In short

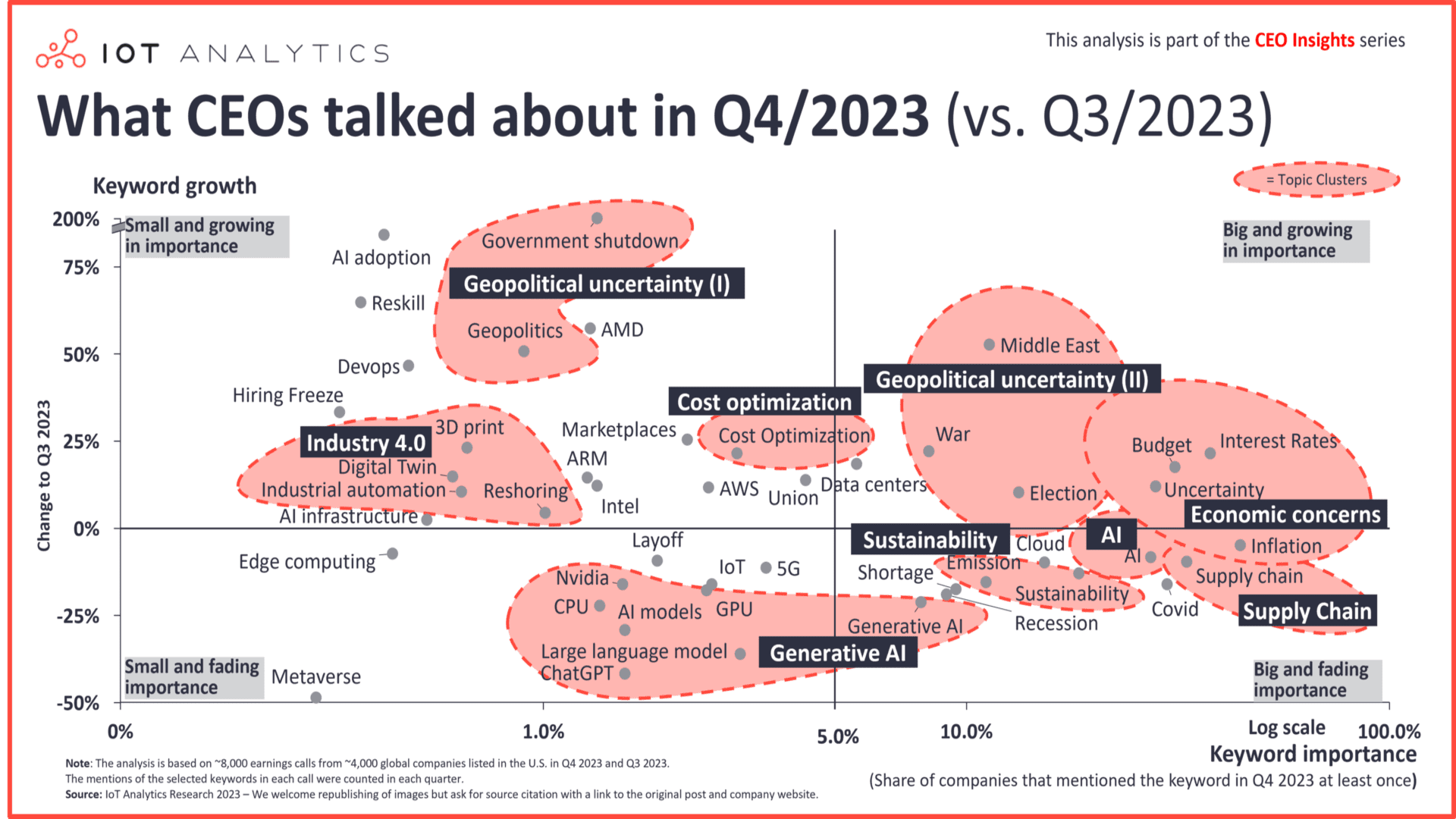

- According to the latest “What CEOs talked about” report, three themes gained noticeable traction in earnings calls in Q4: 1) economic concerns 2) budget and cost optimization, and 3) geopolitical uncertainty around conflict and a possible US government shutdown.

