In short

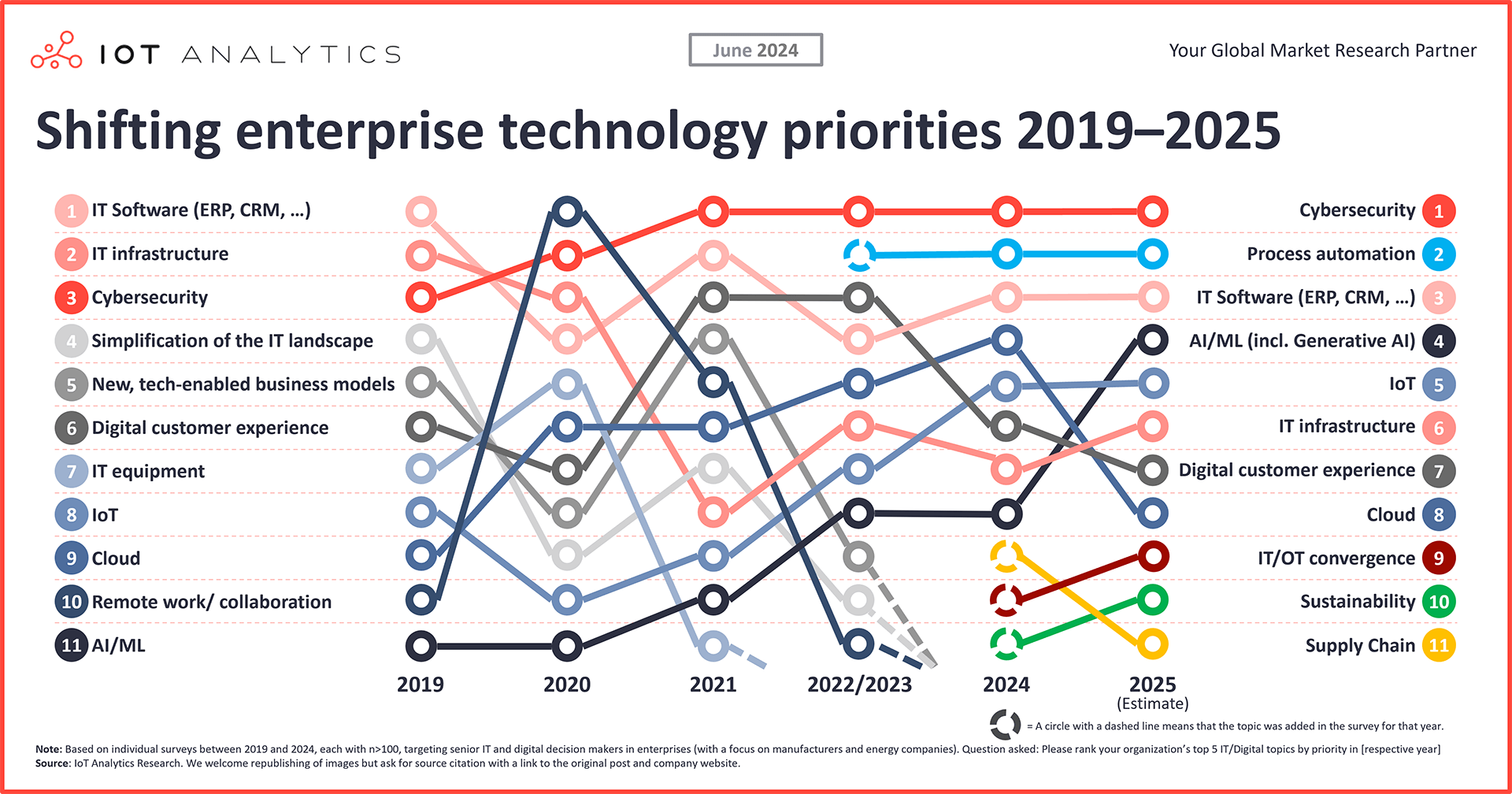

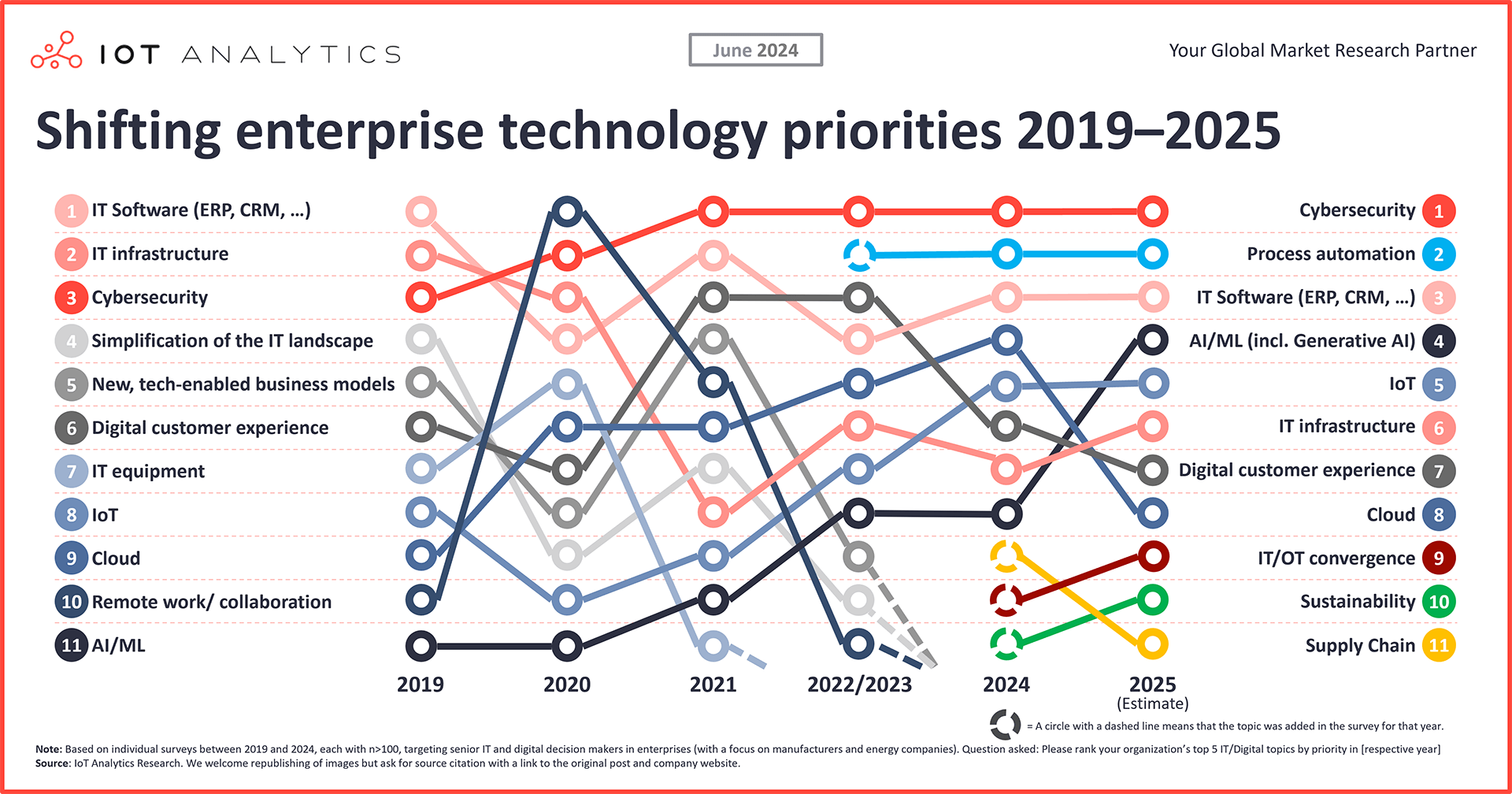

- Cybersecurity, process automation, and IT software were the top 3 enterprise technology priorities in 2024 and are expected to maintain these spots in 2025. AI is expected to rise to 4th place in 2025, and IoT is likely to remain the 5th-ranked priority.

- Every year, IoT Analytics surveys senior IT decision-makers about their companies’ top technology priorities, giving insight into how many organizations prioritize technology investments.

Why it matters

- For technology vendors: Understanding what companies are prioritizing enables vendors to also prioritize their offerings and better target their services.

- For technology adopters: Understanding how peers are prioritizing their technology needs can serve as a benchmark of where an end user stands with its needs and consider whether there are needs they have not yet considered.

AI rising in corporate technology priorities. CEOs discussed AI more than any other technology topic in earnings calls since Q1 2023, reaching 34% of calls in Q2 2024. As a result, AI is rising quickly in corporate technology priorities. In 2019, senior IT decision-makers from the industrial and manufacturing sectors ranked AI 11th in prioritization. However, it started inching up in 2021, rising to 8th place between 2022 and 2024, and it is expected to make a significant jump in 2025.

