We updated this research article. Visit the link to view the latest insights.

In short

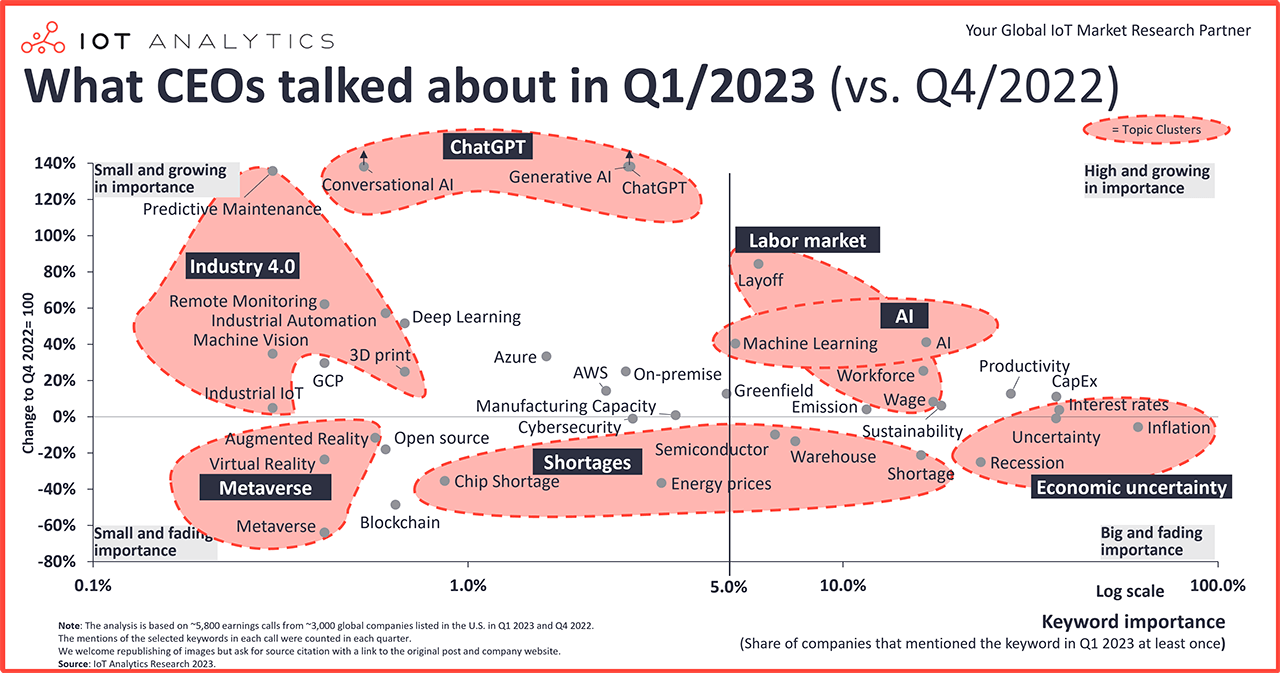

- According to the latest “What CEOs talked about” report, three themes noticeably gained traction in earnings calls in Q1/2023: 1. AI & ChatGPT, 2. the labor market, and 3. Industry 4.0. Discussions around (supply) shortages and the metaverse lost traction.

- Economic uncertainty (inflation, recession, and interest rates) remains the most important topic cluster overall.

Why it matters

- The prioritization of specific topics by CEOs will likely lead to further investment in these areas.

Click on the button to load the content from .

Already a subscriber? Browse your reports here →

The big picture

In Q1 2023, economic uncertainty was at the forefront of CEOs’ minds globally and across the board. In 2023, 61% of all earnings calls discussed inflation, 23% talked about recession, and 38% mentioned interest rates. Even though inflation (-6% decline in mentions compared to Q4/2022) and recession (-25%) were less prevalent than in the last quarter of 2022, economic uncertainty was still the elephant in the room.

Key upcoming themes

AI

AI was discussed by 17% of CEOs (+ 41%). The interest in AI and machine learning was sparked by the release of ChatGPT and the discussions around potential use cases. ChatGPT was mentioned by 2.7% of companies in earnings calls in Q1/2023 (compared to no mentions in the previous quarter).