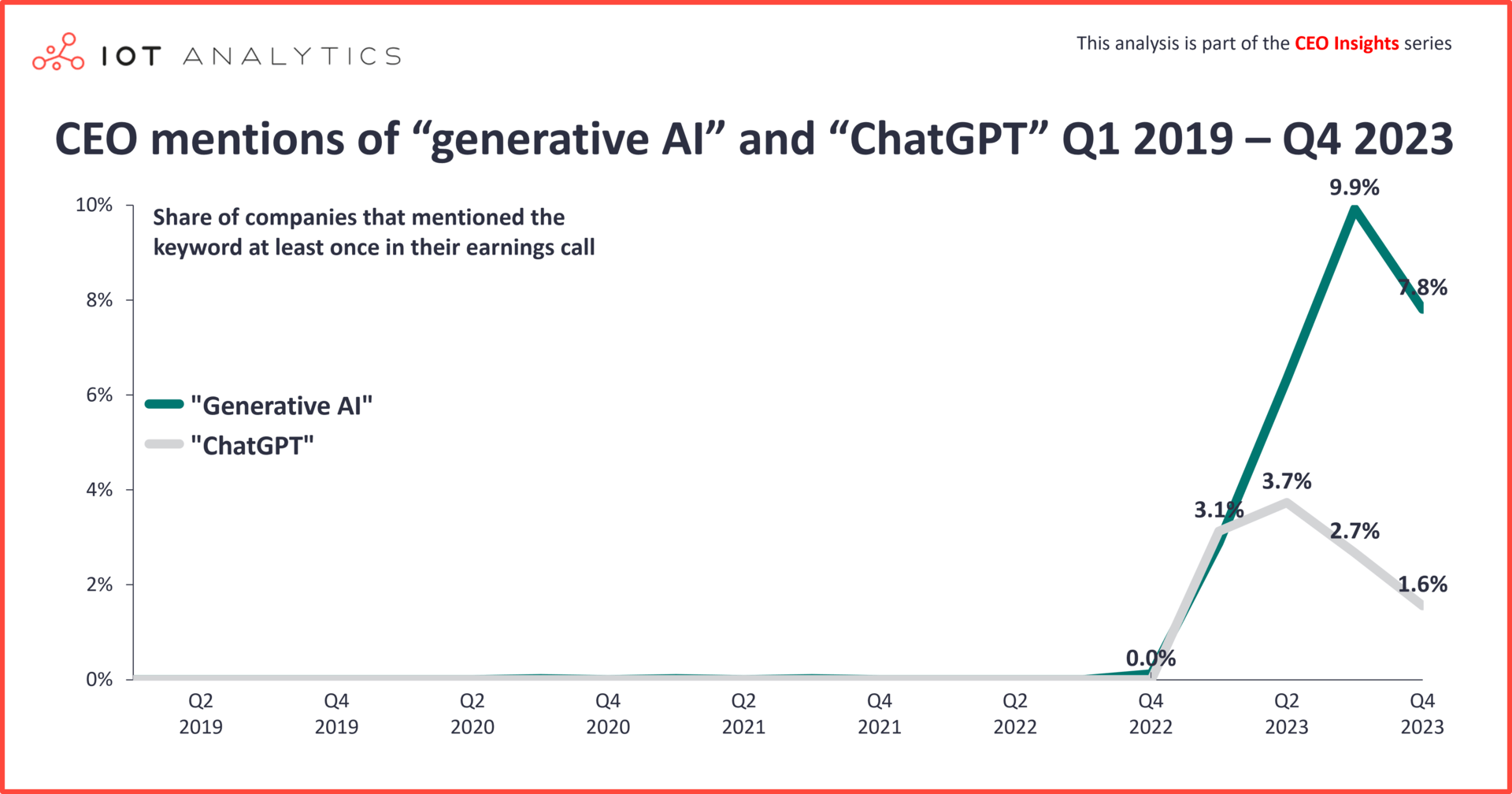

- Generative AI saw its first decline; however, some companies involved in the generative AI market saw significant gains, e.g., AMD, ARM, and AWS.

Why it matters

- The prioritization of specific topics by CEOs may influence investment in these areas.