About the analysis

As part of its coverage of the state of IoT and other industrial transformation topics, IoT Analytics regularly surveys 200+ senior IT decision-makers from the industrial and manufacturing sectors. These decision-makers are asked to rank their companies’ top 5 priorities regarding technology investments, with nearly 20 technology topics presented.

The top 5 enterprise technology priorities in 2024 and 2025

The following are the top 5 priorities in 2024 in IoT Analytics’ latest survey:

- Cybersecurity, maintaining its place from 2023

- Process automation, maintaining its place from 2023

- IT software (e.g., ERP and CRM), up one spot from 2023

- Cloud, up one spot from 2023

- IoT, maintaining its place from 2023

For 2025, survey respondents project a significant change, with AI expected to rise 4 spots to 4th and cloud expected to drop 4 spots to 8th place after companies heavily increased their spending on cloud projects during and just after the COVID-19 pandemic. The 2025 expectation is as follows:

- Cybersecurity

- Process automation

- IT software (e.g., ERP and CRM)

- AI/ML (including generative AI)

- IoT

Other noteworthy priority shifts for 2025 include IT/OT convergence (rising 1 spot to 9th) and sustainability (rising 1 spot to 10th). Meanwhile, supply chain-related technology dropped from 9th place to 11th.

Note: IoT Analytics plans to publish IT/OT convergence and sustainability reports in Q3 2024. Those interested in accessing these reports when they are released can sign up for IoT Analytics’ IoT Research Newsletter at the top right of this article to receive updates on the release of these and other reports.

Recent research into the top enterprise technology priorities for 2024

1. Cybersecurity

Cybersecurity in top position for 4th consecutive year. Cybersecurity has held the #1 spot since 2021, rising from 3rd in 2019. IoT Analytics mostly looks at cybersecurity from the lens of connected IoT devices and operational assets, so much of its research into cybersecurity revolves around such.

Recent IoT Analytics research findings related to cybersecurity

- Cybersecurity the top priority globally. Across all regions, cybersecurity was generally ranked as the top enterprise technology priority for companies adopting IoT software in 2023, with mid-sized and multinational companies globally, on average, marking it as a top priority.

- Cybersecurity is one of the biggest concerns for OEMs developing connected IoT products. Data security was the biggest concern/roadblock end users reported to connected-product OEMs when adopting new digital services and software. Additionally, regulatory hurdles were a major factor in longer timelines in getting their products to market.

- Security is a major factor when selecting an IoT adoption approach. On the end-user’s end, when adopting enterprise IoT projects, 84% of companies that custom-built their IoT solutions did so due to feeling that IT security considerations could be better addressed with that approach. Of the companies who adopted off-the-shelf IoT solutions and used a systems integrator (comprising 42% of those surveyed), 100% shared that a solid IT security track record or reputation was either very important or important.

Select quotes on cybersecurity from recent IoT Analytics research

“The risk of cyberattacks was our greatest concern [during our IoT adoption initiative] because of the greater vulnerability.”

Senior manager of product management at a Japan-based oil and gas company

“The major challenge with [our IoT adoption] initiative has been gaining IT security approval and requesting the vendor to meet our standard for protocol and utilization of our cloud services.”

Senor manager of production and manufacturing at a US-based transportation equipment company

2. Process automation

Process automation remains the 2nd-ranked priority. IoT Analytics added process automation—defined as the use of technology to automate repetitive business tasks and processes—to its 2022/2023 survey, and it has remained the #2 spot ever since.

Recent research findings related to process automation

- Process automation a top-5 priority globally. In 2023, North American and APAC enterprises ranked process automation 2nd in technology priority, while European companies ranked 5th. Additionally, process automation ranked 1st for small-to-medium enterprises.

- IoT plays an important role in process automaton: It is the top IoT use case. Ongoing IoT Analytics research into IoT use cases has observed that among 27 such cases, IoT-based process automation is ranked #1, with nearly 58% of enterprises either currently rolling out or having fully rolled out process automation in their operations. Further, between 2021 and 2024, the share of companies that have seen positive a return on investment after implementing process automation rose from 96.7% to 98.1%, indicating why companies prioritize it so highly.

Note: IoT Analytics plans to release its IoT Use Case Adoption Report 2024 in Q3 2024.

3. IT software

IT software holds steady as a top tech priority. In 2024, senior IT decision-makers ranked IT software as the 3rd highest technology priority on average. With large-scale ERP, CRM, and other IT software rollouts and modernizations paused during the pandemic, such initiatives are now prioritized again.