The labor market

The labor market continues to rise in importance on CEOs’ list of topics. Layoffs were discussed in 6% of all earnings calls (+84% compared to Q4/2022), and 18% discussed wages (+8% from Q4/2022).

Industry 4.0

Another key upcoming theme in Q1/2023 is Industry 4.0 and related topics. Industrial automation was discussed in 0.6% of all earnings calls(+57% compared to Q4/2022). However, the strongest increase in this group was registered for the keyword predictive maintenance, which increased by +136%.

Declining themes

Supply shortages

With supply chains slowly improving and supply shortages easing, discussions around shortages in general (-21%) and chip shortages (-35%) more specifically decreased strongly in Q1/2023.

The Metaverse

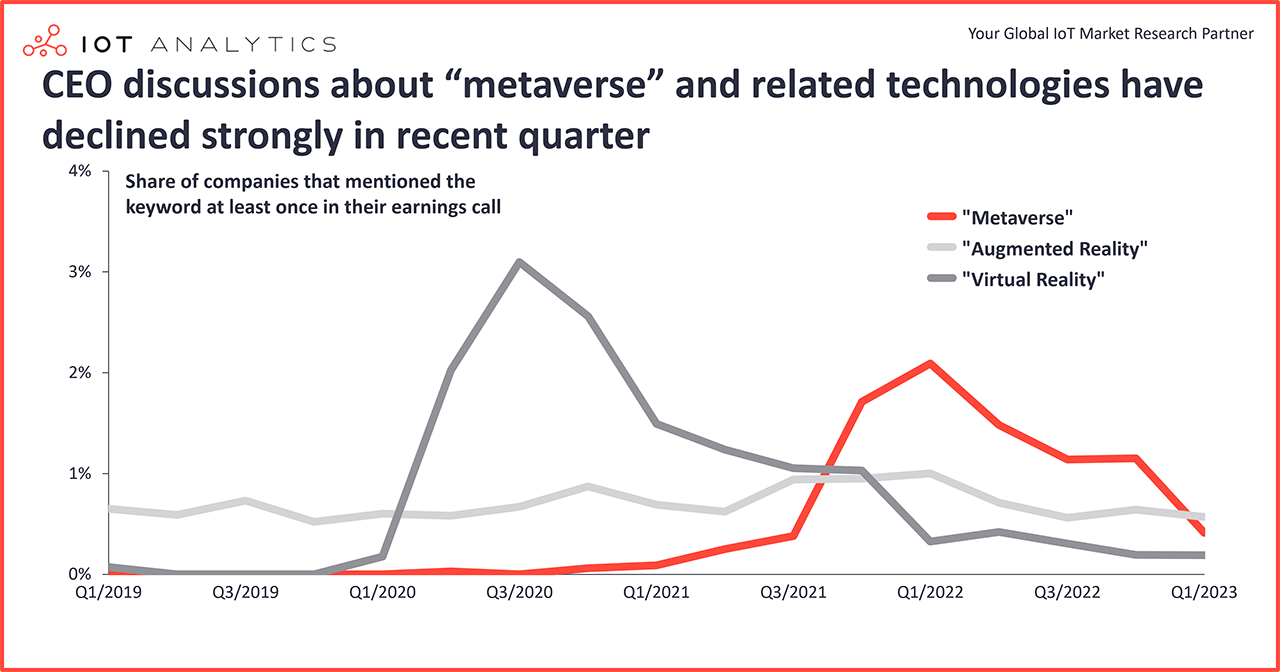

Another theme that reduced in importance in Q1/2023 was the metaverse. The metaverse as a keyword declined by -64% in Q1/2023. Related technologies, such as virtual reality (-24%) and augmented reality (-12%), also declined.

| About the analysis

The analysis highlighted in this article presents the results of IoT Analytics’ research involving the Q1/2023 earnings calls of ~3,000 US-listed companies. The resulting visualization is an indication of the digital and related topics that CEOs prioritized in Q1/2023. The chart visualizes keyword importance and growth.