The big picture

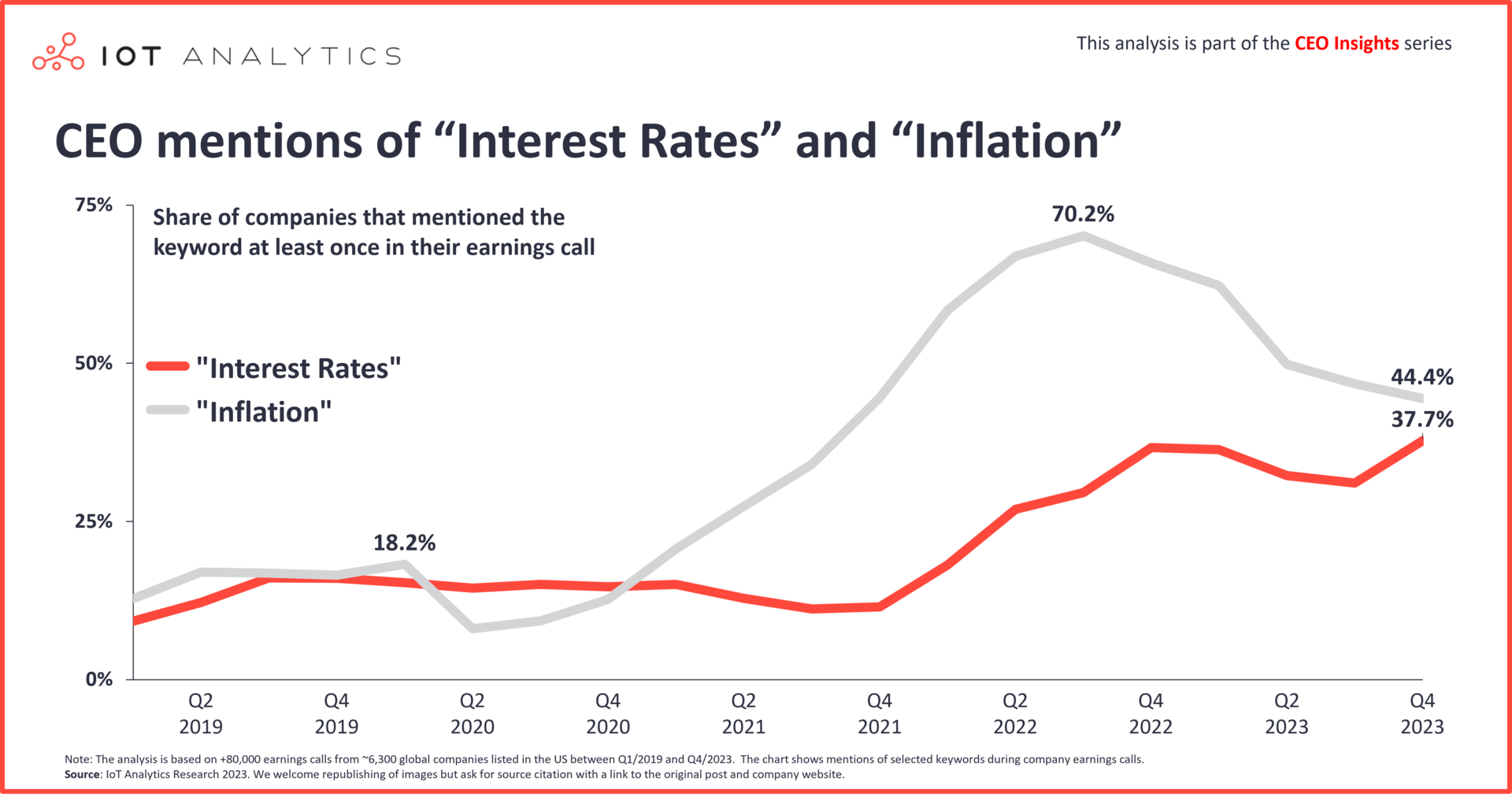

In Q4 2023, economic concerns rose as the forefront topic of CEOs’ minds globally. Mentions of interest rates jumped 21.4% QoQ to 38% of all calls. On a more positive note, discussions regarding inflation declined 5% QoQ to 44.4% of calls while remaining the top topic of earnings calls in Q4 2023. Not soon after many of these earnings calls were held, the US Federal Reserve announced it was keeping interest rates at July 2023 levels on the back of easing inflation. Further, it signaled it may start cutting rates in 2024.