Recent research findings related to IT software

- IT software often a foundation for future digitalization. Based on 22 industrial IoT and Industry 4.0 case studies, many manufacturers elect to prioritize upgrading their ERP systems to ensure their various data sources are connected before other digital transformation initiatives. (Note: The IoT Analytics team has entertained discussions on whether this is a good approach—here, this is simply an observation. IoT Analytics does not endorse this approach.)

- Microsoft a leading IT and industrial software vendor. Looking at software adoption across different layers of the IoT stack, Microsoft was used by 41% of companies that procured IT software, followed by AWS and Google at22% and 11%, respectively.

- Software procurement experiencing a paradigm shift. Often, IT software is procured directly from the vendors themselves; however, a new paradigm is rising: the B2B software marketplace. In 2023, marketplaces accounted for 1.8% of enterprise software purchases in terms of procurement channels. By 2030, this is expected to grow to nearly 10%.

4. AI/ML

AI/ML in the top 5 tech priorities for the first time. AI/ML (including generative AI) is expected to rise 4 spots in technology priority in 2025, from 8th place in 2024 to 4th. Given the amount of attention AI has had since the public release of ChatGPT in late 2022, it is reasonable to expect AI to have climbed to the top 5 by 2024. However, there is a difference between looking ahead at AI initiatives and undertaking them. Many companies find they need to either satisfy other technology needs or lay the foundation for effective AI first.

Recent research findings related to AI

- Groundwork is needed before implementing AI. Often, other technology aspects need to be in place before building and enabling AI, such as a data management strategy and the related software and infrastructure requirements.

- Generative AI market set to experience substantial growth. As other technology priorities are satisfied, AI is likely to climb in prioritization, given projected market growth. The markets for foundational models/platforms and generative AI services (including consulting, integration, and implementation support) are projected to grow at a CAGR of 63% and 37%, respectively.

- Vendors appear poised to capitalize on AI prioritization. The IoT Analytics team has noted a significant increase in AI showcases at Smart Production Solutions (SPS) 2023, Mobile World Congress (MWC) 2024, and Hannover Messe 2024.

Select quote on the need for other prioritization ahead of AI

“Generative AI is at the forefront of customer conversations. However, enterprises are also realizing that they cannot have an AI strategy without a data strategy to base it on.”

Frank Slootman – former CEO, Snowflake, during Snowflake’s Q3 2023 earnings call

Select quote on the future of enterprise generative AI

“Nearly half of all Bosch plants are already using AI in their manufacturing operations. With the help of Gen AI, we’re not only improving existing AI solutions, but we’re also laying the foundations for the optimum take-up of this future technology in our global manufacturing network.”

– Stefan Hartung, chairman of the board of management at Robert Bosch GmbH, in a company press release in Q3 2023

5. IoT

IoT closes out the top 5 tech priorities. On average, IoT ranked 5th as a 2025 technology priority among the senior IT decision-makers. It has also seen a steep climb over the last five years, climbing from 10th. This prioritization aligns with IoT Analytics’ Global IoT Enterprise Spending Dashboard (updated June 2024), which shares end-user spending of IoT markets globally and includes the top 100 IoT companies, their market share, and over 40 use cases. According to the dashboard, the enterprise IoT spending growth rate is expected to increase to a CAGR of 15% until the end of 2030.

IoT encompasses a broad scope of subjects. As IoT Analytics’ founding topic, IoT is central in almost every report, and the topic comprises connectivity and hardware, platforms and software, industrial and non-industrial applications, and—more generally—even market players themselves, among others. Readers are encouraged to explore IoT Analytics’ coverage areas to stay apprised of current IoT research.

Recent research findings related to IoT connectivity and hardware

- Cellular IoT module market witnesses renewed growth. In Q1 2024, the cellular IoT modules experienced growth for the first time in 4 quarters due to increased demand in China and continued adoption of 5G and LTE Cat 1 bis modules worldwide.

- AI-capable cellular IoT modules are on the rise. By 2027, these modules are expected to comprise 9% of total cellular IoT module shipments—a CAGR of 73%.

Recent research findings related to IoT platforms and software

- Strong market growth projected for data management and analytics. Data sources are the 1st of 7 key components of the data management key stack, and IoT devices are a key data source in most industrial and manufacturing settings. By 2030, the data management and analytics market is expected to reach $513 billion at a CAGR of 16%.

- IoT software offerings gaining popularity on hyperscaler and edge marketplaces. The aforementioned rise of B2B marketplaces has brought forth new means for companies to procure IoT software. Many IoT applications require data storage, analytics, and visualization integration with cloud services. Of the hyperscalers, Microsoft’s Azure Marketplace currently offers the most IoT products, with over 1,000. Likewise, edge marketplaces are gaining importance due to their ability to reduce latency, enable offline operation, and facilitate edge device customization.

