We updated this research article. Visit the link to view the latest insights.

In short

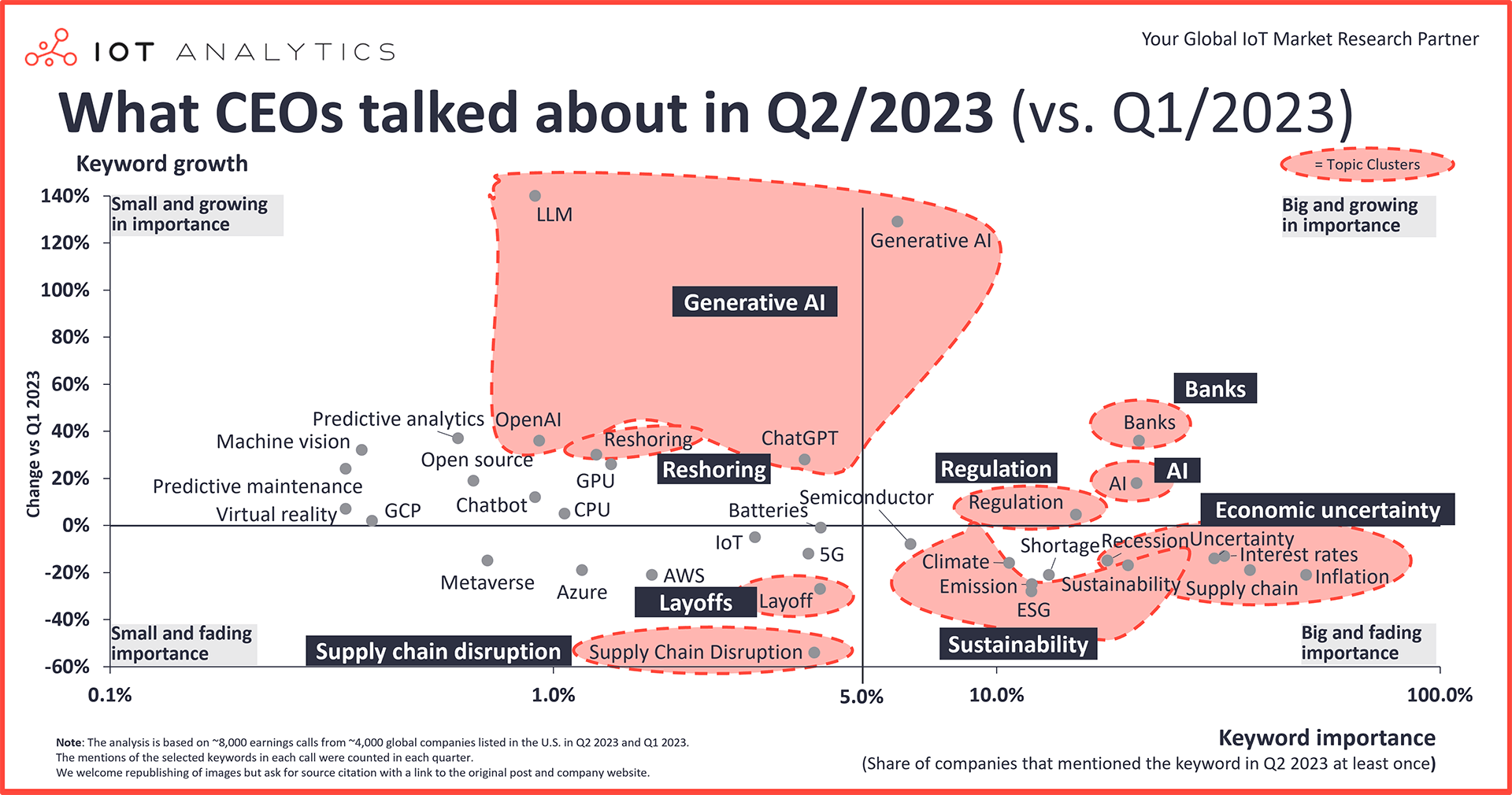

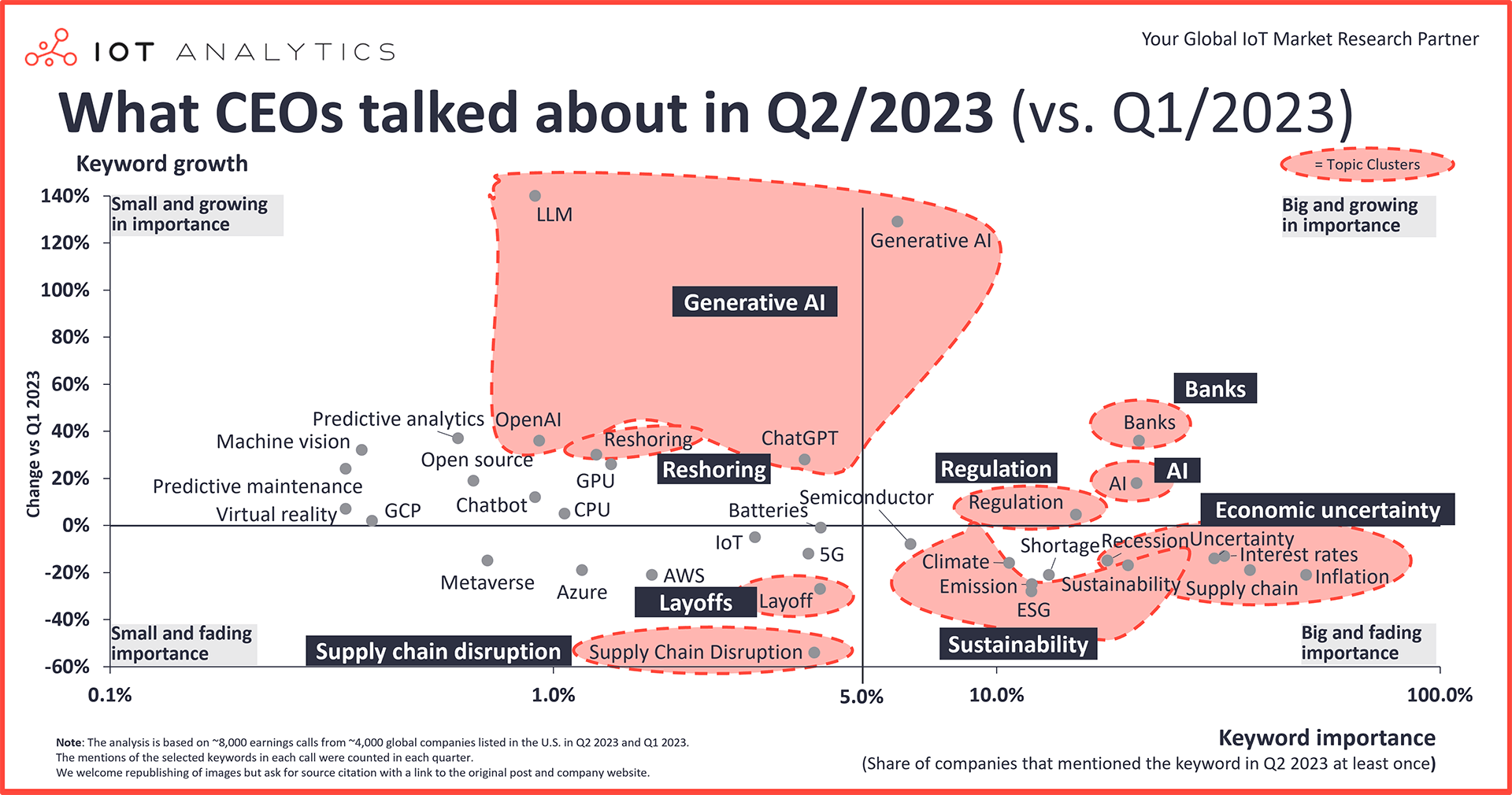

- According to the latest “What CEOs talked about” report, three themes noticeably gained traction in earnings calls in Q2/2023: 1. AI & Generative AI, 2. Bank troubles, and 3. Reshoring.