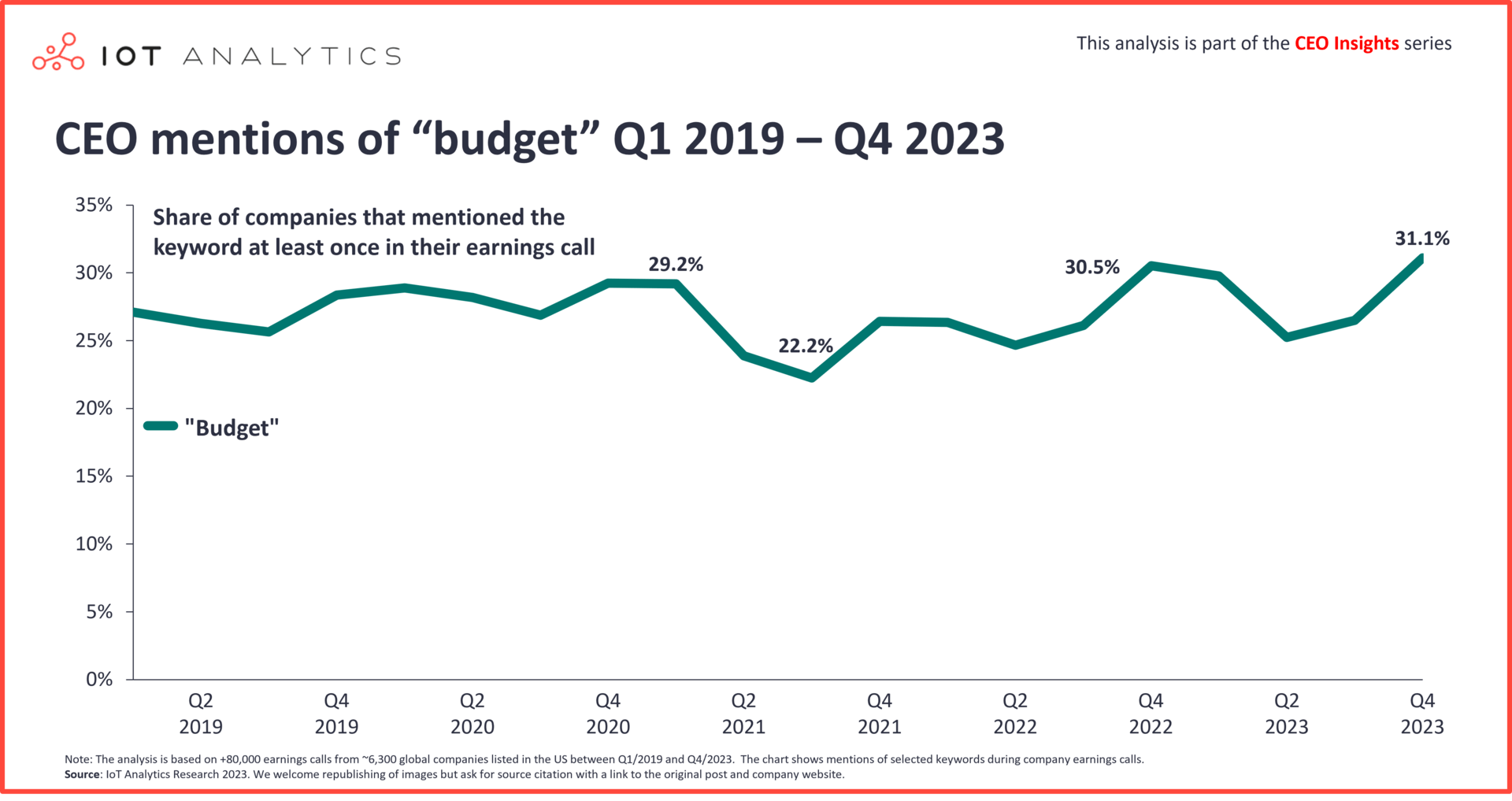

Coinciding with discussions about interest rates were discussions about budgets (+17.4% QoQ to 31% of calls) and cost optimization (+21.4% QoQ to 3% of calls), indicating that CEOs are becoming more cautious going into 2024. All of this comes as geopolitical uncertainty became a theme in Q4 2023 earnings calls, with the Russo-Ukraine war carrying on, Israel beginning its offensive against Hamas, and the threat of a US government shutdown continually looming.

Key quote on the macro environment

The combination of inflation, rising interest rates and geopolitical tension is curtailing risk appetite, and hence, overall economic activity.

Sanjiv Lamba – COO, Linde Plc, October 26, 2023

This article is based on insights from:

Quarterly Trend Report: What CEOs talked about in Q4/2023

Download a sample to learn about the in-depth analyses that are part of the report.

Already a subscriber? Browse your reports here →

Key rising themes in Q4

1. Economic concerns: Interest rates

In Q4 2023, though inflation concerns may be easing, discussions around interest rates jumped 21.4% QoQ to 37.7% of calls. Also rising were discussions around economic uncertainty, which increased 12% QoQ to 28% of calls.