Recent research findings related to industrial IoT and Industry 4.0

- Hardware and software vendors diverge on their 2024 economic outlook. The IoT Analytics team recently attended Hannover Messe 2024 in Hannover, Germany, and shared their top 10 industrial trends as seen at the industrial fair. Based on over 300 individual interviews, vendors with a large hardware footprint (e.g., large industrial automation suppliers) appeared cautious in their 2024 business outlook, as many still grappled with customer inventory surplus and limited demand. Meanwhile, companies with large software footprints appeared extremely optimistic, driven by excitement around AI products and their adoption.

- Flexibility is a top priority amid economic turbulence. The team also attended the Smart Production Solutions (SPS) 2023 fair in Nuremberg, Germany, and shared their top 10 industrial automation trends. Topping this list were solutions addressing the need for flexibility in manufacturing to adapt to unforeseen demand shifts, drastic supply constraints, and a variety of workforce challenges.

Recent research findings related to general IoT market topics

- Tech job openings experience continued decline. In April 2024, IoT Analytics released its inaugural report on the state of tech employment. The analysis of over 1 million US job postings found that tech job postings decreased 2% in Q1 2024 quarter-over-quarter, which marked the 7th consecutive quarter of overall tech job postings.

- More than a third of IoT initiatives exceed expectations. 35% of organizations adopting IoT projects reported that their initiatives either exceeded or clearly exceeded the expectations they set. Meanwhile, a majority reported that their initiatives met their expectations.

What it means for technology vendors

5 questions that executives at technology vendors should ask themselves based on the insights in this article:

- The rise of AI/ML. How can we enhance our product offerings with the increasing priority of AI/ML in enterprise technology?

- The importance of cybersecurity. Are we doing enough to secure our products and communicate those security features well enough to our customers?

- Capitalizing on process automation. How can we help our customers use our products so they tie into their workflows and enable process automation?

- Importance of IoT. What new IoT technologies or enhancements should we invest in to differentiate ourselves in the competitive IoT market, given the projected growth in AI/ML and other emerging technologies?

- Leveraging market insights for success. How can we leverage IoT Analytics reports and similar sources to anticipate and respond to shifts in technology priorities to get ahead of our competition?

What it means for technology adopters

5 questions that executives at companies adopting technology should ask themselves based on the insights in this article:

- Aligning technology roadmap with enterprise priorities. How can we align our technology roadmap with the evolving enterprise priorities in cybersecurity, process automation, and AI/ML to maintain agility and competitiveness in the market?

- Preparing for AI/ML implementation. As AI/ML climbs in priority, what foundational steps do we need to take now to prepare our data management strategy and infrastructure for successful AI implementation in the future?

- Cybersecurity measures. How can we further strengthen our cybersecurity measures to ensure no hacks to our organization?

- Process Automation. What specific processes within our organization can benefit most from automation, and how can we integrate IoT to enhance productivity and accuracy in these areas?

- Leveraging market insights for success. How can we leverage IoT Analytics reports and similar sources to make smart decisions regarding technology adoption?

More information and further reading

Are you interested in learning more about the latest technology market developments?

IoT Analytics is a leading global provider of market insights and strategic business intelligence for the Internet of Things (IoT), AI, Cloud, Edge, and Industry 4.0.

Corporate Research Subscription

Complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time.

Already a corporate research subscriber?

Related publications

You may be interested in the following publications:

- 5G IoT & Private 5G Market Report 2024–2030

- Data Management and Analytics Market Report 2024–2030

- IoT Enterprise Projects Adoption Report 2024

- IoT Commercialization & Business Model Adoption Report 2024

- Generative AI Market Report 2023–2030

Related articles

You may also be interested in the following recent articles:

- State of IoT Spring 2024: 10 emerging IoT trends driving market growth

- Cellular IoT module market Q1 2024 update: Demand recovery, market trends, and competitive landscape

- How global AI interest is boosting the data management market

- LPWAN market 2024: Licensed technologies boost their share among global 1.3 billion connections as LoRa leads outside China

- CEO priorities from 2019 until now: What has changed?

Related market data

You may be interested in the following IoT market data products:

- Global IoT Enterprise Spending Dashboard

- Global Cellular IoT Module and Chipset Tracker and Forecast

- Global Cellular IoT Connectivity Tracker and Forecast

Are you interested in continued IoT coverage and updates?

Subscribe to our newsletter and follow us on LinkedIn and Twitter to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports including dedicated analyst time check out Enterprise subscription.