- Discussions around economic uncertainty, sustainability, and supply chain disruptions lost traction.

Why it matters

- The prioritization of specific topics by CEOs will likely lead to further investment in these areas.

The big picture

In Q2 2023, economic uncertainty remained the most discussed theme in boardrooms globally.

There was a notable decline in the number of CEOs discussing inflation, with only 50% mentioning the keyword (a 21% decrease from the previous quarter). Similarly, other related topics also experienced a decrease in prominence, with interest rates being discussed by only 33% (-13%) of CEOs and the term “recession” being mentioned in just 18% (-15%) of all earnings calls in Q2/2023. Despite these slight variations in the focus on economic topics among CEOs, it is important to note that overall, economic uncertainty remains a prevailing concern in boardrooms.

Key CEO quote on the macro environment

“We expect macro headwinds will continue with the potential for a recessionary environment across both the U.S. and Europe.”

Ian Broaden – Executive Vice President and Chief Financial Officer, McDonald’s, May 2, 2023

Key upcoming themes

(Generative) AI

Generative AI discussions, specifically around use cases and applications, continue to increase.

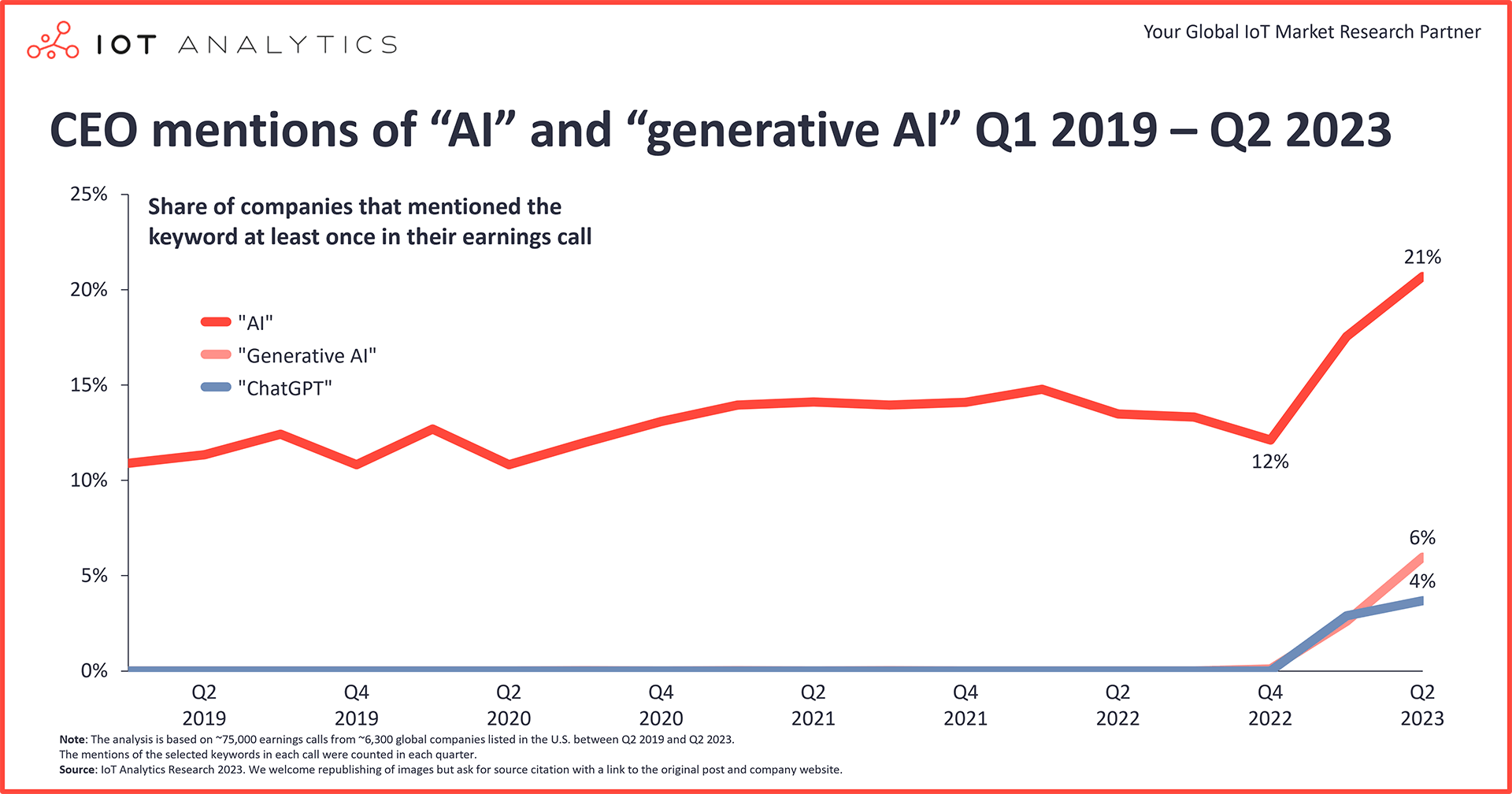

