role rather than data scientists. And that’s where you really see the business impact, and I think that impact will be large over the next three to five years…”

Dev Ittycheria – CEO, MongoDB, September 01, 2023

“The application of AI has both horizontal and vertical components. Horizontal is building out the AI infrastructure.”

Anirudh Devgan – CEO, Cadence, July 24, 2023

#2 AI Chips

Also coinciding with the rise in AI discussions are GPUs, most noteworthy Nvidia, the leading GPU vendor in the market. While general discussions of GPUs rose approximately 102% QoQ to 2.8% of earnings calls, Nvidia rose 146% QoQ to 1.9%. On the chipset front, CPUs only saw a 47% climb QoQ to 1.7% of earnings calls. Meanwhile, on the vendor front, Intel saw a decent climb in discussions (~48% QoQ), and AMD a subtle climb (~10% QoQ).

GPUs are becoming the core of choice for AI applications largely due to their architectural advantages over CPUs. While CPUs are optimized for task switching and fast sequential execution with only a few, large cores, GPUs often have many more, smaller cores designed for parallel processing. Deep learning involves performing many mathematical operations, including floating-point arithmetic (often used in rendering graphics) simultaneously, making GPUs a natural fit.

GPUs also offer better cost efficiency for scaling. Though more expensive than CPUs, the time savings they offer for training large language models can more than compensate for that cost. Given that the race is on for AI market dominance, time can actually be money in this case.

Key CEO quotes on AI chips

“I think you can look at 2023 as really a year of planning for AI, because as I said, there’s tons and tons of GPUs being purchased.”

Jayshree Ullal – CEO, Arista Networks, July 31, 2023

#3 Sustainability

Since their peaks in Q1 2022, the rate of discussions of sustainability, emissions, energy transition, and renewable energy in earnings calls have remained generally consistent each quarter, with each topic generally ticking up and down QoQ. This consistency signals a continued awareness of climate impact considerations in the sectors without it being a growing discussion topic in general.

That said, our analysis showed a general trend of CEOs emphasizing real-world projects for energy transition and renewable energy. It is worth highlighting that this emphasis comes amid a year (even quarter) of record temperatures. The US National Oceanic and Atmospheric Administration (NOAA) found that July 2023 had the warmest monthly sea surface temperature of any month and declared August 2023 the warmest August since NOAA started keeping global climate records 174 years ago.

Basic materials, utilities sectors and EMEA companies lead discussions on sustainability

The basic materials and utilities sectors led the discussions on sustainability—45.7% and 40.9% of their respective earnings calls—with utilities taking the general lead in discussions of emissions, climate, batteries, and renewable energy (including solar power). Of note, the energy sector had the second-highest mentions of emissions (39.3%) and the fourth-highest mentions of sustainability (30.8%).

By region, our analysis showed that European, Middle Eastern, and African (EMEA) companies talked about sustainability the most in Q3 2023, with mentions rising approximately 17% QoQ to 38.5%. Meanwhile, Asia-Pacific (APAC) companies continued to increase their number of mentions over North American companies—the former reaching 28.1% in Q3 2023 while the latter remained stagnant around 17%.

Key CEO quotes on sustainability, energy transition, and renewable energy

“The main areas of investment will be in generative AI, next-generation social infrastructure, and renewable energy.”

Junichi Miyakawa – CEO, SoftBank, August 06, 2023

“The downturn in the global economy is not—across the board—even, and consequently, there [is] still a lot of capital being moved […] And it holds for the energy transition, which is almost a given that we have to move forward one way or another.”

Tom Erixon – CEO, Alfa Laval Corporate AB, July 20, 2023

What it means for CEOs

5 things CEOs should ask themselves based on findings in this report:

- Generative AI and data strategy: How is our company planning to leverage generative AI? Are we strategizing how to deal with this technology breakthrough and do we have a solid data strategy to ensure its effective application? Are we willing to play the “waiting game” and become a smart follower as other companies charge ahead with their generative AI plans.

