We updated this research article. Visit the link to view the latest insights.

In short

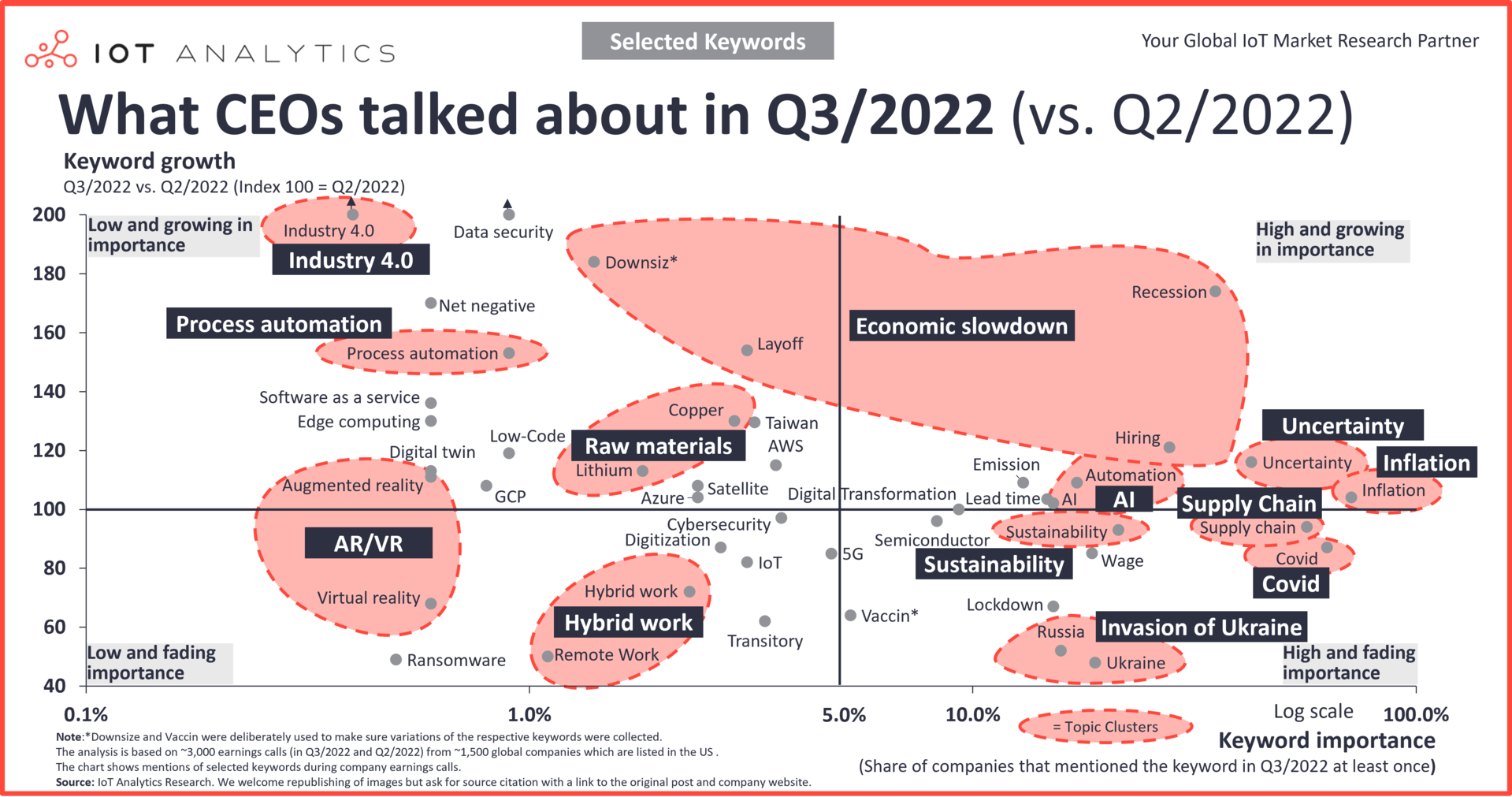

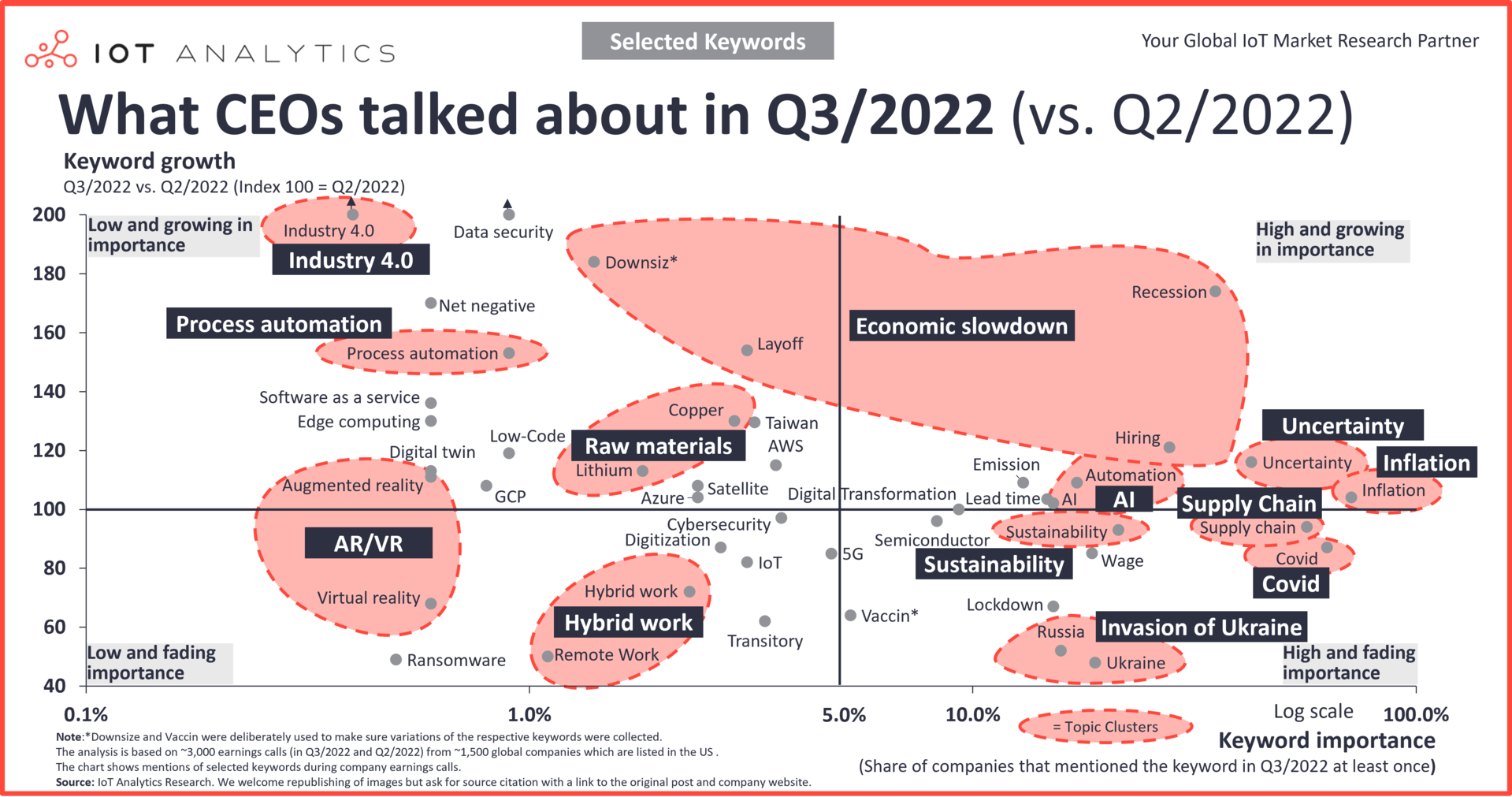

- Three themes noticeably gained traction in Q3/2022, i.e., the recession, raw materials, and Industry 4.0

- Mentions of sustainability-related topics decreased in the last quarter but seemed to stabilize at a higher level than in previous years. Hybrid work has sidelined remote work.