The mention of Generative AI experienced a significant increase of +129% in the last quarter, with 6% of discussions specifically referencing it. Additionally, the broader topic of AI was discussed in 21% of earnings calls (+21%), while the more technical term, “large language model” (LLM), saw a 229% increase in mentions, and was present in 1% of all earnings calls.

Banks

CEOs discussed banks more frequently in Q2 2023 (+36%). Following the banking turmoil involving several institutions including Silicon Valley Bank (SVB) and Credit Suisse in Q1 2023 companies discussed about a potential fallout as well as stricter lending regulations from some (regional) banks.

Key CEO quote on banks

“We have seen a number of banks pulling back from auto lending, which is kind of a hallmark of banks through difficult markets, and that’s created a bit of a pricing opportunity for us, as well as improvement in share – financing share for us.”

Marion Harris – CEO, Ford Motor Company Credit Company, 02 May 2023

Reshoring

Discussions around reshoring increased by +30% in Q2 2023. 1.3% of all companies and 5% of industrial companies talked about the topic. Given the ongoing tensions between China and the USA, many US-based companies appear to prioritize enhancing the resilience of their supply chains, and some have concluded that bringing production closer to home is the solution.

Key CEO quote on reshoring

“Reshoring continues to be a prevalent topic among our customers, and we expect near and longer-term benefits from this trend.”