2. Budget and cost optimization

Coinciding with interest rates’ climb, budgets rose to 31% (+17.4% QoQ) in calls, and cost optimization gained traction, increasing 21% QoQ to 3% of calls. This indicates that CEOs are considering the costs of investments and servicing debt as the US Federal Reserve and other central banks keep interest rates high.

3. Geopolitical uncertainty

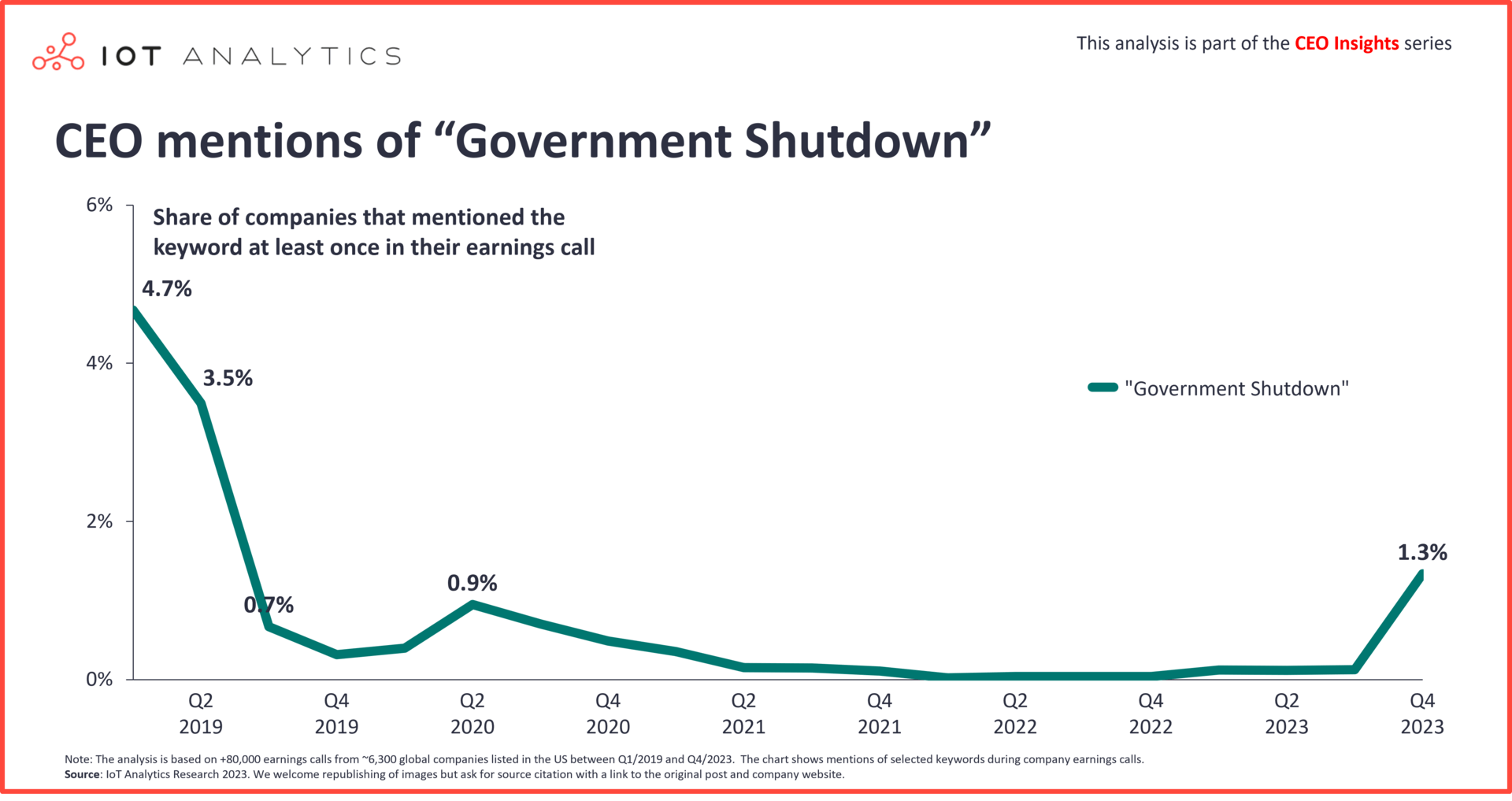

Government shutdown and election saw increases in Q4 2023. Discussions about the possible shutdown of the US government rose the most of any topic, climbing 200% QoQ to 1.3% of boardroom discussions. Meanwhile, discussions around elections rose 10.2% to 13.3% of calls. (More on this in the “Deep dives” section.)