Why it matters

- CEOs’ prioritization of specific topics will likely lead to further investment in these areas

Introduction

In their earnings calls in Q3/2022, 35% of CEOs talked about recession – with layoffs, hiring (freezes), and downsizing the primary topics for most.

Industry 4.0 (+143% growth compared to Q2/2022) and other tech-related topics (such as process automation with +53%) grew strongly, although on a smaller level.

The three most-discussed topics we track remain COVID-19, inflation, and supply chains (mentioned in 57%–72% of all earnings calls).

Topics such as the economic slowdown and automation rose in importance in Q3, while several other topics that had gained significant attention in previous quarters faded. Russia (16%) and Ukraine (19%) were still mentioned by many CEOs but by approximately 50% less than in the previous quarter. Additionally, discussions concerning hybrid work (–28%) and remote work (–50%) declined in the last quarter (see analysis below). In Q3/2022, the topic of new work was of less importance in the high inflation and economically turbulent environment.

| About the analysis

The “What CEOs talked about” analysis (highlighted in this article) presents the results of IoT Analytics’ research involving the Q3/2022 earnings calls of ~1,500 US-listed companies. The resulting visualization indicates the digital and related topics that CEOs prioritized in Q3/2022. The chart visualizes keyword importance and keyword growth as follows:

X-axis: Keyword importance (i.e., how many companies mentioned a keyword in earnings calls in Q3). The further out the keyword falls on the X-axis, the more often the topic was mentioned.

Y-axis: Keyword growth (i.e., the increase or decrease in mentions from Q2/2022 to Q3/2022, indexed to 100). A number >100 on the Y-axis indicates the topic has gained importance, while a number <100 indicates the topic has decreased in importance.

Read our Q2/2022 analysis here.

In this article, we highlight five themes of interest in more depth, including three key upcoming themes (economic slowdown, raw materials, and Industry 4.0), and two additional themes of interest, i.e., hybrid/remote work and sustainability.