Frank Dellaquila – CFO, Emerson Electric Co., 03 May 2023

Declining themes

Sustainability and climate change

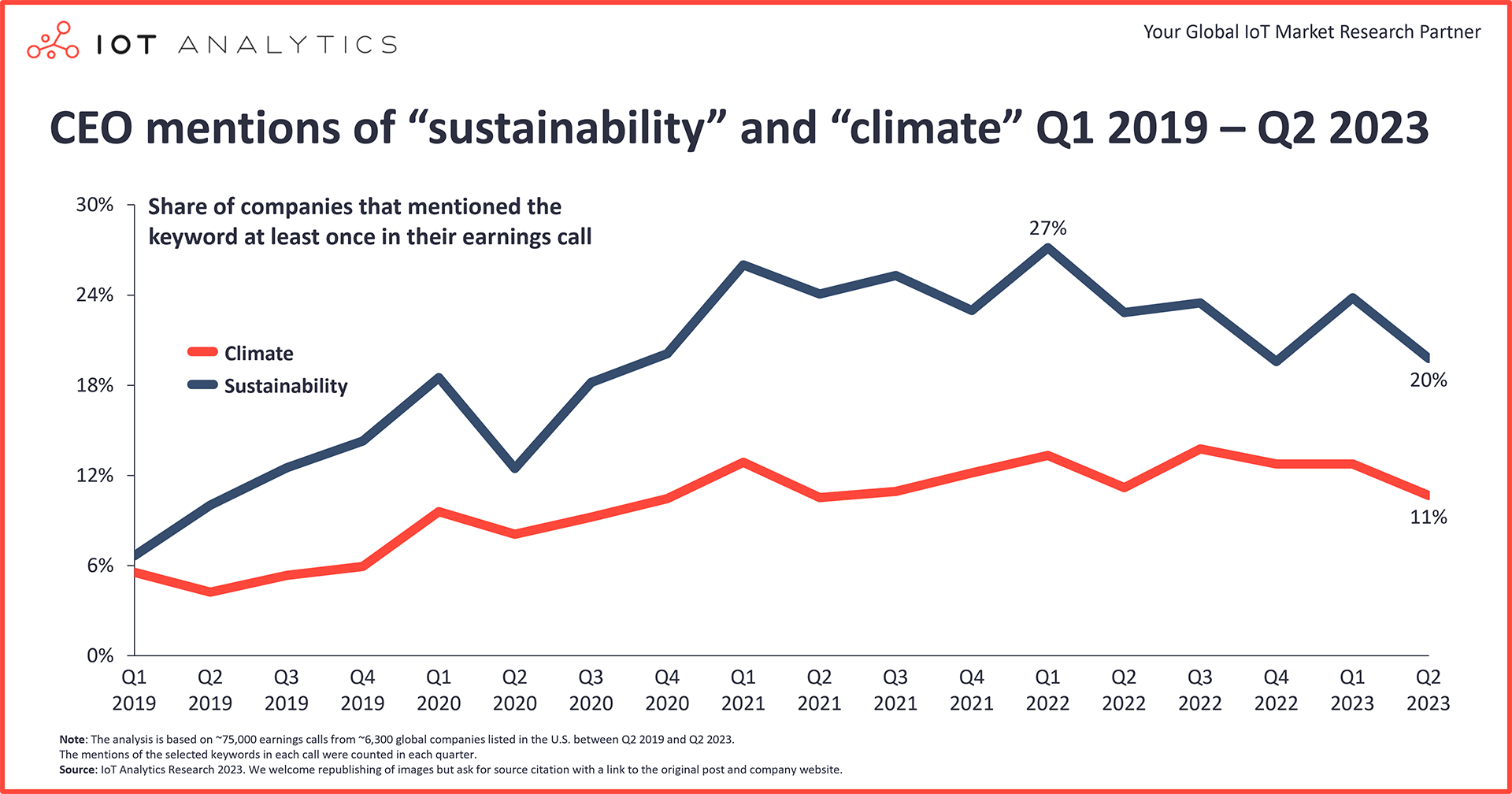

Despite record temperatures around the world (e.g., temperatures in the North Atlantic Ocean increased to records highs), discussions on climate (-16%), emissions (-25%) and sustainability (-17%) experienced a decline in Q2/2023.

Supply chain disruptions

With supply chains slowly improving and supply shortages easing, discussions regarding supply chains in general (-19%), and supply chain disruptions (-54%) in particular, decreased strongly in Q2/2023.

This article is based on insights from:

Quarterly Trend Report: What CEOs talked about in Q2/2023

Download a sample to learn about the in-depth analyses that are part of the report.

Already a subscriber? Browse your reports here →

Click on the button to load the content from .

Deep dives on select themes

#1 (Generative) AI

The release of ChatGPT by OpenAI in November 2022 ignited an unprecedented discussion about the use cases of generative AI in boardrooms. Generative AI was mentioned by 6% of all CEOs in Q2/2023 – a remarkable increase of +129%, compared to the previous quarter. Discussions have transitioned from specifically discussing the tool ChatGPT itself (mentioned by 3.7% in Q2, an increase of 28%) to actual enterprise-wide applications of generative AI. Moreover, an increasing number of CEOs also delved into technical details: The keyword LLM (large language models, the foundation for ChatGPT) was discussed by 1%, representing a substantial increase of +229% compared to the last quarter.