Meanwhile, as the Russo-Ukrainian war drags on and Israel carries out military operations in the Gaza strip, topics around war and the Middle East rose 22% QoQ to 8.2% of earnings calls.

Key quote on geopolitical uncertainty

Second, the continuing macro pressure, including the ongoing conflict in the Middle East, where Israel is a top 10 country for us and the possible U.S. government shutdown, both of which add uncertainty and disruption in particular segments.

Jay Kreps – CEO, Confluent, Inc., November 1, 2023

I think the other more macro or broad thing I just would mention is I think, unsurprisingly, if you look to the Middle East, I mean, we are seeing an impact on our business across a number of the markets in the Middle East and a limited number of markets outside of the Middle East with the conflict that’s going on, obviously, which is tragic.

Ian Borden – CFO, McDonald’s, Inc., December 7, 2023

However, not all mentions of the Middle East were related to conflict. Analysis of the calls mentioning the region showed a fair share of companies discussing positive business in the Middle East.

Internationally, Asia-Pacific and the Middle East continued to be bright spots in the portfolio, supported by Giga Cities and strategic water pursuits.

Bob Pragada – CEO, Jacobs Solutions, Inc., November 21, 2023

Declining themes in Q4

1. Generative AI

For the first time since its first appearance in our Q1 2023 article, generative AI declined in mentions—down 21.3% to approximately 7.8% of calls, with Industrials being the only industry seeing an upward trend in mentions (+21.9% to 22.6% of calls).

In fact, most topics related to AI declined this quarter, including:

- AI: Down 8.4% to 27.3%

- GPUs: Down 17.9% to 2.4% of calls

- AI models: Down 29.3% to 1.6% of calls

- Large language models (LLMs): Down 36.2% to 3% of calls

Notably, the keyword AI adoption grew 84%, though only to approximately 0.4% of calls.

2. Supply chain

Mentions of supply chain dropped 9.7% QoQ to 33.2% of calls, and shortages fell 17.5% QoQ to 9.5%. Though some residual supply chain issues from the COVID-19 pandemic remain and mentions of it remained relatively high in CEO discussions, there has been a continuous quarterly decline in mentions of this topic throughout 2023—actually starting in Q3 2022.

3. Sustainability

Sustainability dropped 13% to 18.4% of calls in Q4 2023, its lowest point in two years. Analysis of what CEOs talked about throughout 2023 shows that this topic has hovered around 20% of boardroom discussions.

Deep dives

1. Economic concerns

Despite inflation decelerating in major economies, central banks are keeping interest rates high for now. And though decreasing this quarter, inflation is still the most talked about topic, and discussions about the impact of interest rates have reached a new high since we started analyzing earnings calls. Consumer-focused companies, such as eBay, highlighted the effect of interest rates on consumer sentiment, while B2B-focused enterprises, such as TELUS, lament the uncertainty of when or if interest rates will be lowered again.

Most of the earnings calls in the What CEOs talked about in Q4 2023 report were before the US Federal Reserve’s announcement that they would hold interest rates to July 2023 levels (5.25%–5.5%), which is likely welcomed news to businesses and consumers alike.

Interestingly, the effects of interest rates are more frequently discussed in EMEA (43% of all earnings calls) than in North America (38%). Companies in APAC seem to be least worried about interest rates (23%).

Coinciding with an increase in discussions around interest rates was a drop in the topic of recession (-19% to 9% of calls), indicating that many CEOs are becoming less concerned with these issues. However, the calls indicated that concerns over inflation and consistently high interest rates had an effect on many executives.

Key quote on inflation & interest rates

As consumers’ sentiment is down, inflation is up and, obviously, the impacts of interest rates.

Steve Priest, CFO, eBay, Inc., November 7, 2023

I think folks are still feeling a bit trepidatious, there’s still some more uncertainty regarding when or if interest rates finally stop being raised and we see some better predictability and stabilization across the planet in terms of geopolitical issues, in particular…

Jeff Puritt – CEO, TELUS International, November 3, 2023

2. Budgets and cost optimization

Discussions around budgets (+17% to 31%) and cost optimization (+21% to 2.9%) climbed in Q4 2023, seemingly as CEOs considered the costs of borrowing money and servicing their debts among relatively high interest rates. As these and other operational expenses start to weigh on the bottom line, many enterprises try optimizing costs, with cloud-related costs as an example focus area. In response to this trend, AWS announced its Cost Optimization Hub at AWS re:Invent 2023, which aims to help customers optimize their cloud spending.