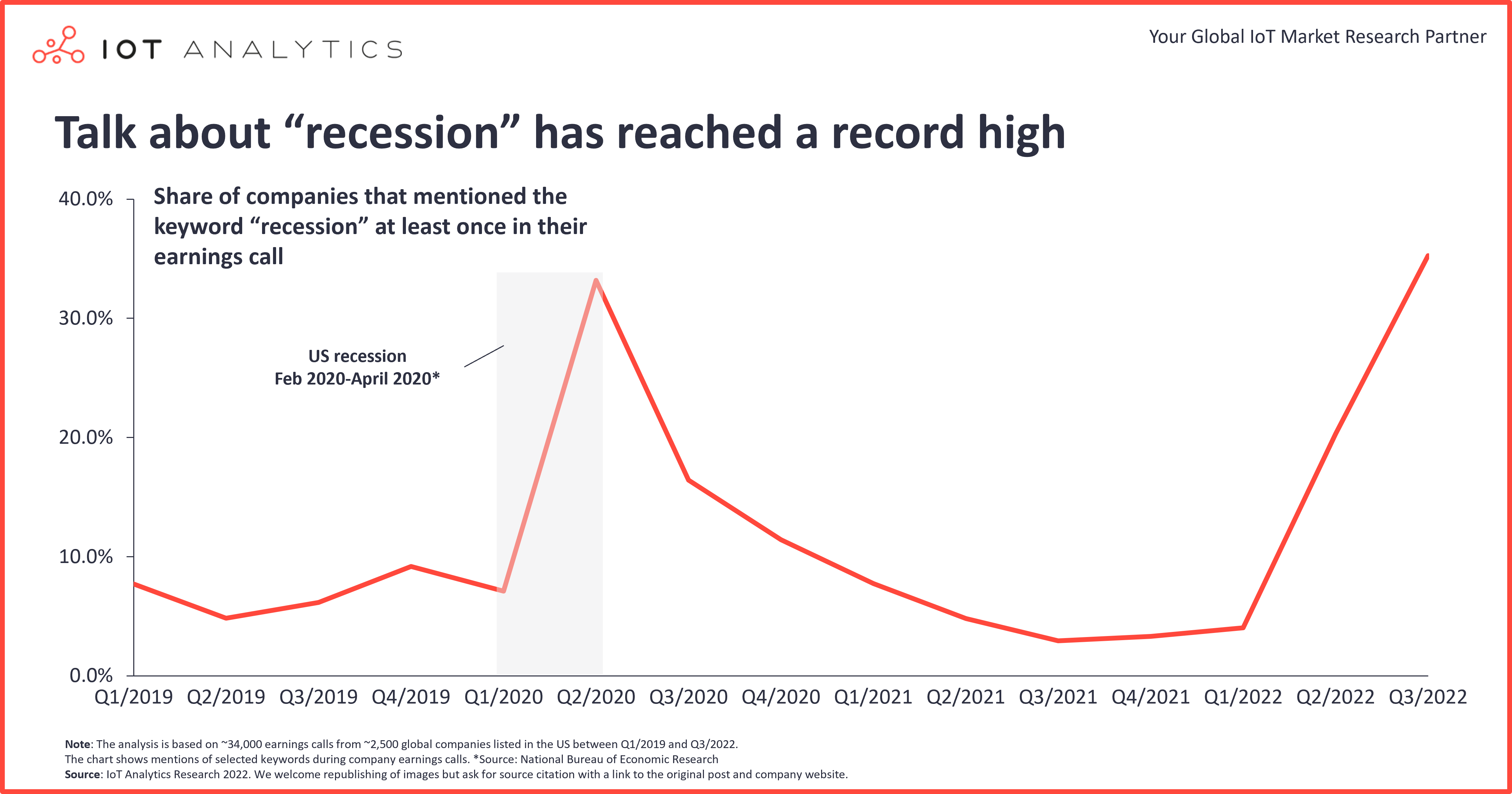

#1 Key upcoming theme: Economic slowdown

In their Q3/2022 earnings calls, 35% of all CEOs talked about “recession.” This number was up 74% from the previous quarter. The analysis shows that, like “recession,” many of the upcoming themes in those earnings calls were related to a weakened economy. With high inflation rates not seen in decades, the topic of inflation was discussed in 71% of all earnings calls in Q3/2022 (up 4% since the previous quarter but overall up 646% in the past two years). The gloomy forecast for economic growth led to many boardroom meetings discussing layoffs.

The keywords “downsizing” (+83%), “layoff” (+54%), and “hiring” (+22%) all increased considerably in Q3 2022. It is essential to mention that “hiring” was often used in the context of a “hiring freeze” or “stop hiring.” However, many companies are still trying to hire, and labor markets seem surprisingly resilient. In the US, job opening rates are still higher than unemployment rates. Additionally, unemployment in Europe continued to decrease in Q3/2022. Nevertheless, companies as diverse as Klarna, Credit Suisse, Meta, and Ford announced layoffs or hiring freezes in Q3/2022.

Discussions about a recession are now (35%) even more frequent than during Q2/2020 (33%), when the COVID-19-induced downturn reached the point of a recession. In Q3/2022, talk about recession reached an all-time high since IoT Analytics began tracking earnings calls (Q1/2019).

“We are seeing advertisers worried about a possible recession and so we’re seeing them reduce their spend in places that are easy for them to turn off and turn back on.”