In Q2/2023, numerous companies started to roll out generative AI as part of their core product. For instance, the online flower shop 1-800-flowers.com launched MomVerse, an AI-powered poetry tool to assist individuals in expressing their love for mothers on Mother’s Day. E-commerce giant eBay has also started to use generative AI to support its marketplace sellers in composing suitable product descriptions. Lastly, travel company Booking Holdings has rolled out ChatGPT as a virtual travel assistant. These are just three examples of companies who are infusing generative AI into their business.

Unsurprisingly, the companies that talked most about generative AI in Q2/2023 were from the Technology sector (22.2% of all tech earnings calls) and Communication Services (22.1%). Consumer Cyclical (3.7%), Consumer Defensive (3.4%) and Industrials (2.8%) also had their fair share in debates.

When it comes to the various generative AI and LLM tools mentioned during these calls, OpenAI clearly dominates the field. OpenAI‘s ChatGPT accounted for over ~99% of the mentions among generative AI tools. Other tools such as Google’s Bard, Meta’s LLaMA or Aleph Alpha were only sporadically mentioned as examples.

Key CEO quotes on generative AI

“With the emergence of generative AI capabilities, we moved quickly to create a fun and playful way to intertwine the emerging AI technology with our gift-giving experience. Just in time for Mother’s Day, we launched the 1-800-FLOWERS MomVerse.”

Chris McCann – Chief Executive Officer, 1-800-flowers.com, 11 May 2023

“Generative AI has a number of exciting use cases outside of descriptions, and we’re exploring numerous potential applications across our marketplace that can enable truly magical customer experiences.”

Jamie Iannone – CEO, eBay Inc, 26 April 2023

“There are current challenges given that current LLMs sometimes produce inaccurate outputs. Nevertheless, we are excited to be exploring how we can make use of these technologies for the benefit of our customers. Some of our brands, like KAYAK and OpenTable, are experimenting regenerative AI plug-ins, while others are building ways to integrate the technology into their own offerings.”

Glenn Fogel – President and Chief Executive Officer, Booking Holdings, 4 May 2023

“We are in advanced stages to apply generative AI across our portfolio, and we are working as an early release partner of OpenAI and together with other vendors. We are planning to announce new disruptive AI use cases.”

Christian Klein – CEO, SAP SE, 21 April 2023

#2 Supply chains

Long lead times and strained supply chains have been a persistent concern for CEOs. We previously highlighted supply chain disruptions as a prevalent topic of discussion, such as in our Q4 2022 analysis, or Q3 2021 analysis.

In Q2 2023, supply chain disruptions were mentioned in 4% of all earnings calls. That is a decrease of -54% compared to Q1 2023. The tone of these discussions has shifted, as many companies now discuss how they have successfully overcome these disruptions and managed the challenges. Although the Global Supply Chain Pressure Index has receded back to pre-pandemic levels, not all earnings calls mirror that sentiment, with some companies still grappling with longer-than-desired lead times.

Key CEO quote on supply chains

“We have seen now that the supply chain disruption has normalized, and we will see that the inventory level will decrease starting actually in Q3 of this year.”

Yves Mueller – Hugo Boss AG, 4 May 2023

“Last 2 or 3 years have seen extreme swings on inventory up and down, given the supply chain disruptions which we all faced in the industry. I think we now see more normalized trade inventory levels. And from what we see across the board, most trade inventory levels in the Q1 were pretty much normalized.”

Marc Bitzer – Chairman and Chief Executive Officer, Whirlpool Corporation, April 25, 2023

“Our inventories will remain high throughout the year also to preserve our agility in a context where the fluidity of the supply chain is not yet fully restored.”