And it is not just organizational budgets at the forefront of the discussions—some calls also discussed consumer budgets. Inflation and high interest rates have left many households having to constrain their spending and seek the best value as well.

Key quotes on budget optimization

In terms of the budget formulation processing, our company is very prudent, very cautious.

Yoshihiko Kawamura – CFO, Hitachi, Ltd., October 27, 2023

We see our customers showing ongoing discretion in seeking value to manage within their household budget …

John David Rainey – CFO, Walmart, Inc., November 16, 2023

In the retail segment, budgets continue to remain tight as clients continue to focus on budget consolidation, cost and efficiency.

Nilanjan Roy, CFO at Infosys Limited, October 12, 2023

Key quotes on cost optimization

Industry analysis of cloud customer behavior suggests that their cost optimization efforts are nearing a conclusion, while enterprises continue migrating new workloads to the cloud[…]. In addition to cost optimization efforts, spending priorities for CSPs [Cloud Service Providers] have temporarily shifted toward AI-related infrastructure, which have further slowed the pace of demand recovery for mass capacity storage.

Dave Mosley – CEO, Seagate Technology Plc, October 26, 2023

And while we still saw elevated cost optimization relative to a year ago, it’s continued to attenuate as more companies transition to deploying net new workloads.

Andy Jassy – CEO, Amazon, October 26, 2023

3. Geopolitical uncertainty: Shutdown

Though the overall call percentage regarding a possible government shutdown is low, the spike in its mentions comes against the backdrop of recent events in the US House of Representatives. In October 2023, a hard-right segment of Republicans in the US House of Representatives filed a successful motion to remove Speaker of the House McCarthy for working with House Democrats in a last-minute deal to temporarily fund the government in September 2023. Given this reasoning, it is reasonable to believe the new speaker faces the same risk, meaning shutdown now seems more likely than before.

A US government shutdown would mainly impact discretionary federal spending on providing services or purchasing goods and services within the US. The US Federal Reserve estimates that for each week of a shutdown, the annual growth of real GDP will decline by 0.2 percentage points, but upon the government reopening, the annual growth of real GDP would then increase the same amount as baseline activity returns. However, a survey in 2013 found that two out of five Americans curbed their spending due to uncertainty around a government shutdown that year—an action that could impact the bottom line of companies globally.

Key quotes on government shutdown

We can’t have a government shutdown for any period of time. We can’t have a continuing resolution. We all know the impact that has on our business.

Chris Kubasik – CEO, L3Harris Technologies, Inc., October 27, 2023.

Finally, we are being cautious with respect to our expectations for the federal vertical given the possibility of a government shutdown.

Mat Calkins – CEO, Appian Corporation, November 2, 2023.

4. Generative AI and related infrastructure

In Q1 2023, generative AI entered the scene thanks to the late 2022 release of ChatGPT. As the year progressed, in Q2 2023, we saw generative AI become the overarching theme for subtopics like ChatGPT and general discussion of LLMs, and in Q3 2023, it stood alone as its own topic, apart from ChatGPT and LLMs as they declined.

This quarter, it appears as if the buzzword craze around generative AI and its related topics has subsided—an ebb in what IoT Analytics believes is just the first wave of generative AI. However, this does not mean there is a loss in excitement around the capabilities and possibilities of generative AI. Indeed, overall, the discussion around it is overwhelmingly positive.

Key quote on generative AI

We already use AI in our software for asset monitoring, and we see huge potential for generative AI during the design phase of the infrastructure life cycle.

Nicholas Cumins – CEO, Bentley Systems, Inc., November 7, 2023

Coinciding with this decline in mentions of generative AI is a drop in mentions of GPUs (-17.9% to 2.4% of calls) and the leading GPU manufacturer, NVIDIA (-16.2% to 1.5% of calls).

NVIDIA has always been the market leader for data center GPUs, and as these GPUs became the backbone of generative AI, NVIDIA’s market for these GPUs greatly increased, and its mentions had the highest increase in Q3 2023. Its data center GPU revenue alone climbed from $4.3 billion in Q1 2023 to an estimated $16 billion in Q4. However, the demand for their GPUs also created a shortage, and other companies are taking steps to try and eat into NVIDIA’s data center GPU market share in the coming years.