Anthony Wood — Chief Executive Officer, Roku, 28 July 2022

“Given the uncertain global economic outlook and the hiring progress achieved to date, as Sundar previously announced, we intend to slow the pace of hiring. We expect our actions on hiring to become more apparent in 2023.”

Ruth Porat — Chief Financial Officer, Alphabet, 26 July 2022

“There’s a massive opportunity to talented professionals who aspire to build their future on ServiceNow. And as an employer, while others in the tech industry are slowing or even stopping hiring, ServiceNow is hiring. We are hiring. We are doubling down on our talent brand.”

Bill McDermot — Chief Executive Officer, ServiceNow, 26 July 2022

#2 Key upcoming theme: Raw materials

Several CEOs (3%) talked about copper (+30% compared with Q2/2022), and 2% talked about lithium (+13%). These two raw materials are part of a long list of other raw materials, such as lumber, nickel, and cobalt, all of which experienced increased price volatility in the past three years.

Copper prices experienced quite a roller coaster ride and increased to record heights in March 2022 after hitting rock bottom in March 2020. Since then, its record high price decreased by 18% in the past six months.

Lithium is needed in many types of batteries and is particularly important for connected devices and electric vehicles. In Q3/2022, GM introduced a new supply chain initiative, while Tesla’s CEO, Elon Musk, asked entrepreneurs to enter the lithium refining business, calling it “a license to print money” (see quotes below). Lithium prices increased by 190% in the past year.

Policymakers are trying to ease the pain of strained raw material supply chains by pushing for more strategic autonomy. The European Union, for example, is working on a Raw Materials Act, including an early warning system and crisis management mechanism for critical raw materials, boosting investment in production and recycling, and ensuring a global level playing field.

“What this means is GM now has binding agreements securing all battery raw materials supporting our goal of 1 million units in annual capacity in North America in 2025. This includes lithium, nickel, cobalt, and the full CAM supply. As we move forward, we will increasingly localize our supply chain just as we have localized battery cell production.”

Mary Barra — Chief Executive Officer, General Motors, 26 July 2022

There’s like software margins in lithium processing right now. So I would really like to encourage, once again, entrepreneurs to enter the lithium refining business. You can’t lose.

Elon Musk — Chief Executive Officer, Tesla, 21 July 2022

It’s a license to print money.”

#3 Key upcoming theme: Industry 4.0

On a much smaller scale than the previously mentioned topics, Industry 4.0 was discussed by 0.4% of all CEOs in Q3/2022 (+113% since Q2/2022). By nature, Industry 4.0 primarily applies to the manufacturing industry. The recently published IoT Signals Report—Manufacturing Spotlight (August 2022), jointly published by IoT Analytics, Microsoft, and Intel, shows that 72% of manufacturers have to date partially or fully implemented a smart factory strategy. Despite the prevalence of the pandemic, looming recession, inflation, and global supply chain issues in the past year(s), manufacturers are determined to fast-track their digital transformation projects in the next three years. With some companies having made significant Industry 4.0 investments several years back, implementation success stories are now entering earnings calls, as some of the quotes below show.

“We have our factories. Some of them are already at industry 4.0. And all of these investments and strategies are paying off.”

Judy Marks — Chief Executive Officer, Otis Worldwide, 27 July 2022

“Factory automation is something that we have been doing for a number of years. I think about the Iver facility we have at Pratt Canada that went online more than five years ago, completely lights out manufacturing. So we have been making investments, I’ll call it, an industry 4.0 across all of our factories. We’ve got the new project down in Dallas, the new factory, automated factory that’s going in down there”

Greg Hayes — Chairman and Chief Executive Officer, Raytheon Technologies, 26 July 2022