X-axis: Keyword importance (i.e., how many companies mentioned the keyword in earnings calls in Q2)—the further out the keyword falls on the x-axis, the more often the topic was mentioned.

Y-axis: Keyword growth (i.e., the increase or decrease in mentions from Q4/2022 to Q1/2023)—a higher number on the y-axis indicated that the topic had gained importance, while a negative number indicated decreased importance.

Read our Q4/2022 analysis here.

Q1/2023 deep dives

Three technological themes of interest in Q1/2023 are highlighted in this article in greater depth: AI & ChatGPT, Industry 4.0, and the metaverse.

#1 AI & ChatGPT

ChatGPT was released on 30 November 2022. The chatbot, which is built on a large language model by OpenAI, went viral and set records as the fastest-growing consumer application in history, reaching 100 million active users within two months of its launch. ChatGPT sparked discussions around potential use cases of AI in general. 17% of all earnings calls mentioned AI, which constitutes a strong increase of +41% in Q1/2023. More specifically, generative AI was discussed by 2.7% of all earnings calls (an increase of nearly 1,600%) and conversational AI was mentioned in 0.5% of earnings calls.

ChatGPT was mentioned in 2.7% of all earnings calls, up from zero mentions in the last quarter. The CEO of IBM highlights the release of ChatGPT as one of the three key moments for AI in the last decade (after IBM Watson winning Jeopardy and DeepMind winning GO competitions). So far, most discussions that mention ChatGPT occur within earnings calls of technology companies that talk about how they want to market the new technology. Most applications have not reached large-scale adoption by enterprise end-users. But the potential is tremendous, including use cases of generative AI for IoT.

Key CEO quotes on AI and ChatGPT

Microsoft:

“We’re excited about ChatGPT being built on Azure and having the traction it has. So, we look to both. There is an investment part to it and there is a commercial partnership. But fundamentally, it’s going to be something that’s going to drive, I think, innovation and competitive differentiation in every one of the Microsoft solutions by leading in AI.”

Satya Nadella, CEO, Microsoft, 24 January 2023

IBM:

“AI has become a big topic of conversation this year […] If I think about it, over the last decade, I think there were three moments you can talk about, […] One, when IBM won Jeopardy with Watson, […] Second, when deep mind from Google or Alphabet started winning competitions around, for example, GO […] and now with OpenAI and ChatGPT.”

Arvind Krishna, CEO, IBM, 25 January 2023

Meta:

“Generative AI is an extremely exciting new area with so many applications, and one of my goals for Meta is to build on our research to become a leader in generative AI in addition to our leading work in recommendation AI.”

Mark Zuckerberg, CEO, Meta, 1 February 2023

Seagate Technologies:

“If you think about it, early days of AI or training models and things like that, that needed access to big data sets. But I think as time goes on, big data sets have to be very real time to make decisions that are relevant in the moment.”

“And sometimes, they need to be kept at the edge because you have a lot of video data, for example, at the edge, to make good decisions on consumer behavior or inventory, […] all these new applications that are coming.”

Dave Mosley, CEO Seagate Technologies, 25 January 2023

#2 Industry 4.0

As this analysis clearly shows, many companies discuss how to fight rising inflation, labor costs, and general cost pressure. Many business leaders come to the result that more, not less, investment into digitization is the solution. Therefore, even during times of economic uncertainty, spending on enterprise IoT is expected to stay strong prior to 2027.

This expectation is also reflected in boardroom discussions: predictive maintenance (+136%), remote monitoring (+62%), and industrial automation (+57%) were discussed much more than in Q4 2022. Vendors and end users emphasize cost cutting through IoT-connected solutions. For example, machine vision enables many Industry 4.0-related use cases, such as flaw detection and operation optimization.

Note: The IoT Analytics team will be at the world’s largest industrial fair, Hannover Messe 2023, in mid-April 2023 to discuss industrial transformation and Industry 4.0. Make sure to reach out!

Key CEO quotes on Industry 4.0

Cognex:

“The market is still in the early stages of adopting machine vision. Most companies are still highly reliant on labor, and very few warehouses globally are realizing the full potential of automation.”