In early December 2023, US-based semiconductor manufacturer AMD announced the release of its Instinct MI300 Series accelerators. These new accelerators are cheaper than NVIDIA’s comparable chips, and AMD claims they are also faster. Further, in mid-December 2023, Intel released its latest generation of Habana Labs Ai processors, the Gaudi 3, to compete against the NVIDIA H100 chip and AMD’s new MI300 series. These releases may have given AMD and Intel boosts in boardroom discussions, as both climbed approximately 57.2% and 12%, respectively.

Some customers still prefer to train their own model, but the GPU export restrictions will put the brakes on that. It will eventually become clear that training LLMs from scratch is very difficult, especially when trying to achieve emergent abilities.

Robin Li ––CEO, Baidu, Inc., November 21, 2023

And so, we will have a mix of GPUs. Today, we’re standardized around NVIDIA, but we’re good friends with the folks at AMD and Intel and Qualcomm.

Matthew Prince – CEO, Cloudflare, Inc., November 2, 2023

What it means for CEOs

6 key questions that CEOs should ask themselves based on the insights in this report:

- Inflation management: How can we further adapt our strategies to manage the ongoing impact of inflation on our business operations and pricing models?

- Interest rate fluctuations: With interest rates holding steady, should we revisit our financial planning and debt management strategies?

- Budget and cost optimization: In light of the increased focus on budgets and cost optimization, what areas of our business can we target for efficiency improvements without sacrificing quality or growth potential?

- Geopolitical risks: What impacts do geopolitical uncertainties like war and possible government shutdowns have on our company? Can we mitigate the associated risks on our supply chain and overall business?

- Consumer sentiment: Considering the impact of economic factors on consumer sentiment, how should we adjust our marketing and product strategies to maintain customer loyalty and market share?

- Technological investments: Considering the changing market dynamics and emerging competitors in AI and technology, do we have a defendable AI strategy in place that we are starting to execute?

What it means for those serving CEOs

There is an opportunity for employees, service providers, and other stakeholders to help CEOs excel at the topics they care about. Here are 5 key questions that those who serve CEOs could ask themselves based on the findings in this report:

- Budgeting and cost optimization: What tools or strategies can I provide or suggest to help the company optimize budgets and reduce costs effectively?

- Monitoring geopolitical developments: How can I keep the CEO informed about geopolitical developments, especially regarding the conflicts in Eastern Europe and the Middle East and a potential U.S. government shutdown, and their potential impact on our business?

- Assessing technology trends: Given the continued positivity around generative AI, what insights can I offer regarding the relevance and application of these technologies in our business context?

- Competitive analysis in tech investments: How can I assist in evaluating our position and strategy regarding investments in AI, GPUs, and related infrastructure, especially considering market shifts and competition?

- Impact of government shutdown: In what ways can I help the CEO prepare for and respond to the potential impacts of a possible U.S. government shutdown and its economic implications?

More information and further reading

Are you interested in learning more about the latest CEO insights?

Quarterly Trend Report: What CEOs talked about in Q4/2023

A 58-page report on the trends that emerged in Q4/2023 earnings calls. The report is based on data from 80,000+ corporate earnings calls of US-listed companies from Q1/2019 to Q4/2023.

Related publications

You may also be interested in the following reports:

- Generative AI Market Report 2023-2030

- Predictive Maintenance & Asset Performance Market Report 2023–2028

- IoT Software Go-to-Market & Commercialization Report 2023

- Global Cloud Projects Report and Database 2023

- State of IoT – Spring 2023

Related articles

You may also be interested in the following articles:

- The leading generative AI companies

- Cellular IoT module & chipset market 2023: 18% decline due to destocking and softening demand in key segments

- The top 10 industrial automation trends

- Predictive maintenance market: 5 highlights for 2024 and beyond

- Industry 4.0 check-in: 5 learnings from ongoing digital transformation initiative

- Digital twin market: Analyzing growth and emerging trends

- State of IoT 2023: Number of connected IoT devices growing 16% to 16.7 billion globally

Related dashboard and trackers

You may also be interested in the following dashboards and trackers:

- Global IoT Enterprise Spending Dashboard

- Global Cellular IoT Module and Chipset Market Tracker & Forecast

- Global Cellular IoT Connectivity Tracker & Forecast

- Global Cellular IoT eSIM Module & iSIM Chipset Tracker

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.