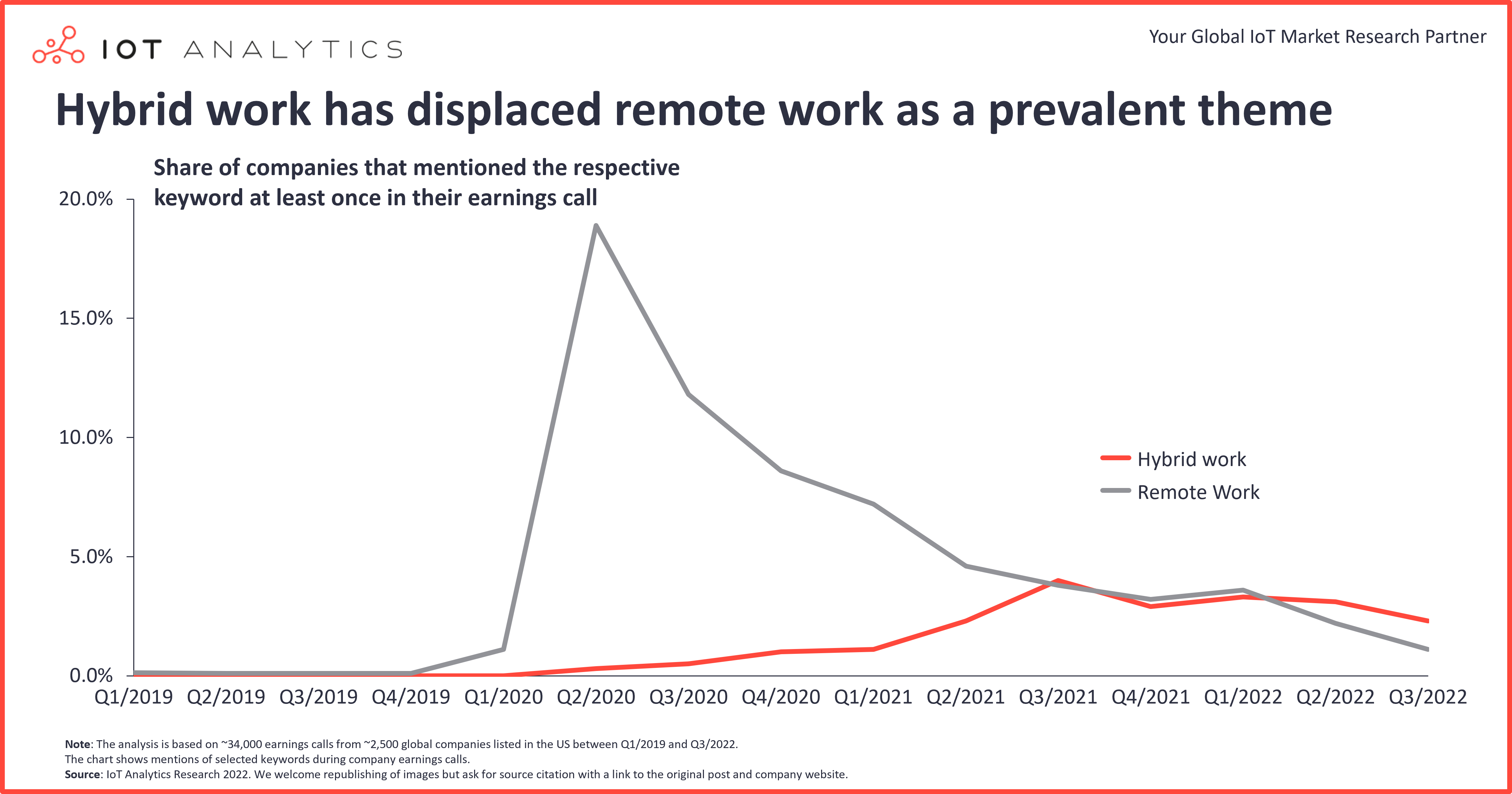

#4 Theme of interest: Remote work and hybrid work

The remote work discussion in Q3/2022 appeared in 1.1% of earnings calls. This constitutes a decrease of 50% compared to the previous quarter and a decrease of 94% since its peak in Q2/2020. Concurrently, hybrid work was mentioned by 2.3% of CEOs and was down 28% since the previous quarter.