Rob Willett, President and CEO, Cognex, 17 February 2023

Liberty Energy:

“[…] We saw that in our cost of maintenance last year, our ability to run our equipment at, well, really flat maintenance costs in the face of very, very strong inflationary pressure. So that’s a credit to that team and the work they’ve done from a predictive maintenance standpoint.”

Ron Gusek, President, Liberty Energy, 26 January 2023

Acorn Energy:

“I’ve talked about how inflation has an impact on our cost, but conversely, it can also have a benefit in terms of our business and our value proposition. This is because our monitoring solutions reduce the personnel costs, travel time, emissions, and overall environmental impact required to maintain industrial equipment and critical systems. Therefore, as our customers’ costs increase, the return on investment of our services to them also improves. […] Remote monitoring will always be a significantly less expensive alternative than physical inspection, particularly with higher personnel and fuel costs.”

Jan Loeb, CEO, Acorn Energy, 16 March 2023

#3 The Metaverse

Mentions of the metaverse decreased by 64%. The keyword was mentioned in 0.4% of all earnings calls in Q1 2023. That constitutes a steep decline since its peak in Q1/2022 when a couple of companies jumped on the hype train and announced their own (industrial) metaverse projects, including Microsoft, Siemens, Disney, Nvidia, and Meta. In Q1/2022, about 2% of all earnings calls discussed the metaverse. However, in the last quarter, a lot of related layoffs and announcements show that the trend might be over for now. Microsoft laid off its Metaverse core team of roughly 100 employees in February 2023, and Google announced the end of its Google Glass Enterprise Edition. Some consumer-focused companies, such as Disney, have ended their metaverse projects for now.

While the keyword “metaverse” might lose steam, related technologies are likely to stick around. The CEO of T-Mobile, Mike Sievert, said the following during an earnings call in October 2022: “No matter what you believe about how the metaverse might or might not unfold, clearly more immersive 3D experiences are on their way.”

Expected key product announcements from some leading tech companies are likely to set the tone for the market in the coming years and will play a role in whether the industrial metaverse becomes a reality. For example, in late March 2023, Nvidia and Microsoft announced a partnership to bring industrial metaverse applications to the cloud.

Key CEO quotes on the metaverse

Ralph Lauren:

“And as we continue to lead in gaming and the metaverse, we launched an innovative collaboration with Fortnite, targeted to next-gen consumers with additional exciting partnerships to come for spring and fall ‘23.”

Patrice Louvet, CEO, Ralph Lauren, 9 February 2023

Himax Technologies:

“Metaverse-related developments are early in the lifecycle but overall remain an attractive opportunity for us potentially.”

Jordan Wu, CEO, Himax Technologies, 9 February 2023

More information and further reading

Are you interested in learning more about the latest technology market developments?

IoT Analytics is a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), AI, Cloud, Edge, and Industry 4.0.

Quarterly Trend Report: What CEOs talked about in Q1/2023

A 47-page report on the trends that emerged in Q1/2023 earnings calls. The report is based on data from ~56,000 corporate earnings calls of US-listed companies.

Click on the button to load the content from .

Related publications

You may be interested in the following publications:

- Embedded World 2023—the Latest IoT Chipset and Edge Trends

- IoT Software Adoption Report 2023

- Generative AI Trend Report

- Digital Twin Market Report 2023-2027

- Enterprise Augmented/Mixed Reality Market Report 2022–2027

Related articles

You may also be interested in the following recent articles:

- The top 10 IoT chipset and edge trends—as showcased at Embedded World 2023

- Using generative AI for IoT: 3 generative AIoT applications beyond ChatGPT

- Decoding Digital Twins: Exploring the 6 main applications and their benefits

- Global IoT market size to grow 19% in 2023—IoT shows resilience despite economic downturn

- The enterprise AR market and the industrial metaverse: Why 2023 marks an inflection point

Related market data

You may be interested in the following IoT market data products:

- Global Cellular IoT Module and Chipset Tracker and Forecast

- Global Cellular IoT Connectivity Tracker and Forecast

- Global IoT Enterprise Spending Dashboard

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.