Antonio Picca Piccon – Chief Financial Officer, Ferrari N.V., 4 May 2023

#3 Climate change

In 2023, global temperatures have risen by 1.1 °C from pre-industrial levels, and news regarding climate-related catastrophes continues to make headlines regularly (e.g., major floodings in Pakistan, record heat in the North Atlantic or severe droughts in the western Mediterranean).

Our analysis reveals a significant increase in discussions related to climate and sustainability during earnings calls from Q1 2019 to Q1 2021. However, since then, the prevalence of these topics has leveled off or even experienced a slight decline. In Q2 2023, 20% of CEOs discussed sustainability (-17% compared to the previous quarter), and 11% focused on the climate (-16%) during their earnings calls.

Economic uncertainty and the emphasis on AI use cases seem to have sidelined the sustainability and climate topic. Amazon, for example, quietly gave up parts of its climate pledge recently. Additionally, several companies, including Yamaha (as seen below), have acknowledged falling short of their previously set targets.

On a positive note, numerous vendors offering sustainability-related products are experiencing significant adoption. Microsoft and Siemens, for example, highlight the considerable customer demand for sustainability-related products.

Key CEO quote on climate and sustainability

“Our Cloud for Sustainability is seeing strong adoption from companies in every industry, including BBC, Nissan and TCL as they deliver on their respective environmental commitments.”

Satya Nadella – Chairman & CEO, Microsoft Corporation, Apr. 25, 2023

“We are in the sweet spot with automation and digitalization and in particular, with the sustainability offerings we have for our customers to help them transitioning in their business models.”

Ralf Thomas – CFO, Siemens AG, May 17, 2023

“As for the sustainability efforts, in fact, we have made greater progress in some of the areas, but the sustainable timber usage ratio was affected by the change in the model mix. So, we have not achieved much numerical results to mention yet.”

Takuya Nakata, CEO, Yamaha Corporation, 9 May 2023

| About the analysis

The analysis highlighted in this article presents the results of IoT Analytics’ research involving the Q2/2023 earnings calls of ~4,000 US-listed companies. The resulting visualization is an indication of the digital and related topics that CEOs prioritized in Q1/2023. The chart visualizes keyword importance and growth.

X-axis: Keyword importance (i.e., how many companies mentioned the keyword in earnings calls in Q2)—the further out the keyword falls on the x-axis, the more often the topic was mentioned.

Y-axis: Keyword growth (i.e., the increase or decrease in mentions from Q1/2023 to Q2/2023)—a higher number on the y-axis indicated that the topic had gained importance, while a negative number indicated decreased importance.

Read our Q1/2023 analysis here.

More information and further reading

Are you interested in learning more about the latest CEO insights?

Quarterly Trend Report: What CEOs talked about in Q2/2023

A 46-page report on the trends that emerged in Q2/2023 earnings calls. The report is based on data from ~75,000 corporate earnings calls of US-listed companies from Q1/2019 to Q2/2023.

Related publications

You may also be interested in the following reports:

- State of the IoT – Spring 2023

- Generative AI Trend Report

- Digital Supply Chain Market Report 2022–2027

- Machine Vision Market Report 2022-2027

Related articles

You may also be interested in the following articles:

- CEO priorities from 2019 until now: What has changed?

- Mapping 7,000 global cloud projects: AWS vs. Microsoft vs. Google vs. Oracle vs. Alibaba

- Winning in IoT: How the enterprise IoT market is evolving

- State of IoT 2023: Number of connected IoT devices growing 16% to 16.7 billion globally

- Global cellular IoT module market declined 6% in Q1 2023 in a weakening demand environment

- What CEOs talked about in Q1/2023: Economic uncertainty, layoffs, and the rise of ChatGPT

Related dashboard and trackers

You may also be interested in the following dashboards and trackers:

- Global Cellular IoT Module and Chipset Market Tracker & Forecast

- Global Cellular IoT Connectivity Tracker & Forecast

- Global IoT Enterprise Spending Dashboard

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.