Considering the future, two developments become apparent:

- Remote work was one of the key topics during the COVID-19 lockdowns when 18% of CEOs discussed this topic in their earnings calls. It has decreased ever since and seems to be a topic of the past.

- Hybrid work has grown much slower than remote work. While it never reached the double-digit shares of remote work, it seems more likely to remain relevant in the long run. It has decreased since its peak of 4% in Q3/2021 but seems to have stabilized at approximately 2%.

It appears that most CEOs aim to use a hybrid work setup with some mandatory office days but more freedom than before the COVID-19 lockdowns. Apple, Google, and Tesla, for example, have called their office clerks back from their home offices to their respective brisk-and-mortar headquarters. However, most offer a higher degree of freedom compared with three years ago.

“The year-on-year increase in general and administrative expenses driven by higher deal sales taxes, which are tied to revenue, as well as increased personnel-related expenses due to return to a hybrid work environment.”

David Goulden — Chief Financial Officer, Booking Holdings, 04 August 2022

“Hybrid work is now just work, and it’s imperative that collaborate synchronously and asynchronously as well as remote and in-person.“

Satya Nadella — Chairman and Chief Executive Officer, Microsoft, 27 July 2022

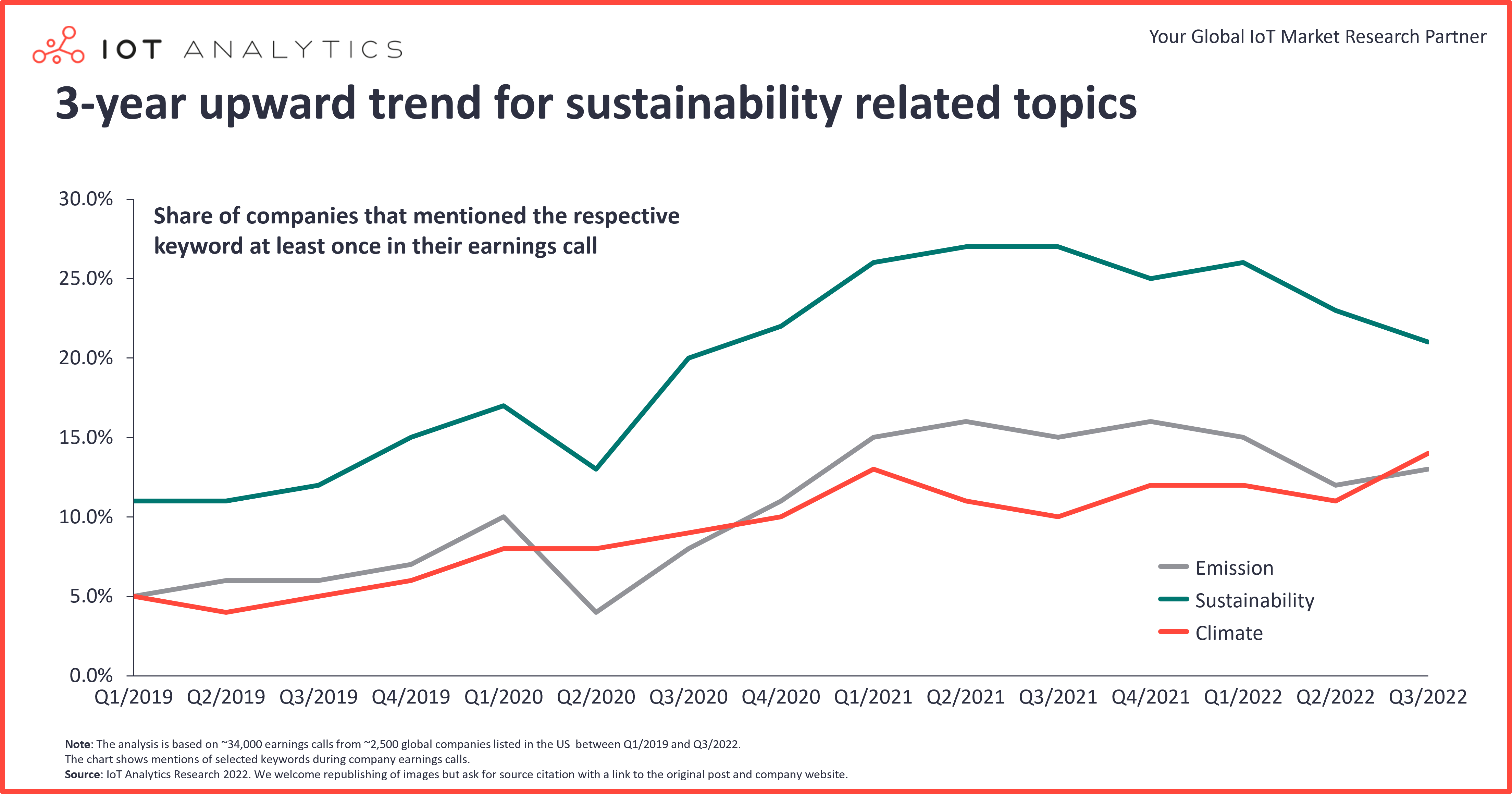

#5 Theme of interest: Sustainability, climate, and emissions

The share of earnings calls that discuss sustainability (discussed by 21% of all CEOs), climate (14%), and emissions (13%) decreased in the previous quarter. However, in the long run, since Q1/2019, this shows a highly positive trend. All three topics have gained extensive boardroom importance. In early 2020, discussions about the transition to a more sustainable and greener economy drowned in the noise caused by the COVID-19 lockdowns. The same seems to be happening currently, as CEOs focus on handling the upcoming recession, high inflation, and high uncertainty. Nevertheless, most CEOs seem convinced that the push towards more sustainability be beneficial for their enterprises.