- AI chips: With GPUs seemingly becoming the hardware of choice for AI processes, how are we positioned in terms of hardware infrastructure? Do we have access (directly or through strategic partners) to the compute capacity we may need?

- Macroeconomic concerns: With inflation, supply chain worries, and recession discussions seemingly on the decline, are we prepared for a potentially better than anticipated 2024?

- Remote work and in-person mandates: With some companies calling employees back to the office and others continuing to operate remotely or flexibly hybrid, what are we communicating to our teams?

- Sustainability: With an increasing focus on sustainability, what is our strategy to achieve net-zero? Are we really doing enough and have we baked in unforeseen challenges into our calculations, such as high electricity demand through the upcoming AI wave?

What it means for those serving CEOs

There is an opportunity for employees, service providers and other stakeholders to help CEOs excel at the topics they care about. Here are 5 questions those people serving CEOs could ask themselves based on findings in this report:

- Generative AI implementation: How are we helping the CEO prioritize and implement generative AI projects? Are we helping in aligning the teams behind the opportunity and help secure the infrastructure that may be needed?

- Making the most of generative AI: Beyond ChatGPT and obvious use cases such as chatbots or coding, what other generative AI technologies are on the horizon that might be relevant to our operations? How can we ensure that our CEO is briefed on these potential opportunities?

- Economic pulse: While macroeconomic concerns like inflation and recession are declining in discussions, how are we ensuring that our CEO gets regular, concise, and clear updates on these topics and their potential impacts on our operations?

- Work model adaptation: How can we help the CEO formulate a remote/hybrid work policy that ensures productivity, ongoing learning, employee happiness and safety for the employees?

- Sustainability initiatives: Do the company’s current projects and investments reflect the increasing importance of sustainability and renewable energy? How can we help the CEO better communicate these initiatives to shareholders and the public?

About the analysis

The analysis highlighted in this article presents the results of IoT Analytics’ research involving the Q3 2023 earnings calls of ~4,000 US-listed companies. The resulting visualization is an indication of the digital and related topics that CEOs prioritized in Q3 2023. The chart visualizes keyword importance and growth.

X-axis: Keyword importance (i.e., how many companies mentioned the keyword in earnings calls in Q3 2023)—the further right the keyword falls on the x-axis, the more often the topic was mentioned.

Y-axis: Keyword growth (i.e., the increase or decrease in mentions from Q2 2023 to Q3 2023)—a higher number on the y-axis indicated that the topic had gained importance, while a negative number indicated decreased importance.

Read our Q2 2023 analysis here.

More information and further reading

Are you interested in learning more about the latest CEO insights?

Quarterly Trend Report: What CEOs talked about in Q3/2023

A 52-page report on the trends that emerged in Q3/2023 earnings calls. The report is based on data from 75,000+ corporate earnings calls of US-listed companies from Q1/2019 to Q3/2023.

Related publications

You may also be interested in the following reports:

- IoT Chipset & IoT Module Trends Report 2023

- IoT Software Go-to-Market & Commercialization Report 2023

- Global Cloud Projects Report and Database 2023

- State of IoT – Spring 2023

- Industrial AI and AIoT Market Report 2021–2026

Related articles

You may also be interested in the following articles:

- Top 10 IoT semiconductor design and technology trends

- Successful IoT software commercialization: 7 important considerations according to IoT executives

- What CEOs talked about in Q2/2023: Generative AI applications, bank troubles, uncertain economy

- Winning in IoT: How the enterprise IoT market is evolving

- State of IoT 2023: Number of connected IoT devices growing 16% to 16.7 billion globally

- The rise of industrial AI and AIoT: 4 trends driving technology adoption

- Using generative AI for IoT: 3 generative AIoT applications beyond ChatGPT

Related dashboard and trackers

You may also be interested in the following dashboards and trackers:

- Global IoT Enterprise Spending Dashboard

- Global Cellular IoT Module and Chipset Market Tracker & Forecast

- Global Cellular IoT Connectivity Tracker & Forecast

- Global Cellular IoT eSIM Module & iSIM Chipset Tracker

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.