“We see IoT exploding. You see all of the climate activity is going to be a tailwind to our business because you have to connect all these industrial systems to be able to control them.”

Chuck Robbins — Chairman and Chief Executive Officer, Cisco Systems, 17 August 2022

“One of the biggest long-term opportunities in alternatives will be the intersection of infrastructure and sustainability. Recent supply shocks have only increased the focus on energy security and compounded the need for infrastructure investments.”

Larry Fink — Chairman and Chief Executive Officer, Black Rock, 15 July 2022

More information and further reading

Are you interested in learning more about the latest technology market developments?

IoT Analytics is a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), AI, Cloud, Edge, and Industry 4.0.

Quarterly Trend Report: What CEOs talked about in Q3/2022

A 38-page quarterly report on the trends that emerge in the earnings calls, based on a database of ~34,000 earnings calls of US-listed companies during Q1/2019 through Q3/2022.

Related publications

You may be interested in the following publications:

- IoT Communication Protocols Report 2022

- Satellite IoT Market Report 2022-2026

- Industrial Software Landscape 2022-2027

- Industrial AI and AIoT Market Report 2021-2026

- Virtualization in Industrial Automation | Adoption Report 2021

Related articles

You may also be interested in the following recent articles:

- 5 things to know about IoT protocols

- Satellite IoT connectivity: Three key developments to drive the market size beyond $1 billion

- The top 10 industrial software companies

- The rise of industrial AI and AIoT: 4 trends driving technology adoption

- Soft PLCs: Revisiting the industrial innovator’s dilemma

Related market data

You may be interested in the following IoT market data products:

- Global Cellular IoT Module and Chipset Tracker and Forecast

- Global Cellular IoT Connectivity and LPWA Tracker and Forecast

- Global IoT Enterprise Spending Dashboard

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.